From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Shows Positive Momentum Amidst New Plant Investments and Fluctuating Regional Activity

Asia’s steel market displays positive sentiment driven by significant investments in advanced steel production. The impact of these investments on regional steel plant activity is mixed. Recent news, such as “ANDRITZ receives final acceptance for cold rolling mill from Ansteel Group, China” and “ArcelorMittal/China Oriental Group JV orders high-end silicon steel processing plant from ANDRITZ,” highlight expansion and technological upgrades in China. No direct relationship could be established between these investments and the satellite-observed activity levels of the selected steel plants.

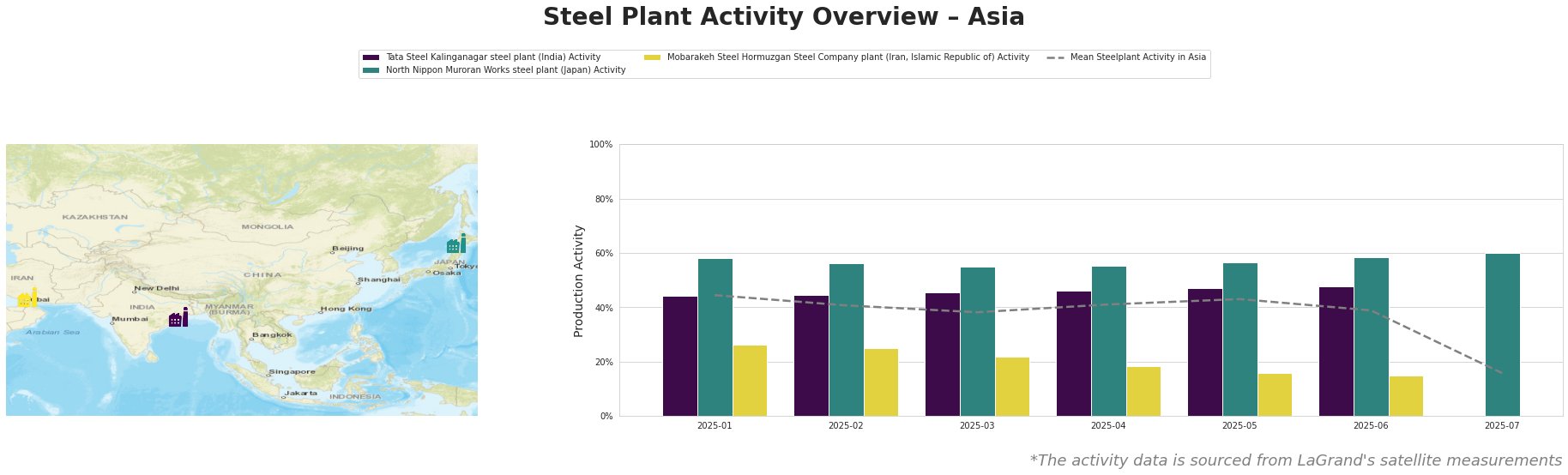

The mean steel plant activity in Asia experienced a notable decline in July, dropping to 16% after hovering between 38% and 44% in the preceding months.

Tata Steel Kalinganagar steel plant (India), an integrated BF-BOF plant with a 3 million tonne crude steel capacity focusing on finished rolled products for the automotive sector, showed a gradual increase in activity from 44% in January to 48% in June. However, July data is missing. There is no direct relationship between the news articles and this plant’s activity.

North Nippon Muroran Works steel plant (Japan), an integrated BF-BOF plant with EAF capacity totaling 2.598 million tonnes crude steel, producing semi-finished and finished rolled products like bars and wires, maintained a relatively stable activity level between 55% and 58% from January to June, peaking at 60% in July, significantly above the regional average. There is no direct relationship between the news articles and this plant’s activity.

Mobarakeh Steel Hormuzgan Steel Company plant (Iran), an integrated DRI-EAF plant with a 1.5 million tonne crude steel capacity producing semi-finished and finished rolled products for automotive, energy, and steel packaging, experienced a steady decline in activity from 26% in January to 15% in June, significantly below the regional average. July data is missing. There is no direct relationship between the news articles and this plant’s activity.

The increase in steelmaking capabilities through ANDRITZ mill deliveries, as highlighted in “ANDRITZ Delivers Cold Rolling Mill to Ansteel Group,” suggests an increased availability of high-strength and titanium alloy strips in the Chinese market. Simultaneously, the plant activity data indicate potential regional disparities with significantly reduced activity at the Mobarakeh Steel Hormuzgan plant in Iran.

Given these developments, steel buyers should:

- Diversify Procurement: Explore alternative suppliers beyond Iran due to the observed activity decline at Mobarakeh Steel Hormuzgan, to mitigate potential supply disruptions.

- Monitor Chinese Market: Closely monitor the Chinese market for competitive pricing on high-strength steel and titanium alloy strips due to the new capacities coming online.