From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Stable Production Despite Import Declines; Procurement Opportunities Emerge

In Asia, steel production remains generally stable despite recent shifts in import data reported in news articles. Specifically, “China’s iron ore imports decrease by 5.5 percent in January-April” and “China’s coal imports decrease by 5.3 percent in January-April“ indicate potentially softening demand for raw materials within China. Satellite data on Asian steel plants only partially confirm this trend; while the mean plant activity has fluctuated, individual plants show diverse behavior, requiring careful evaluation.

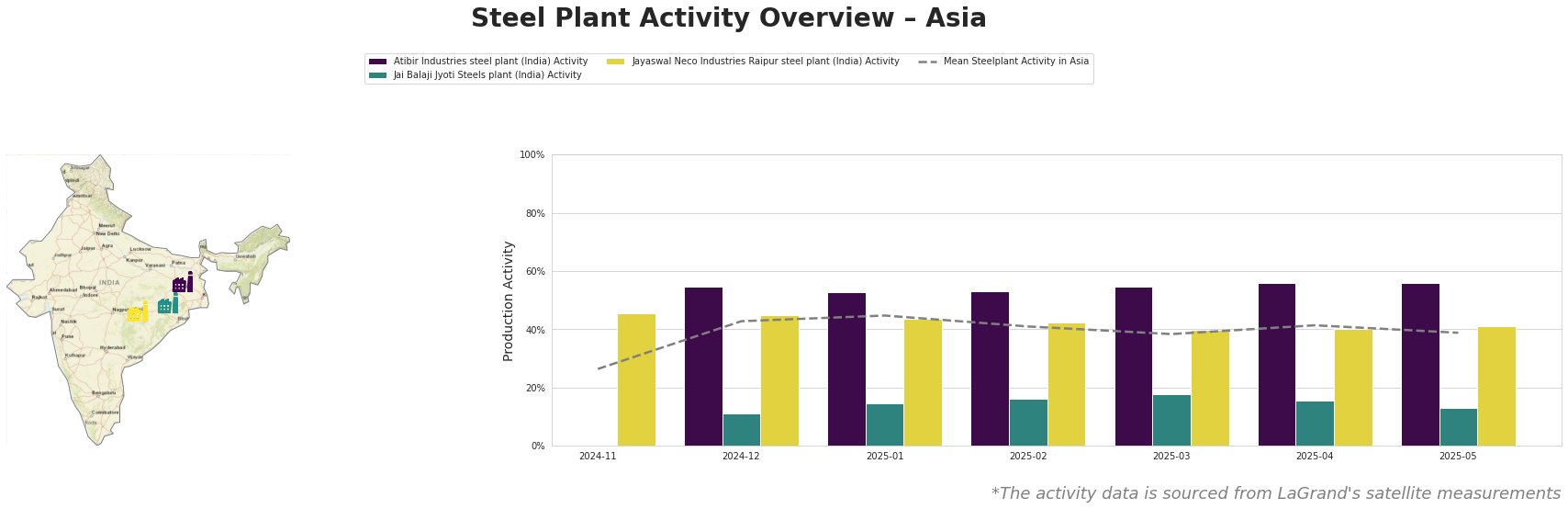

The mean steel plant activity in Asia has fluctuated between a low of 26% in November 2024 and a high of 45% in January 2025. Since January, there has been a slow overall decline to 39% in May 2025. Specific plants show varied activity: Atibir Industries shows consistently high activity, while Jai Balaji Jyoti Steels has very low activity.

Atibir Industries, a 600 ttpa integrated (BF) steel plant in Jharkhand, India, has maintained consistently high activity levels. Ranging between 53% and 56% since December 2024, the satellite data suggests stable or increasing utilization of its BOF production route despite the backdrop of potentially decreasing Chinese iron ore imports reported in “China’s iron ore imports decrease by 5.5 percent in January-April”.

Jai Balaji Jyoti Steels, a 92 ttpa integrated (DRI) plant in Odisha, India, shows consistently low activity. Starting from 11% in December 2024 and peaking at 18% in March 2025, activity declined to 13% in May 2025. This low activity level does not directly correlate with the news articles on Chinese imports, and a direct relationship cannot be established based on the provided information.

Jayaswal Neco Industries Raipur, a 1200 ttpa integrated (BF and DRI) steel plant in Chhattisgarh, India, has shown relatively stable activity. Its activity has hovered around 40-46% since November 2024. No direct connection can be established between its activity and the news articles on Chinese imports or PPI changes.

The news article “China’s steel industry PPI down 10 percent in January-April“ coupled with stable or high activity at Atibir Industries may indicate potential cost advantages for Indian steel producers relative to Chinese competitors. Given China’s declining iron ore and coal imports, coupled with declining PPI, steel buyers should explore opportunities to diversify their supply chains, specifically focusing on Indian producers like Atibir Industries. Closely monitor Jai Balaji Jyoti Steels plant activity for potential supply disruptions, but prioritize procurement from plants with stable observed production, like Jayaswal Neco Industries Raipur, if product specifications align.