From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Stable Iron Ore Prices Boost Production Despite Fluctuations

Asia’s steel market presents a mixed picture with stable iron ore prices supporting production amidst some plant-level activity fluctuations. News articles like “Moody’s expects iron ore prices to remain stable at $80-100/t in the coming years” and “Rio Tinto forecasts stable demand for iron ore in China” suggest continued operational confidence, though we cannot directly connect this sentiment with the observed drops in steel plant activity.

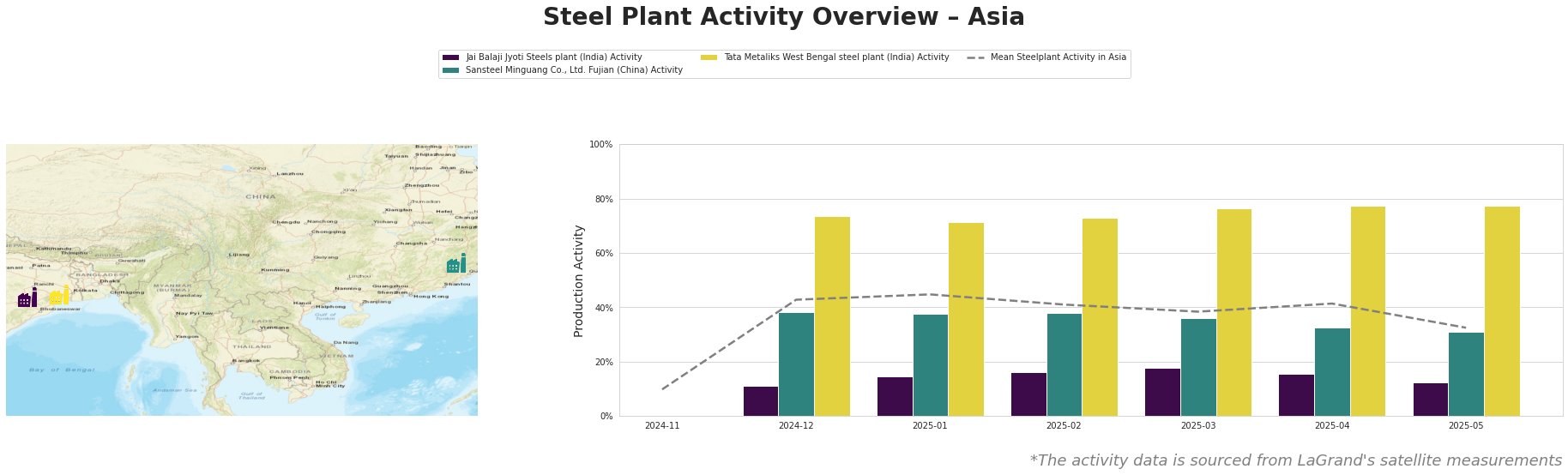

The mean steel plant activity in Asia peaked in January 2025 at 45% and has since declined to 32% by the end of May 2025. Jai Balaji Jyoti Steels plant activity shows a low start and a small activity increase up to March 2025 at 18% with a significant decline to 12% in May 2025. Sansteel Minguang Co., Ltd. Fujian’s activity remained relatively stable around 38% until March 2025, then decreasing to 31% in May 2025. Tata Metaliks West Bengal steel plant, however, shows consistently high activity, reaching 78% in May 2025, significantly above the Asian average.

Jai Balaji Jyoti Steels plant: This Odisha-based plant, with a 92 ttpa EAF capacity and integrated DRI process, showed an increase in activity from November 2024 to March 2025, peaking at 18%. However, activity dropped to 12% in May 2025. While news articles like “Moody’s expects iron ore prices to remain stable at $80-100/t in the coming years” suggest stable iron ore prices, we cannot directly relate these price forecasts to the observed activity fluctuations at this specific plant.

Sansteel Minguang Co., Ltd. Fujian: Operating in Fujian with a 6,800 ttpa BOF capacity, this integrated BF steel plant experienced a slight decline in activity from 38% to 31% between December 2024 and May 2025. While “Iron ore as a pillar: industry giants rely on Chinese steel production” points towards sustained demand in China, no direct connection can be established between this general outlook and the marginal decline in activity observed at Sansteel Minguang.

Tata Metaliks West Bengal steel plant: This plant in West Bengal, featuring a 600 ttpa BF capacity and focusing on pig iron and ductile pipes, has demonstrated consistently high activity. Its activity increased from 74% in December 2024 to 78% in May 2025, significantly exceeding the regional average. Despite news of stable iron ore demand (“Rio Tinto forecasts stable demand for iron ore in China”), we cannot explicitly link these forecasts with the plant’s observed increasing activity levels.

Evaluated Market Implications:

Given the stable outlook on iron ore prices as indicated by “Moody’s expects iron ore prices to remain stable at $80-100/t in the coming years,” potential supply disruptions are less likely due to raw material costs. However, the observed decline in average plant activity across Asia, coupled with the specific reduction at Jai Balaji Jyoti Steels plant, might indicate localized production adjustments or maintenance shutdowns.

Recommended Procurement Actions:

- Steel Buyers focused on pig iron and ductile pipes: Prioritize securing supply contracts with Tata Metaliks West Bengal steel plant. Their consistently high production suggests a reliable source amidst fluctuating regional activity.

- Steel Buyers of construction steel in Fujian: Closely monitor Sansteel Minguang Co., Ltd. Fujian’s production levels. The slight decline, while not drastic, warrants diversification of supply sources to mitigate potential delays.

- Steel Market Analysts: Analyze localized demand and production costs at Jai Balaji Jyoti Steels plant to identify drivers behind the observed activity drop, providing more accurate insights for regional supply forecasting.