From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Stable Production Amidst US-China Trade Tensions

Steel production in Asia shows relatively stable trends, with some variance across specific plants. Recent news regarding potential US trade actions does not yet show any clear direct impact on observed steel plant activity.

While updates from the “Liveblog USA unter Trump: Xi hatte nur einen schlechten Moment | FAZ” report on Trump’s threats of 100% tariffs on Chinese goods, as well as further updates covered in “Liveblog USA unter Trump: Trump verteidigt Einschränkung der Pressefreiheit im Pentagon” and “Liveblog USA unter Trump: US-Richterin stoppt Trumps Massenentlassungen im „Shutdown“ | FAZ“, suggest potential future disruptions to global trade flows, no direct impact is immediately visible on Asian steel production from provided plant activity data. The article “Liveblog USA unter Trump: Trump würdigt Charlie Kirk mit höchster Auszeichnung” does not appear to have an impact on steel production.

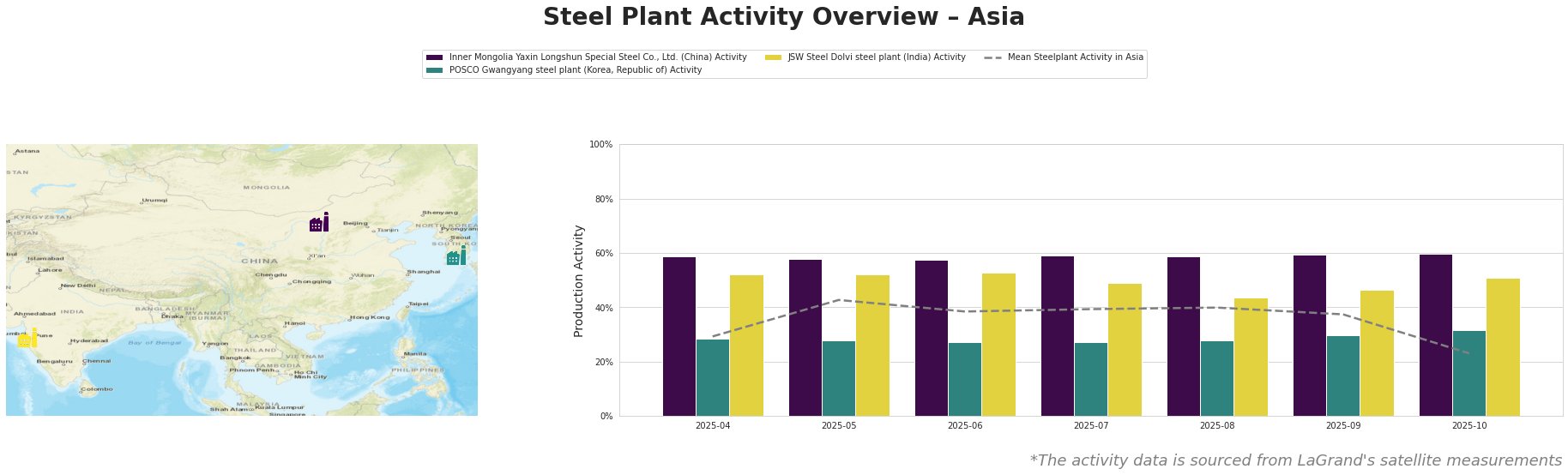

The mean steel plant activity in Asia fluctuated between 23% and 43% over the observed period, with a significant drop to 23% in October.

Inner Mongolia Yaxin Longshun Special Steel Co., Ltd., a BF/BOF integrated steel plant with a 2 million tonne crude steel capacity, producing high-strength anti-vibration rebar and high-speed coil screw and high-speed wire, shows a stable activity level around 59% to 60% throughout the period. No direct relationship between the stability of this plant and the named news articles can be established.

POSCO Gwangyang steel plant, an integrated BF plant with 23 million tonnes crude steel capacity, producing hot rolled steel, plate, wire rod, cold rolled steel, galvanized steel, electric galvanized steel, stainless steel, and titanium, has shown an increase in activity from 29% in April to 32% in October. While the activity is increasing, no connection between this specific trend and the named news articles can be established.

JSW Steel Dolvi steel plant, with a 5 million tonne crude steel capacity using both BF/BOF and DRI/EAF routes and producing wire rod, cold rolled, bar, hot rolled, specialty steel, and galvanized steel, experienced a decrease in activity from 52% in April/May to 44% in August, and then a rise to 51% in October. No direct relationship between this plant’s activity trends and the named news articles can be established.

Evaluated Market Implications:

While the “Liveblog USA unter Trump: Xi hatte nur einen schlechten Moment | FAZ” article discusses potential tariffs, the satellite data does not yet reflect these potential disruptions. The mean activity level in Asia shows a drop in October; however, this decline does not coincide with any specific policy changes explicitly mentioned in the news articles provided.

- Procurement Action: Steel buyers and analysts should closely monitor further developments related to US-China trade relations, as highlighted in “Liveblog USA unter Trump: Xi hatte nur einen schlechten Moment | FAZ,” and track subsequent activity changes at major steel plants in Asia. Although current satellite data doesn’t show immediate impacts, the risk of future supply chain disruptions remains. Consider diversifying sources, particularly for products similar to those produced by POSCO Gwangyang, given its increasing activity, to mitigate potential price volatility.