From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Stable Plant Activity Amidst US Tariff Concerns

Asia’s steel market shows consistent plant activity amidst global trade uncertainties. While concerns regarding US tariffs, as reported in “Trumps US-Zölle im Liveticker: USA und Japan einigen sich auf Handelsabkommen | FAZ“, “Trumps US-Zölle im Liveticker: Außenhandelsverband kritisiert Zollabkommen mit den USA | FAZ“, “Trumps US-Zölle im Liveticker: | FAZ: Merz: Deutsche Wirtschaft wird erheblichen Schaden nehmen durch Zölle“, and “Trumps US-Zölle im Liveticker: VCI: „Das Abkommen mit den USA zeigt: Augenhöhe war früher“ | FAZ“, could impact demand, satellite data shows largely stable production levels in selected plants. However, no direct correlation between tariff-related news and specific plant activity changes could be explicitly established.

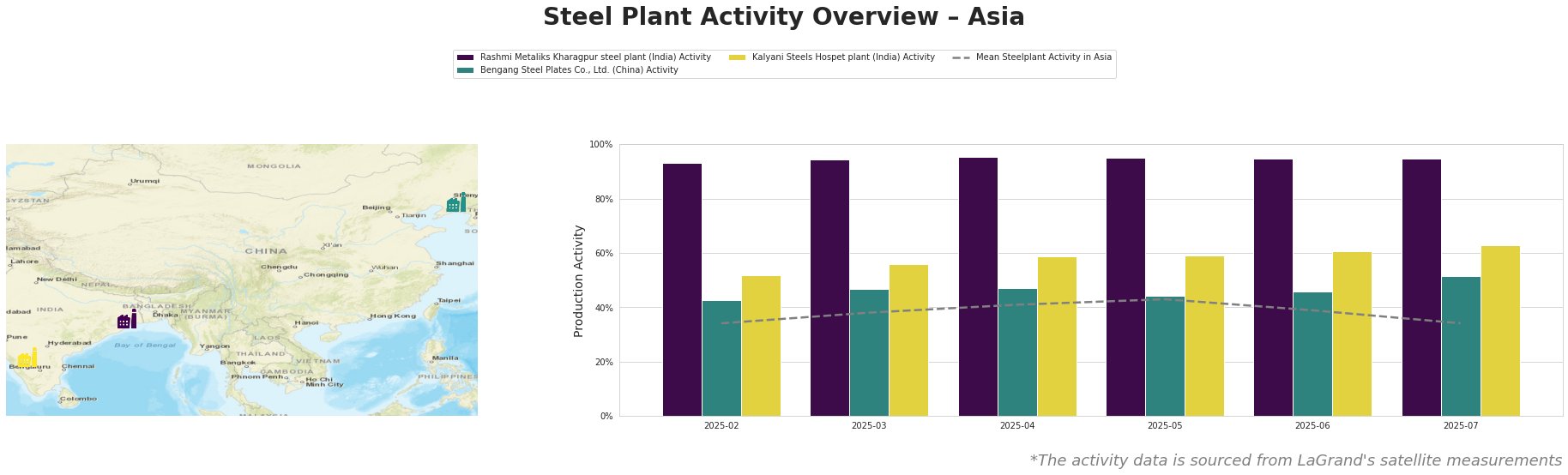

The mean steel plant activity in Asia fluctuated between 34% and 43% from February to July 2025. Rashmi Metaliks Kharagpur consistently showed high activity, remaining at 93-95%. Bengang Steel Plates Co., Ltd. saw activity ranging from 43% to 51% over the period. Kalyani Steels Hospet plant showed a general upward trend, increasing from 52% in February to 63% in July.

Rashmi Metaliks Kharagpur steel plant, located in West Bengal, India, primarily utilizes DRI and BF technologies with a crude steel capacity of 1.5 million tonnes per annum (ttpa). The plant focuses on producing DRI, pig iron, billets, TMT bars, DI pipes, and wire rod. Activity remained consistently high at around 95% throughout the observed period. No direct link between this sustained high activity and the tariff-related news articles could be established.

Bengang Steel Plates Co., Ltd., a major integrated BF steel plant in Liaoning, China, boasts a crude steel capacity of 12.8 million ttpa. It specializes in finished rolled products, including automotive, home appliance, oil pipeline, and container plates. Plant activity fluctuated, increasing from 43% in February to 51% in July. This increase doesn’t seem to be directly connected to the tariff-related news, as the products of Bengang Steel Plates Co., Ltd are used and consumed mainly within Asia.

Kalyani Steels Hospet plant in Karnataka, India, uses both BF and DRI methods with a crude steel capacity of 860,000 ttpa. Its product range includes rolled bars, rounds, and machined bars used in the automotive, building, and energy sectors. Plant activity showed a consistent increase from 52% in February to 63% in July. No immediate connection can be found between these increases and the provided tariff-related news articles.

The relative stability in plant activity suggests that, despite concerns about potential trade disruptions arising from US tariffs reported in “Trumps US-Zölle im Liveticker: USA und Japan einigen sich auf Handelsabkommen | FAZ“, “Trumps US-Zölle im Liveticker: Außenhandelsverband kritisiert Zollabkommen mit den USA | FAZ“, “Trumps US-Zölle im Liveticker: | FAZ: Merz: Deutsche Wirtschaft wird erheblichen Schaden nehmen durch Zölle“, and “Trumps US-Zölle im Liveticker: VCI: „Das Abkommen mit den USA zeigt: Augenhöhe war früher“ | FAZ“, Asian steel production remains relatively robust. Steel buyers should monitor the Bengang Steel Plates Co., Ltd. in Liaoning, China to investigate the cause of production increase. This could indicate preparations to take on exports slowed by tariffs, or alternatively growing internal demand. No immediate procurement changes appear necessary, but the potential impact of evolving trade policies requires continued vigilance, especially given the lack of direct connections identified between the provided news and production levels.