From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Rising Production Amidst US Import Shifts – Procurement Opportunities Emerge

Asia’s steel market shows overall positive momentum, despite individual plant fluctuations. Observed activity changes at key Chinese steel plants occur concurrently with shifts in the US steel market as reported in “US steelmakers shipped 7.51 million tons of steel in May – AISI” and “US raw steel production is down 0.6 percent – week 27, 2025” but no direct links can be established.

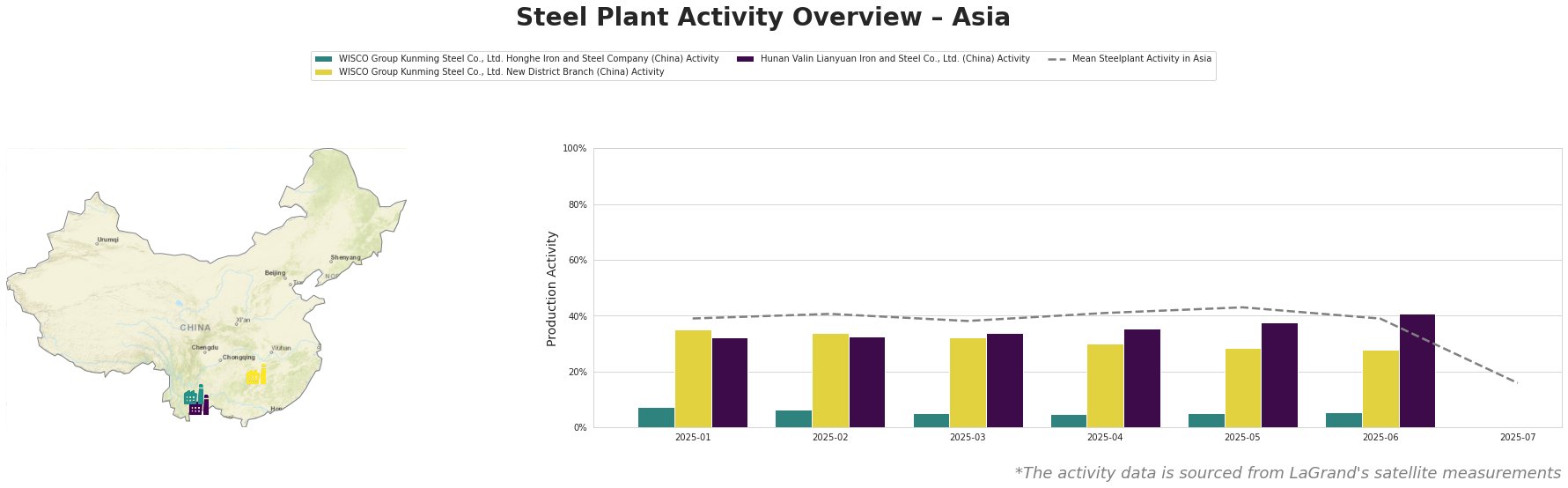

The mean steel plant activity in Asia fluctuated between 38% and 43% from January to May 2025, before dropping sharply to 16% in July. WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company consistently operated at very low activity levels (5-7%). WISCO Group Kunming Steel Co., Ltd. New District Branch saw a gradual decline in activity from 35% in January to 28% in June. Hunan Valin Lianyuan Iron and Steel Co., Ltd. showed a positive trend, increasing from 32% in January to a peak of 41% in June.

WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company, a Yunnan-based integrated steel plant with a crude steel capacity of 1.15 million tonnes, has consistently exhibited low activity levels (around 5%) throughout the observed period. While holding a Responsible Steel Certification, its reliance on BF/BOF technology for producing bars, wire, and hot-rolled products does not appear to have been significantly impacted by the US market shifts detailed in “US steelmakers shipped 7.51 million tons of steel in May – AISI“, as no direct correlation can be established with its persistently low activity.

WISCO Group Kunming Steel Co., Ltd. New District Branch, another integrated steel plant in Yunnan with a 2.8 million tonne crude steel capacity and Responsible Steel Certification, experienced a gradual activity decline from 35% in January to 28% in June. Its similar product portfolio (bars, wire, hot-rolled products) and technology (BF/BOF) to the Honghe branch suggest similar market pressures, but no direct connection can be established to any announcements about the US market.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., a major integrated steel producer in Hunan with a 9 million tonne crude steel capacity and certifications including ISO14001, ISO50001 and Responsible Steel Certification, demonstrated increasing activity, reaching 41% in June. This plant produces a range of products including electric steel, automotive steel, and pipeline steel, and utilizes BF/BOF technology. The increase in activity cannot be directly correlated with the developments reported in “US steelmakers shipped 7.51 million tons of steel in May – AISI” or any other specific news.

Given the increasing activity at Hunan Valin Lianyuan Iron and Steel Co., Ltd., while other plants show a downtrend, procurement professionals should:

- Prioritize securing supply contracts with Hunan Valin Lianyuan Iron and Steel Co., Ltd. to capitalize on their increased production, mitigating potential supply disruptions from other facilities.