From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Resilient Despite China’s Real Estate Slowdown: DRI Production Up, India Remains Strong

Asia’s steel market demonstrates resilience despite challenges in China’s real estate sector. Decreased real estate investments reported in “China’s real estate investments in January-September decreased by 13.9% y/y” correlates with a decrease in Chinese steel production, as highlighted in the article, while steel exports increased. This is coupled with the information in “Slight Decline in China’s Rebar Production in the First Nine Months of 2025“. Globally, pig iron production dipped, as reported in “Global pig iron production fell to a two-year low in September” but direct reduction production saw a significant increase according to “Global DRI output up 4.9 percent in September 2025“, led by India, suggesting a shift towards DRI-based steelmaking. While “World crude steel output down 1.6 percent in September 2025” indicates an overall decrease, India’s output increased significantly. Satellite data reveals fluctuating activity levels across key Asian steel plants, with specific plant performance potentially influenced by these broader market trends.

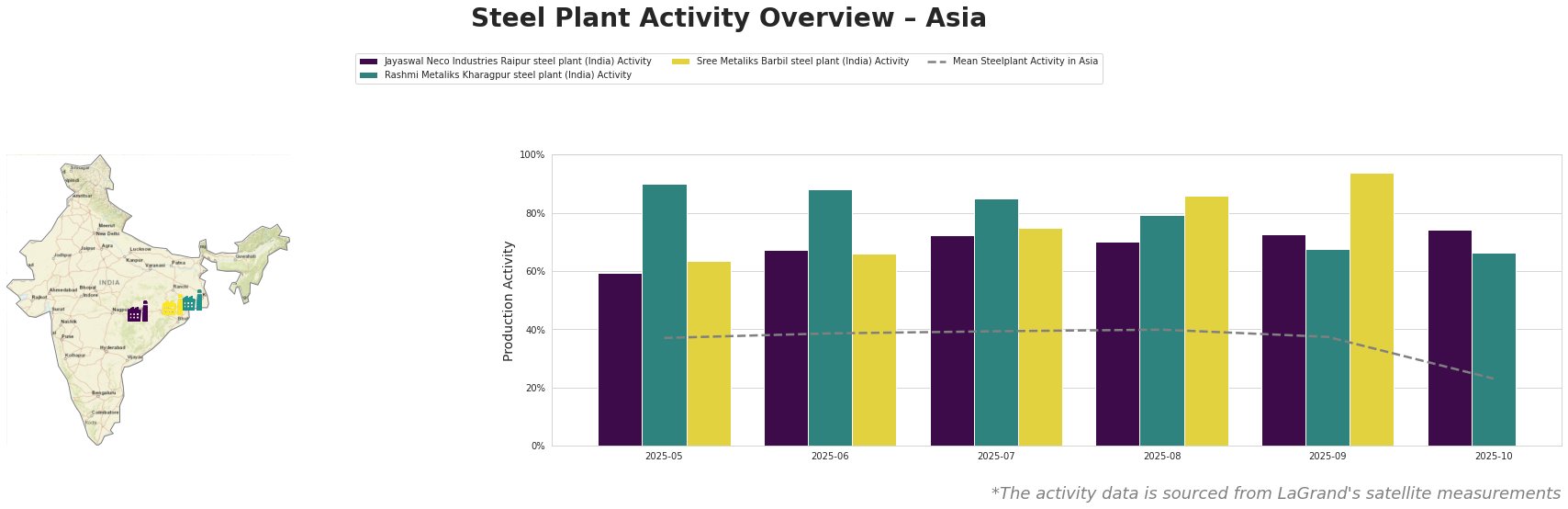

The mean steel plant activity in Asia peaked in August 2025 at 40.0% before decreasing to 23.0% in October 2025. Jayaswal Neco Industries Raipur steel plant demonstrated a consistent upward trend in activity, reaching 74.0% in October. Rashmi Metaliks Kharagpur steel plant saw a notable drop from 90.0% in May to 66.0% in October. Sree Metaliks Barbil steel plant showed a significant increase, peaking at 94.0% in September. The considerable drop in the mean Asia steelplant activity in October does not coincide with any specific news events and the reason for this decline is unclear.

Jayaswal Neco Industries Raipur, located in Chhattisgarh, India, boasts a crude steel capacity of 1.2 million tonnes per annum (ttpa) utilizing both BF and DRI processes, with 270 ttpa DRI capacity. Satellite data shows a consistent increase in activity levels from 60.0% in May to 74.0% in October. This increase is consistent with the overall rise in DRI production detailed in “Global DRI output up 4.9 percent in September 2025,” positioning Jayaswal Neco as a potentially reliable supplier in the face of broader market volatility, but no direct connection can be established.

Rashmi Metaliks Kharagpur, situated in West Bengal, India, features an integrated BF and DRI operation with a crude steel capacity of 1.5 million ttpa. The plant’s activity level began at a high of 90.0% in May but experienced a substantial decline to 66.0% by October. This drop, while coinciding with reported decreases in global steel production (“World crude steel output down 1.6 percent in September 2025“), cannot be directly linked to any specific event or news article. The decline might be connected to a realignment of production due to China’s drop in real estate investment (China’s real estate investments in January-September decreased by 13.9% y/y), but a direct connection is not explicitly supported.

Sree Metaliks Barbil, located in Odisha, India, operates an integrated BF and DRI plant with a relatively smaller crude steel capacity of 700,000 ttpa. Satellite-observed activity at this plant steadily increased from 63.0% in May to a high of 94.0% in September, before activity data ceases to be available in October. This growth aligns with the increased DRI output in India. The plant’s reliance on captive iron ore mines in Khandbandh may insulate it from fluctuations in global iron ore prices, as referred to in “China reduced iron ore production by 3.8% y/y in January-September” and “China’s iron ore output down 3.8% in January-September 2025“.

The decline in China’s real estate investment (“China’s real estate investments in January-September decreased by 13.9% y/y“), coupled with decreased steel production and increased exports, creates potential supply chain vulnerabilities within Asia. The rise in DRI production, as mentioned in “Global DRI output up 4.9 percent in September 2025“, and the relatively stable/increasing activity levels at Jayaswal Neco Industries and Sree Metaliks Barbil, suggest that Indian DRI-based steel producers could offer supply chain alternatives.

Recommended Procurement Actions:

- Prioritize DRI-Based Steel Sourcing: Steel buyers should proactively engage with Indian DRI producers like Jayaswal Neco and Sree Metaliks, especially for products like pig iron and billets, to mitigate risks associated with reduced Chinese output.

- Carefully Monitor Rashmi Metaliks: The observed decline in activity at Rashmi Metaliks warrants careful monitoring. Steel buyers who rely on Rashmi Metaliks for TMT bars and DI pipes should consider diversifying their supply base to avoid potential disruptions.

- Evaluate Iron Ore Sourcing: As China reduces its Iron Ore production (China reduced iron ore production by 3.8% y/y in January-September) while maintaining imports, evaluate contracts for potential price adjustments.