From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Steady Amid Global Shifts: US Steel Deal Impact Unclear

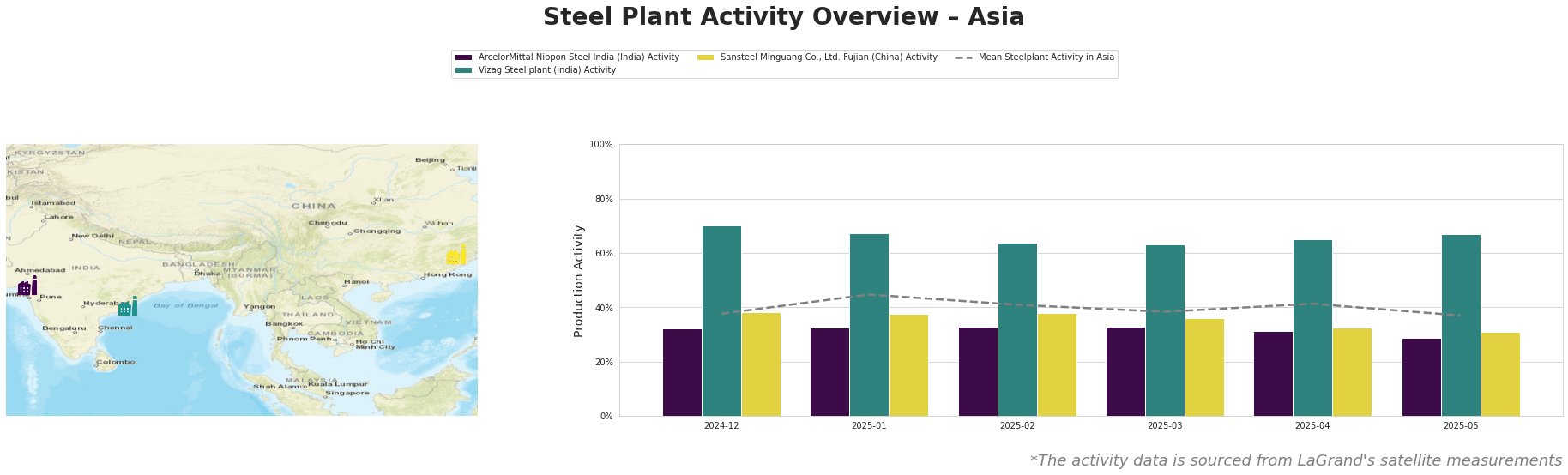

Asia’s steel market demonstrates relative stability despite potential global ripple effects from the announced “partnership” between Nippon Steel and US Steel. Activity levels at major Asian steel plants have remained largely consistent in recent months. There is no immediately clear relationship between the satellite-observed activity data of Asian steel plants and news events such as “USW calls on Trump to reject USS, Nippon deal“, “US steelworkers urge Trump to block US Steel acquisition“, “Trump OKs US Steel, Nippon ‘partnership’“, “Trump, USS say ‘partnership’ deal reached with Nippon“, “Trump announces planned partnership between US Steel and Nippon Steel“, and “Trump officially backs Nippon Steel-US Steel deal“.

Across all observed plants, the mean activity level in Asia peaked in January 2025 at 45% and decreased to 37% in May 2025.

ArcelorMittal Nippon Steel India, a plant with 9.6 MTPA crude steel capacity utilizing both BF and DRI processes, has shown a gradual decrease in activity, from 33% between January and March 2025 to 29% in May 2025. This consistently underperforms compared to the average Asian activity. This decline may warrant investigation by procurement professionals in the region, though no direct correlation to the provided news articles can be established.

Vizag Steel plant, an integrated BF-BOF plant with 7.3 MTPA crude steel capacity, maintained a relatively high activity level. Though there was a consistent decrease in activity from December 2024 (70%) to March 2025 (63%), there was an increase back to 67% in May 2025, significantly outperforming the mean Asian activity levels. This level of stability could be seen as a more reliable source of steel in the region. No direct connection to the provided news articles can be established.

Sansteel Minguang Co., Ltd. Fujian, a BF-BOF plant with 6.8 MTPA crude steel capacity, showed the most consistent behavior over the observed period with a relatively steady, low-side decrease. From 38% from December 2024 to February 2025, the activity decreased to 31% in May 2025, slightly below the Asian average. Procurement professionals should monitor the causes for this decline, although no direct link to the provided news articles can be established.

Evaluated Market Implications:

Based on current trends, the Asia steel market shows no immediate supply disruption. However, the US Steel-Nippon Steel “partnership” remains a potential disruptor in the long term, even though current steel plant activity data in Asia has no obvious correlation. Given the gradual decline in activity at ArcelorMittal Nippon Steel India, procurement professionals relying on this plant for supplies should:

- Diversify their sourcing to include Vizag Steel plant if product mix allows, given its more stable and above-average activity level. This recommendation is grounded in observed plant activity levels and plant details.

- Actively engage with ArcelorMittal Nippon Steel India to understand the reasons behind the declining activity and potential impacts on supply commitments.

- Monitor the news and developments surrounding the Nippon Steel-US Steel deal, as any shifts in global steel dynamics could eventually impact Asian markets. While the provided news articles do not directly address Asia, the scale of the deal and potential trade implications are significant enough to warrant ongoing monitoring.