From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Report: Strong Growth Amid Demand Shifts and Export Opportunities in 2025

India’s steel market is demonstrating resilience and growth potential against the backdrop of evolving export dynamics and local production increases. Significant shifts in activity levels at various steel plants are evidenced by the articles Oversupply, rains drag Indian HRC prices lower in 2025 and India increased steel exports by 31% y/y in April-November. These developments directly correlate with satellite-observed activity levels, particularly at the Tata Steel BSL Dhenkanal plant, which reported stable production despite market fluctuations.

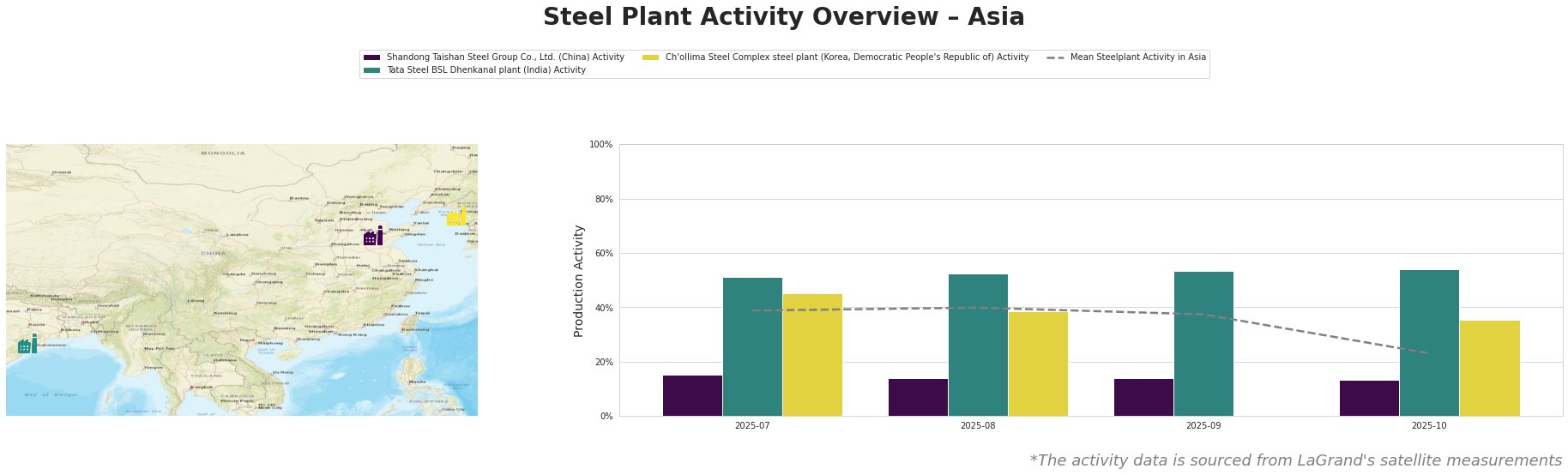

The Tata Steel BSL Dhenkanal plant in Odisha reflects a robust operational trend, with activity soaring to 54% in October, aligned with increased domestic production aimed at export markets as noted in India increased steel exports by 31% y/y in April-November. Conversely, the Shandong Taishan Steel Group reflects declining trends, stabilizing at a low point of 13% activity as local oversupply pressures mount without any direct correlation to the named news articles. The Ch’ollima Steel Complex observed reduced data availability; thus, direct implications remain ambiguous.

Shandong Taishan, with a capacity for 5,000 tons of crude steel through integrated processes, was impacted more by regional market pressures and global competition than local demand shifts, as indicated in Oversupply, rains drag Indian HRC prices lower in 2025. On the other hand, Tata’s strong performance and pivot towards export-ready production underscore potential for procurement gains for steel buyers focusing on higher-quality products suited for both domestic and international markets.

Evaluating these dynamics indicates potential supply disruptions from Shandong’s reduced capacity utilization, suggesting a need for steel buyers to consider diversified sourcing strategies. Concurrently, the Tata Steel BSL plant should be prioritized for procurement due to its robust performance and export capabilities, essential insights for market analysts navigating steel procurement in 2025.

In conclusion, decisively recommended actions include prioritizing procurement from Tata Steel BSL during this period of heightened production capacity, while also hedging against potential supply shortages linked to the performance of other Asian producers, particularly from Shandong, influenced by local market fluctuations and increasing inventories.