From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Strengthens Despite Rebar Output Shifts: China’s Production Dip Offset by Turkish Surge

Asia’s steel market shows resilience, with production adjustments occurring across the region. While “China’s rebar output down 0.9 percent in January-April” indicates a slight contraction in Chinese rebar production, this appears to be balanced by increased activity observed at other regional plants. No direct relationship was established between the Chinese Rebar ouput and US HRC and Rebar import data.

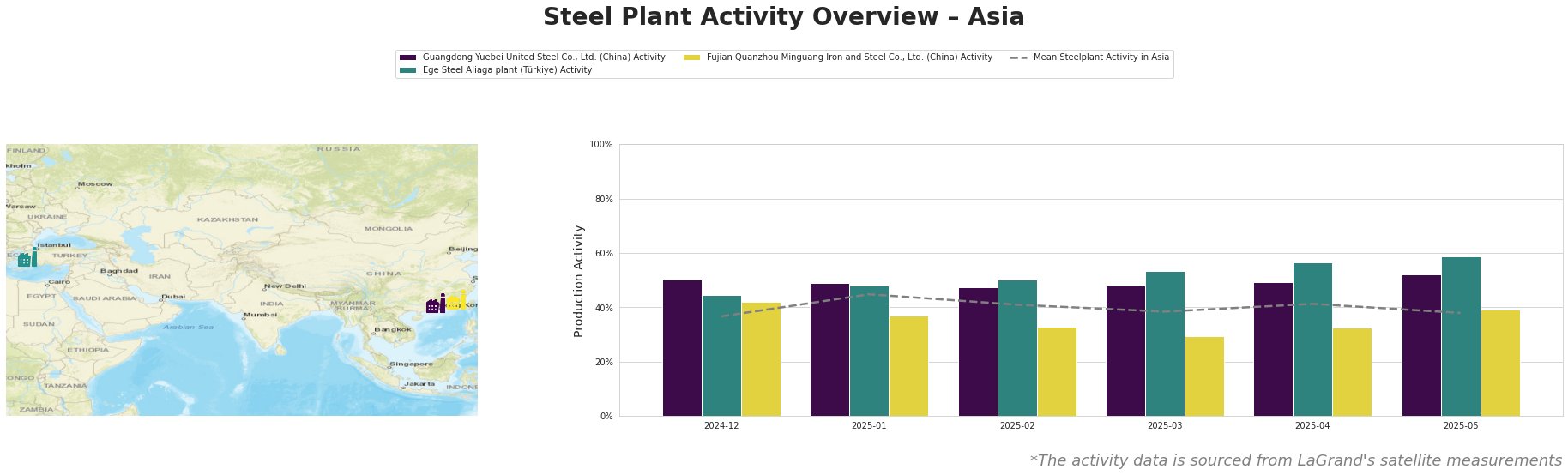

Observed steel plant activity levels in Asia over the past six months:

The mean steel plant activity in Asia fluctuated, peaking in January 2025 at 45.0% and reaching a low of 37.0% at the end of December 2024. Guangdong Yuebei United Steel Co., Ltd. has consistently maintained activity levels above the Asian mean, peaking at 52% in May 2025. Ege Steel Aliaga plant has shown a steady increase in activity, reaching 59% in May 2025, significantly above the regional average. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. experienced a significant drop in activity in March 2025, bottoming out at 29% but recovered to 39% in May 2025. No direct connection between these plant activities and the news articles “US HRC imports down 11.5 percent in March from February” or “US rebar imports down 11.5% in March 2025” could be established.

Guangdong Yuebei United Steel Co., Ltd., an integrated BF-based steel plant with a crude steel capacity of 2 million tonnes, primarily produces rebar for the building and infrastructure sectors. Its activity has remained relatively stable and above the regional average, reaching 52% in May 2025. There is no direct indication from the provided news whether these activities are related to specific market developments.

Ege Steel Aliaga plant, an EAF-based steel plant in Türkiye with a 2 million tonne crude steel capacity, produces semi-finished and finished rolled products like rebar and wire rod. The plant showed a strong upward trend, reaching 59% activity in May 2025, the highest among the observed plants. No direct connection between these plant activities and the news articles could be established.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF-based steel plant with a crude steel capacity of 2.55 million tonnes, produces various finished rolled products, including rebar and wire rod. The activity dropped to 29% in March 2025, but has since recovered to 39% in May 2025. This drop may be linked to the “China’s rebar output down 0.9 percent in January-April” if Quanzhou production was reduced in anticipation of the Rebar price drop in April, but no definitive connection can be established based on available data.

Evaluated Market Implications:

The activity decrease at Fujian Quanzhou Minguang Iron and Steel Co., Ltd. combined with overall decreased Rebar production in China could indicate a tightening in the regional supply of rebar. The increasing activity at Ege Steel Aliaga plant could partially offset any supply issues from China, though transport times and logistics must be considered.

Procurement Actions:

- Steel buyers focused on rebar should closely monitor price fluctuations and lead times. Given the potential for tightened rebar supply from China, sourcing from the Ege Steel Aliaga plant and other Turkish producers can be considered.

- Market analysts should further investigate the drivers behind the production adjustments at Fujian Quanzhou Minguang Iron and Steel Co., Ltd. This information can help anticipate future supply dynamics and price movements.