From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Stable Output Amid EU Trade Concerns

Asia’s steel market shows largely stable production, even as the EU addresses steel derivative imports. The “EUROMETAL urges EU to close loopholes allowing surge in high-emission steel derivative imports” and related articles highlight concerns about circumvention of trade regulations and CBAM, but a direct impact on Asian steel production is not yet evident from observed activity levels.

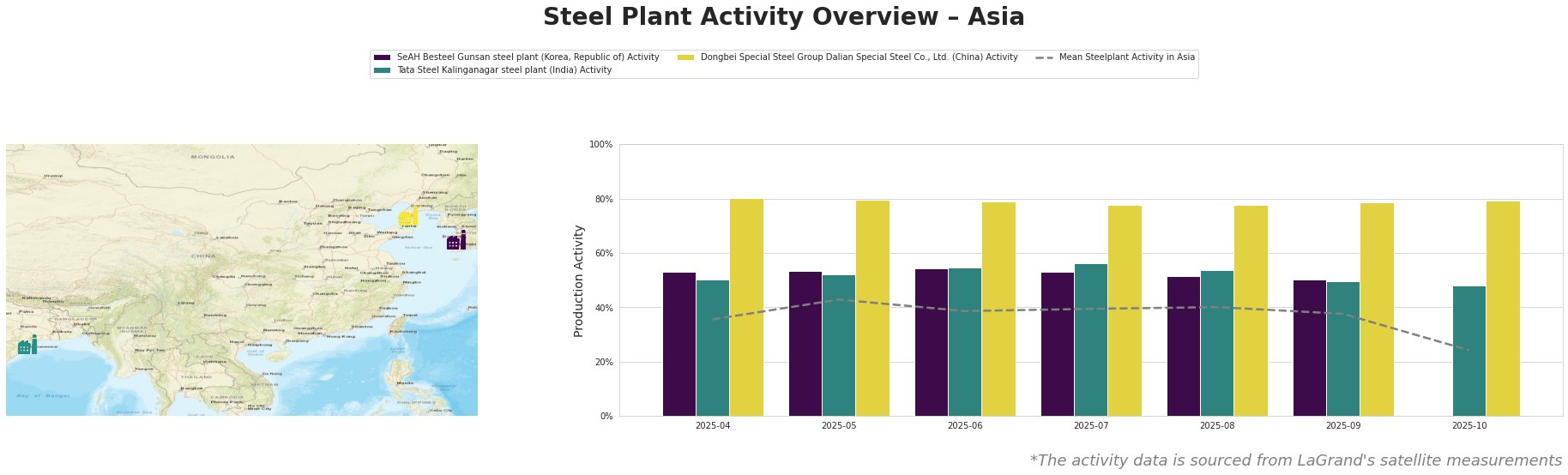

Observed monthly activity across key Asian steel plants shows relative stability through September 2025, with a slight dip in average activity in October. This is based on satellite observations that may not capture the full picture of steel derivative production specifically.

The mean steel plant activity in Asia remained relatively stable from April to September 2025, ranging from 36% to 43%, before dropping to 24% in October.

SeAH Besteel Gunsan steel plant, a South Korean EAF-based special steel producer focused on automotive parts, showed activity fluctuating between 50% and 54% from April to September. Activity data for October is unavailable. While EUROMETAL articles address automotive part imports from countries with lax environmental regulations that circumvent trade protection laws and the Carbon Border Adjustment Mechanism (CBAM) (“EUROMETAL urges EU to take action on imports of metal derivatives, CBAM report says” and “EUROMETAL urges EU to close loopholes allowing for a sharp increase in imports of high-emission steel derivatives“), a direct impact of these concerns on SeAH Besteel’s activity is not evident from provided activity data alone.

Tata Steel Kalinganagar, an integrated BF-BOF plant in India producing 3000 ttpa of crude steel for the automotive sector, displayed a stable activity level between 50% and 56% from April to September, dropping slightly to 48% in October. The provided news articles do not establish a direct connection to the steel plant in India.

Dongbei Special Steel Group Dalian Special Steel, a Chinese integrated steel plant producing 1540 ttpa of crude steel, specializing in stainless steel and automotive steel, operated at a consistently high activity level around 79-80% throughout the observed period. This high level may indicate strong domestic demand or export activity, but we cannot directly correlate this to concerns raised in the EUROMETAL articles regarding Chinese steel derivative exports without further information.

The recent EU pressure around steel derivative imports, as highlighted in “EUROMETAL urges EU to close loopholes allowing surge in high-emission steel derivative imports,” could indirectly impact demand for Asian steel products, particularly automotive parts. Steel buyers should closely monitor policy changes in the EU and potential shifts in trade flows.

Recommendations for Steel Buyers:

- Diversify Sourcing: Given the uncertainty surrounding EU trade policy and its potential impact on specific product segments, consider diversifying steel sourcing to mitigate risks associated with potential tariffs or quotas.

- Monitor EU Policy: Closely track EU policy announcements related to CBAM implementation and trade defense measures, as mentioned in “Eurometal calls on the EU to take action on imports of steel derivatives.” These policies could affect the competitiveness of Asian steel exports.

- Assess Automotive Steel Supply Chains: Buyers relying on Asian steel for automotive component manufacturing should evaluate potential disruptions from EU trade measures and explore alternative sourcing options if necessary, especially given the concerns raised in “”EUROMETAL urges EU to close loopholes allowing for a sharp increase in imports of high-emission steel derivatives.”

- Engage with Suppliers: Communicate with steel suppliers in Asia to understand their strategies for addressing potential trade barriers and ensure continued supply chain resilience.