From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Report: Neutral Sentiment Amid Regulatory Changes

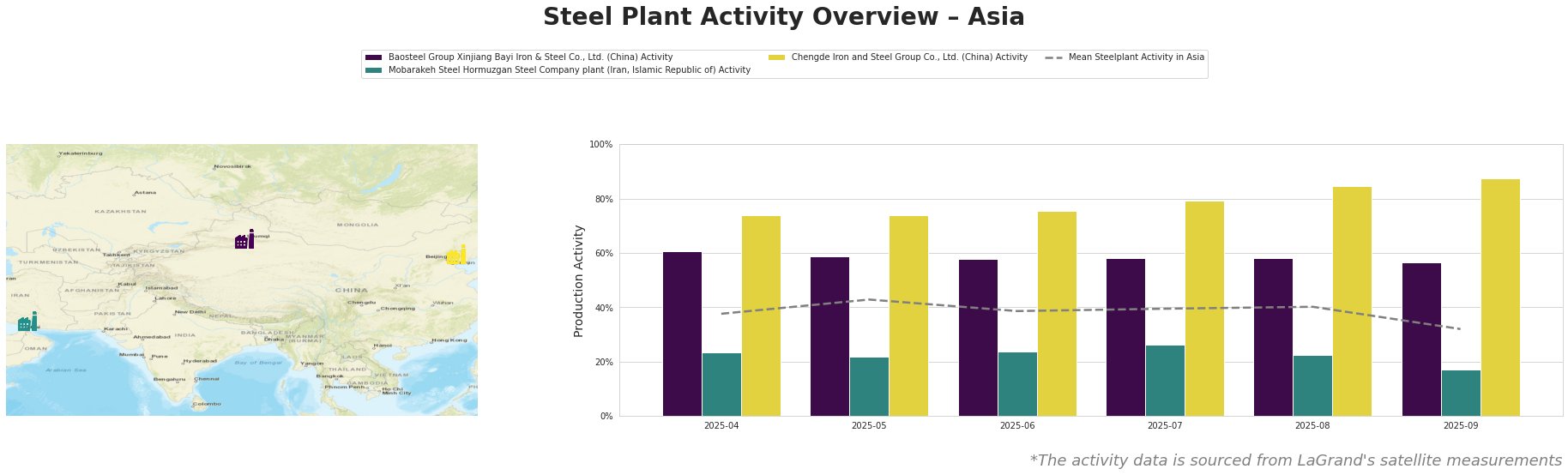

Recent developments in the Asian steel market indicate a Neutral sentiment as external regulatory pressures impact import dynamics. The EU anti-dumping investigation reinforces steel importers’ concerns about prices and the EU’s plans to impose tariffs of 25%-50% on Chinese steel and related products have heightened uncertainty regarding foreign steel supplies. Consequently, satellite data show mixed activity levels across key Asian steel plants, highlighting the immediate effects of these trade actions.

In September 2025, satellite observations revealed that Baosteel Group Xinjiang Bayi Iron & Steel Co., Ltd. experienced a drop to 57% activity from prior months, which could reflect decreasing orders as the European market braces for potential new tariffs. Meanwhile, Mobarakeh Steel Hormuzgan Steel Company’s activity rose to 88%, suggesting a robust demand for its product line potentially linked to stable local markets or regional supply shifts, though no direct news correlation was found. Chengde Iron and Steel Group shows a declining trend, dropping to 79% from previous peaks, which coincides with larger market apprehension towards imports due to the EU’s stringent regulatory actions on cold and hot-rolled steel imports.

Baosteel Group Xinjiang Bayi Iron & Steel Co., Ltd. demonstrated a decline to 57% in September, potentially influenced by the EU anti-dumping investigation affecting international pricing strategies. Conversely, Mobarakeh Steel’s activity level remains high at 88%, but no direct links to the observed news can be established. Chengde Iron and Steel, reflecting market aversion to imports, dropped to 79%, potentially indicative of operational adjustments in anticipation of heightened tariffs influencing sourcing channels.

The potential supply disruptions may stem from Baosteel’s reduced activity and the uncertainty enveloping EU tariffs which can lead to increased domestic demand shifting within Asia. Buyers are recommended to pivot towards securing orders from plants like Mobarakeh Steel, which shows resilience under current market conditions. Immediate procurement strategies should focus on maintaining relationships with suppliers poised to fulfill needs in light of regulatory pressures, particularly as EU actions are forcing shifts in Asian supply patterns.

Steel buyers should prioritize sourcing strategies in response to these developments to mitigate risks associated with fluctuating import availability and pricing pressures linked to new tariffs and regulations.