From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Stable Output Amid US Trade Case Developments

In Asia, steel production levels are generally stable, although recent trade actions by the U.S. introduce some uncertainty, specifically the preliminary results of the CVD review on CTL plate from S. Korea” and “US issues preliminary results of CVD review on welded pipe from S. Korea“. A direct relationship between these US trade cases and observed plant activity levels within Asia cannot be definitively established based on the provided data.

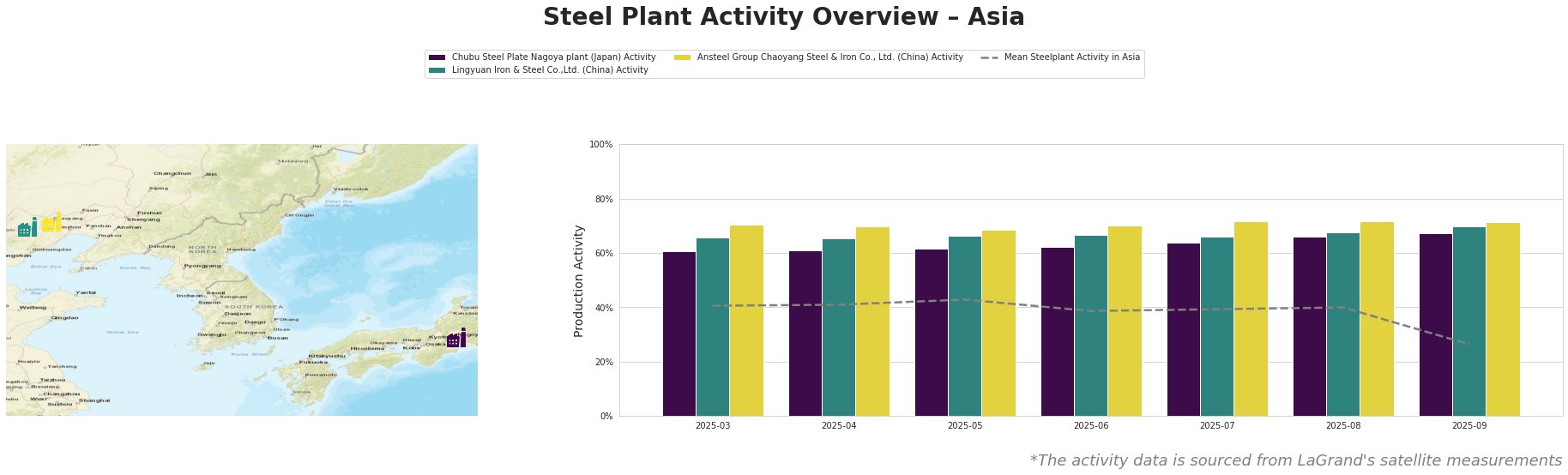

Overall, the average steel plant activity in Asia fluctuated, starting at 41% in March-April 2025, peaking at 43% in May before declining to 26% by September 2025.

Chubu Steel Plate Nagoya plant, a Japanese EAF-based plate producer focused on automotive and infrastructure sectors, showed a consistent upward trend from 61% in March-April to 67% in September. This is significantly above the Asian average. There is no discernible link between this activity and any of the provided US trade case news.

Lingyuan Iron & Steel Co., Ltd., a Chinese integrated BF-BOF producer of special steel and rebar, exhibited relatively stable activity levels, starting at 66% in March-April and increasing to 70% in September, consistently above the Asian average. No explicit connection to the provided news can be established.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., another Chinese integrated BF-BOF producer of steel plate and pipe, also demonstrated stable activity, commencing at 70% and rising to 72%. No explicit connection to the provided news can be established.

The significant drop in the average steel plant activity in Asia in September to 26% does not seem to be reflected in the activity of the analyzed steel plants.

The US DOC has issued preliminary findings from its review of countervailing duties on large diameter welded pipe from South Korea. The review, covering January 1 to December 31, 2023, indicates that certain South Korean producers and exporters are receiving countervailable subsidies.

Evaluated Market Implications:

Given the preliminary CVD findings against South Korean welded pipe producers highlighted in “US issues preliminary results of CVD review on welded pipe from S. Korea,” and the amended final results of AD review on HWR from Mexico’s Maquilacero”, steel buyers should:

- Diversify welded pipe sourcing: Procurement professionals who rely heavily on South Korean welded pipe should explore alternative suppliers to mitigate potential disruptions and price volatility stemming from the CVD duties.

- Carefully review contracts: Examine existing contracts with South Korean and Mexican welded pipe suppliers and consider clauses addressing potential duty changes and their impact on pricing.

- Monitor updates: Continuously track the DOC’s final determinations on the CVD reviews concerning South Korean welded pipe.