From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Resilient Amidst China’s Capacity Controls, Demand Remains Stable

Asia’s steel market remains positive, with China’s efforts to balance supply and demand influencing activity. Recent changes in steel plant activity coincide with the implementation of the “China to ban construction of steel production facilities” and “China will ban new capacity and reduce steel production” policies, while emissions saw a rise, as reported by “Emissions in China’s steel industry rose by 20.8% y/y in July“. Observed activity levels at several Chinese steel plants show recent decreases. The impact of “China releases Work Plan for steel industry in 2025-2026, supporting value-added and low emissions capacities” is expected to materialize over time.

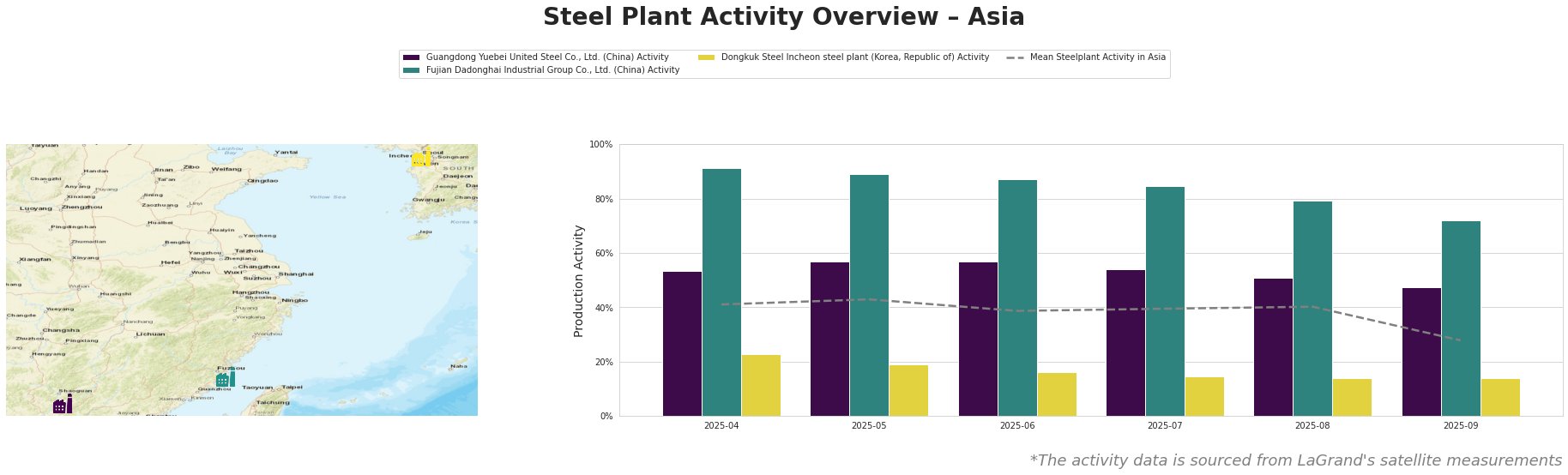

The average steel plant activity in Asia has declined significantly in September 2025, reaching 28%, following a period of relative stability around 40%. Guangdong Yuebei United Steel and Fujian Dadonghai Industrial Group saw a gradual decrease in activity since April, with a larger drop in September. Dongkuk Steel Incheon plant activity has remained consistently low since April.

Guangdong Yuebei United Steel Co., Ltd., an integrated BF-based producer with 2,000 TTPA crude steel capacity and specializing in rebar for building and infrastructure, has seen a gradual decrease in activity from 53% in April to 47% in September. This decline may be partially attributable to the capacity control measures outlined in the “China to ban construction of steel production facilities” and “China will ban new capacity and reduce steel production” news articles. The focus on modernization for ultra-low emissions from “China releases Work Plan for steel industry in 2025-2026, supporting value-added and low emissions capacities” may also be a contributing factor, though a direct link cannot be explicitly established.

Fujian Dadonghai Industrial Group Co., Ltd., another integrated BF-based producer with 2,200 TTPA crude steel capacity, specializing in rebar, experienced a decrease in activity from 91% in April to 72% in September. This decrease is most likely influenced by the Chinese government’s initiatives to reduce steel production capacity as part of the policies described in “China will ban new capacity and reduce steel production”. The plant’s activity decrease might relate to “China releases Work Plan for steel industry in 2025-2026, supporting value-added and low emissions capacities”, however, a direct causal relationship is not observed.

Dongkuk Steel Incheon steel plant, an EAF-based producer in South Korea with 2,200 TTPA crude steel capacity producing rebar for various sectors, has maintained a consistently low activity level, around 14%, from July to September. No direct connection between this trend and the provided news articles can be established, as these articles primarily focus on the Chinese steel industry.

Evaluated Market Implications:

The observed decrease in activity at Guangdong Yuebei United Steel Co., Ltd. and Fujian Dadonghai Industrial Group Co., Ltd., combined with China’s ban on new steel production facilities (“China to ban construction of steel production facilities” and “China will ban new capacity and reduce steel production”), indicates potential supply disruptions in the rebar market, particularly from Chinese producers utilizing BF/BOF technology.

Recommended Procurement Actions:

- Steel buyers sourcing rebar from China should proactively engage with suppliers to understand their compliance plans with the new capacity restrictions and emission standards outlined in “China to ban construction of steel production facilities,” “China will ban new capacity and reduce steel production” and “China releases Work Plan for steel industry in 2025-2026, supporting value-added and low emissions capacities”.

- Given the observed reduction in production and the focus on value-added products, analysts should closely monitor the price of specialized steel products and consider diversifying sources outside of China if possible.

- Monitor the activities of EAF-based producers like Dongkuk Steel, though their activities seem stable, broader understanding of Asian EAF producers will benefit from potentially disrupted supply chains.