From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Stable China Production Offsets European HRC Concerns

In Asia, steel production remains relatively stable despite global HRC price fluctuations. The relative stability of steel production in China occurs despite the fact that “Global prices for hot-rolled coil came under pressure in most regions in July,” reporting increases in China, which is reflected in the satellite data. The “ArcelorMittal increases northern Europe coil prices again: sources” news article highlights concerns in Europe, where increased import restrictions and potential trade measures could impact Asian exports.

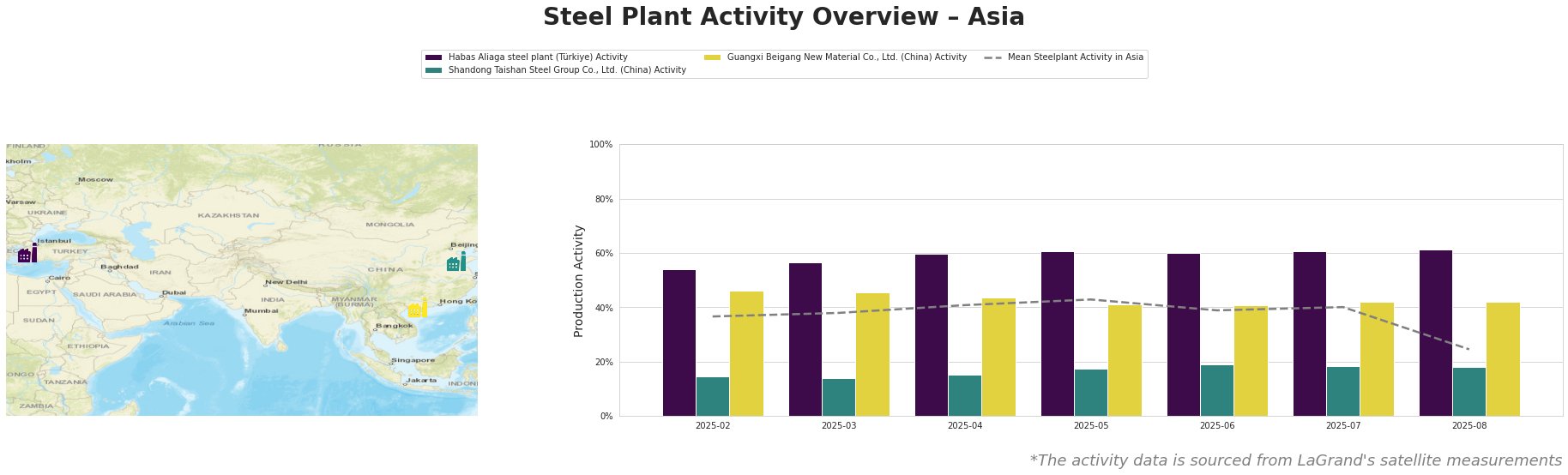

Here’s an overview of recent plant activity:

The mean steel plant activity in Asia decreased significantly in August, dropping from 40% to 25%.

Habas Aliaga steel plant: This Turkish plant, with a 4.5 million tonnes per annum (ttpa) EAF-based crude steel capacity, has maintained a consistently high activity level. The plant produces semi-finished and finished rolled products, including hot rolled coil. Its activity has been above the Asian average for the entire period, remaining at 61% between May and August. No direct connection between “ArcelorMittal increases northern Europe coil prices again: sources” and plant activity can be established.

Shandong Taishan Steel Group Co., Ltd.: This Chinese integrated steel plant has a crude steel capacity of 5 million ttpa, with both BF and EAF processes and focuses on hot and cold rolled coil. Its activity levels remain significantly below the Asian average, fluctuating slightly between 14% and 19% from February to August. The increase in activity reported from May to June aligns with the price increase reported in “Global prices for hot-rolled coil came under pressure in most regions in July,” but a conclusive relationship can not be established due to limited data.

Guangxi Beigang New Material Co., Ltd.: Another Chinese plant with a crude steel capacity of 3.4 million ttpa, utilizing both BF and EAF processes and producing hot and cold rolled coil. Its activity has remained relatively stable, fluctuating between 41% and 46% from February to August. The plant’s activity is around the Asian average. No direct connection between the stability in activity and any of the listed news articles can be established.

Evaluated Market Implications:

The “ArcelorMittal increases northern Europe coil prices again: sources” news article, coupled with potential new trade instruments in Europe, suggests potential import restrictions that could disrupt Asian steel exports to Europe. This article states that buyers are anticipating price consolidation due to diminishing options from Asia because of the EU policies. The Habas Aliaga steel plant shows strong, stable production that may be redirected to other markets because of these EU policies.

Recommended Procurement Actions:

- Steel Buyers: Given potential trade restrictions in Europe and the possibility of supply disruptions, Asian buyers should focus on securing domestic supply agreements, especially for hot rolled coil. While the European market experiences volatility, stable production in China offers an alternative. Diversify your sources, considering Turkish suppliers as an alternative in case Chinese suppliers struggle to access the European market. The Habas Aliaga plant activity levels suggest it is a reliable supplier, particularly given its ResponsibleSteel certification.

- Market Analysts: Monitor European trade policy developments closely. The implementation of the Carbon Border Adjustment Mechanism and any new trade instruments could significantly impact Asian steel exports. The combination of strong domestic demand and European supply disruptions may see increased export activity from China.