From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Stable Production Despite US Import Shifts, Procurement Opportunities Emerge

Asia’s steel market shows overall stable production levels, even as shifting US import patterns signal potential opportunities. While no direct relationship can be established between Asian plant activity and fluctuations in US import data reported in articles such as “US reduced its imports of rolled steel by 7.6% m/m in June“, “US structural pipe and tube exports down 6.3 percent in May 2025“, “US cut-length plate imports up 18.0 percent in May 2025“, “US standard pipe imports down 8.7 percent in May 2025“, and “US tin plate imports down 5.2 percent in May 2025“, the data highlights evolving global trade flows that influence the Asian steel landscape.

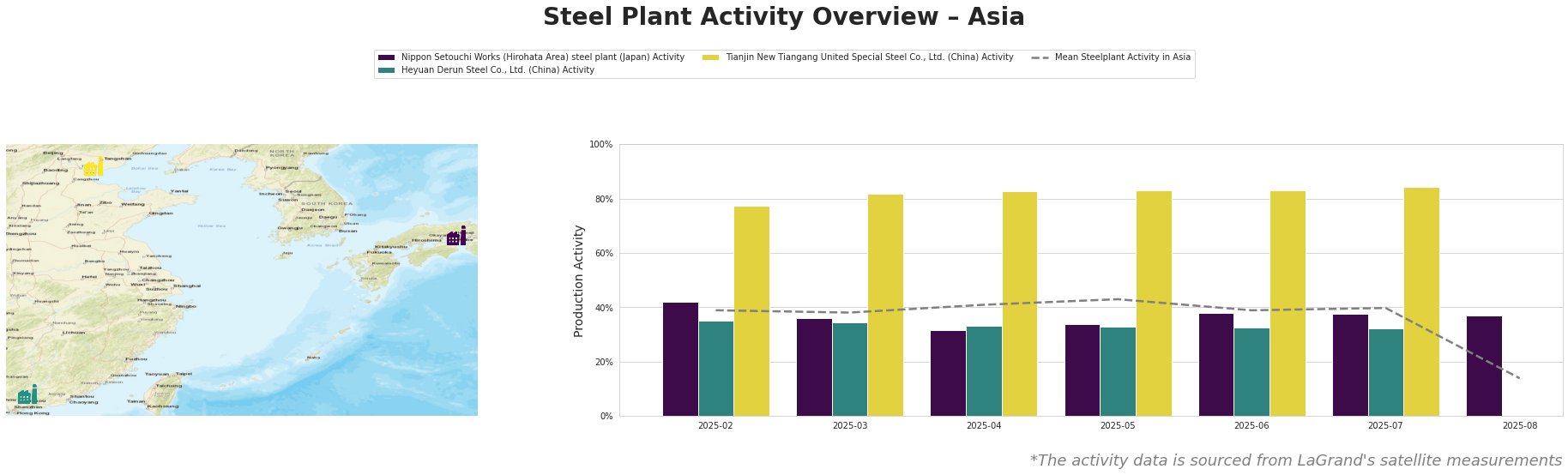

The mean steel plant activity across Asia has fluctuated, with a notable drop to 14% in August 2025 following a period of relative stability around 40%.

Nippon Setouchi Works (Hirohata Area) steel plant in Japan, a large integrated BOF steel plant with a 2,816 ttpa crude steel capacity, primarily producing finished and semi-finished rolled sheets, has shown relatively stable activity. Starting at 42% in February 2025, it experienced a dip to 32% in April 2025, then recovered and stabilized around 38% until the end of August, where it remained stable at 37%. There’s no directly observable link between this plant’s production levels and the aforementioned US import/export news articles.

Heyuan Derun Steel Co., Ltd., a smaller EAF-based steel plant in Guangdong, China, with a 1,200 ttpa crude steel capacity specializing in hot rolled rebar and billet production, shows a gradually declining activity level, from 35% in February 2025 to 32% in July 2025. The reduced activity occurs alongside reports such as “US reduced its imports of rolled steel by 7.6% m/m in June“, but no direct relationship can be established given the lack of specificity of the reports.

Tianjin New Tiangang United Special Steel Co., Ltd., a major integrated BF/BOF steel plant in Tianjin, China, boasts a significant 4,500 ttpa crude steel capacity, focusing on angle steel and continuous casting billet. Its activity level has remained consistently high, hovering between 78% and 84% throughout the observed period. This robust output may suggest a focus on domestic demand or alternative export markets. The plant’s stable high activity may be indirectly linked to reports about shifts in US import patterns of steel, such as in “US reduced its imports of rolled steel by 7.6% m/m in June“, although no direct connection is evident.

Based on the available data and news, here are specific procurement actions for steel buyers and analysts:

- Monitor Tianjin New Tiangang’s Output: The consistently high activity at Tianjin New Tiangang suggests a reliable source for angle steel and continuous casting billet. Buyers should closely monitor their pricing and availability, especially if US import restrictions redirect more Asian steel into other markets.

- Assess Rebar & Billet Supply from Heyuan Derun Steel Co., Ltd.: Due to the slight decline in the activity levels a potential decline in supply in the near future could be expected. Steel Buyers focused on hot rolled rebar and billet production might want to consider to seek alternative options.

- Evaluate the Impact of US Import Changes on Specific Steel Products: While there’s no direct link between the US import news and specific Asian plants, monitor how changes in US demand for products like cut-length plate (“US cut-length plate imports up 18.0 percent in May 2025“) might indirectly affect pricing and availability of those product categories within the Asian market.