From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Shows Strength Despite US Import Shifts: China Plants Lead Production

Asia’s steel market displays overall positive sentiment driven by increased plant activity in China, despite shifts observed in US steel import and export dynamics. Increased activity levels in key Chinese steel plants do not directly correlate with the news articles “US beam exports down 33.9 percent in April 2025“, “US increased its imports of rolled steel by 10.4% m/m in May“, “US exports of plates in coil down 12.9 percent in April from March“, “US rebar imports down 36.1 percent in April 2025“, “US standard pipe imports down 3.4 percent in April 2025“, “US line pipe imports down 48.3 percent in April 2025“ and “US hot rolled bar exports down 12.1 percent in April 2025“, which primarily focus on US trade flows.

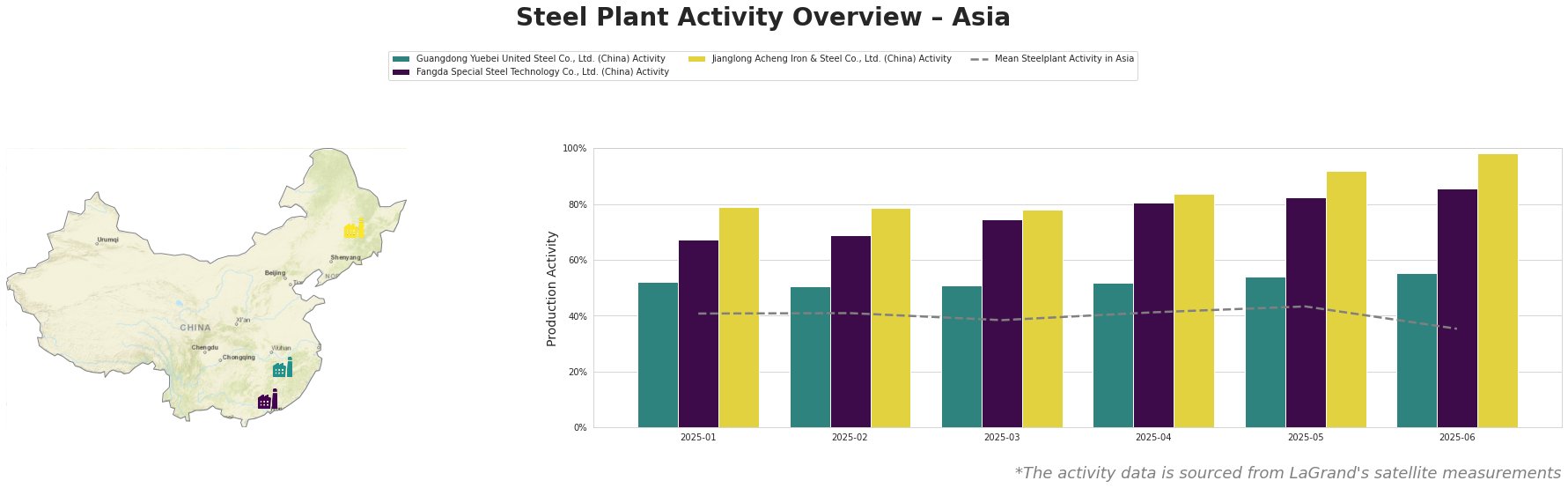

The mean steel plant activity in Asia fluctuated between 35% and 43% during the observed period, with a notable dip to 35% in June 2025. Guangdong Yuebei United Steel Co., Ltd. shows a relatively stable activity level around 51-55%, consistently exceeding the mean. Fangda Special Steel Technology Co., Ltd. demonstrates a clear upward trend, rising from 67% in January to 85% in June. Jianglong Acheng Iron & Steel Co., Ltd. exhibits the most significant growth, peaking at 98% in June, significantly above the Asian mean.

Guangdong Yuebei United Steel Co., Ltd., an integrated steel plant with a 2000 TTPA capacity specializing in rebar for building and infrastructure, shows consistent activity. Activity has increased slightly from 52% in January 2025 to 55% in June 2025. This steady state, higher than the regional mean, suggests stable production, though no direct link can be established with the named news articles concerning US import/export changes.

Fangda Special Steel Technology Co., Ltd., a major integrated steel producer (3600 TTPA) in Jiangxi, focuses on special steel products. Its activity increased substantially from 67% in January 2025 to 85% in June 2025, far exceeding the mean activity level for Asia. This increase does not appear to be directly influenced by the dynamics described in the provided US-focused news articles.

Jianglong Acheng Iron & Steel Co., Ltd., an integrated steel plant (1100 TTPA) producing hot-rolled and coated products for automotive, energy, and machinery sectors, shows the most pronounced increase in activity. From 79% in January, it reached 98% in June. This surge significantly surpasses the regional average, suggesting a strong focus on domestic or regional demand. This notable increase cannot be directly linked to any of the provided news articles about US trade.

Evaluated Market Implications:

Based on the observed data, increased activity in the Chinese steel plants Fangda Special Steel Technology Co., Ltd. and Jianglong Acheng Iron & Steel Co., Ltd. indicates a potentially tighter supply of special steel and hot-rolled/coated products within the Asian market, which could be caused by an increased domestic demand. Although US import shifts do not appear to be directly correlated with plant activity in China, the US shift might provide opportunities for steel buyers and market analysts in Asia.

* Recommended Procurement Action: Steel buyers should closely monitor the pricing and availability of special steel and hot-rolled/coated products, particularly from Fangda Special Steel Technology Co., Ltd. and Jianglong Acheng Iron & Steel Co., Ltd.