From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Rising Scrap Exports & Stable Indian Production Signal Continued Growth

Asia’s steel market demonstrates resilience as US scrap exports increase and key regional plants maintain high activity. This report analyzes these trends using recent news and satellite-observed plant activity. While US export changes might indirectly influence regional supply dynamics, no direct connection to specific Asian plant activities could be established.

The “US iron and steel scrap exports up 17.3 percent in May 2025,” indicating potential shifts in raw material availability for Asian steelmakers. However, observed steel plant activities in Asia do not show immediate reactions tied to these exports.

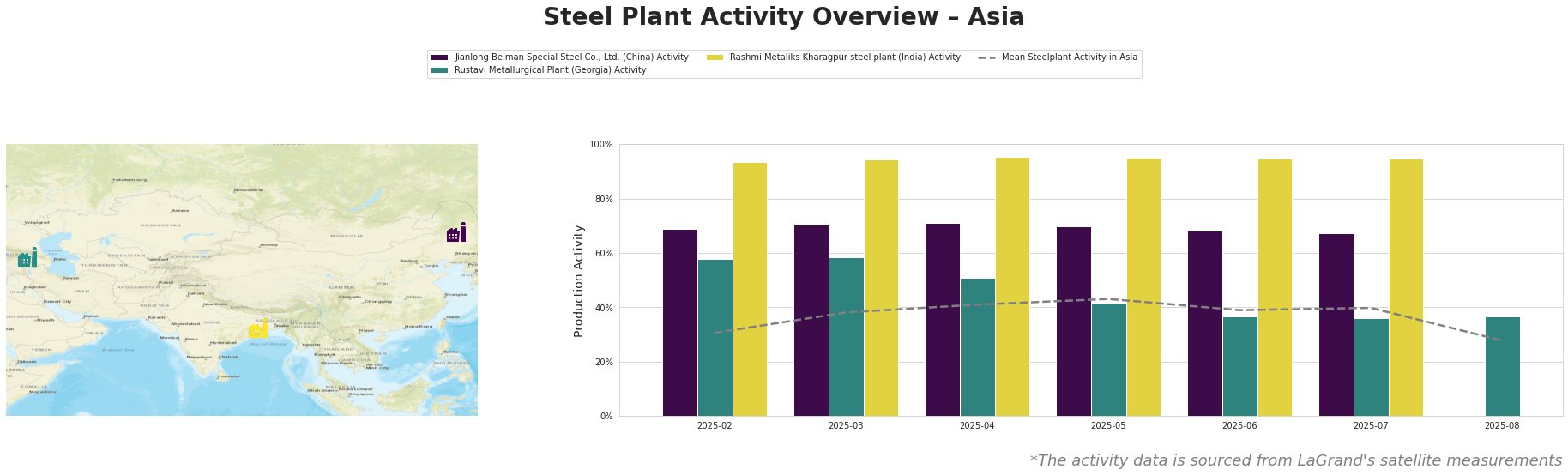

Measured Activity Overview:

Overall, the mean steel plant activity in Asia has fluctuated, peaking in May 2025 at 43% and subsequently declining to 28% by August 2025. Jianlong Beiman Special Steel Co., Ltd. in China, while consistently above the Asian average, experienced a gradual decrease from 71% in April 2025 to 67% in July 2025. Rustavi Metallurgical Plant in Georgia showed a marked decline from 59% in March 2025 to 36% in July 2025, falling below the regional mean. Rashmi Metaliks Kharagpur steel plant in India maintained a consistently high activity level of approximately 95% throughout the observed period. The “US iron and steel scrap exports up 17.3 percent in May 2025” showed no immediate impact on observed Asian steel plant activities.

Jianlong Beiman Special Steel Co., Ltd., an integrated BF steel plant in Heilongjiang, China, with a crude steel capacity of 2.2 million tons, primarily produces semi-finished and finished rolled products, including tool steel and bearing steel. Its activity level decreased slightly from 71% in April 2025 to 67% in July 2025, remaining above the regional average. Given the plant’s focus on specialized steels and the export trends reported in the news articles (“US tool steel exports up 24.2 percent in May 2025“), it is possible that the plant could be indirectly affected by the shift in the USA.

Rustavi Metallurgical Plant, an integrated BF steel plant in Kvemo Kartli, Georgia, with a crude steel capacity of 120,000 tons, produces a range of products including rebar and seamless pipes. Its activity experienced a notable decline, falling from 59% in March 2025 to 36% in July 2025. The observed decline could be associated with plant specific events or localized demand fluctuations, as no direct link with the provided news articles could be established.

Rashmi Metaliks Kharagpur steel plant, an integrated BF and DRI plant in West Bengal, India, with a crude steel capacity of 1.5 million tons, produces DRI, pig iron, and TMT bars. Its activity remained consistently high at around 95% throughout the observed period, indicating stable production. No direct connection between Rashmi Metaliks’ activity and the provided news articles can be established.

Evaluated Market Implications:

The observed stable high activity at Rashmi Metaliks Kharagpur suggests a reliable supply of TMT bars from India. Steel buyers should consider securing contracts with Rashmi Metaliks to mitigate potential supply chain disruptions in the TMT bar market. The plant information and satellite data indicates consistently high utilization of the plant. Buyers are advised to proactively engage with Rashmi Metaliks to establish supply agreements and potentially negotiate favorable terms given their consistent output.

The decline in activity at Rustavi Metallurgical Plant in Georgia raises concerns about potential supply disruptions in rebar and seamless pipes. Steel buyers who rely on Rustavi Metallurgical Plant as a supplier should proactively seek alternative sources to mitigate risks associated with potential production cuts.