From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Report: Neutral Sentiment Amid Mixed Production Trends

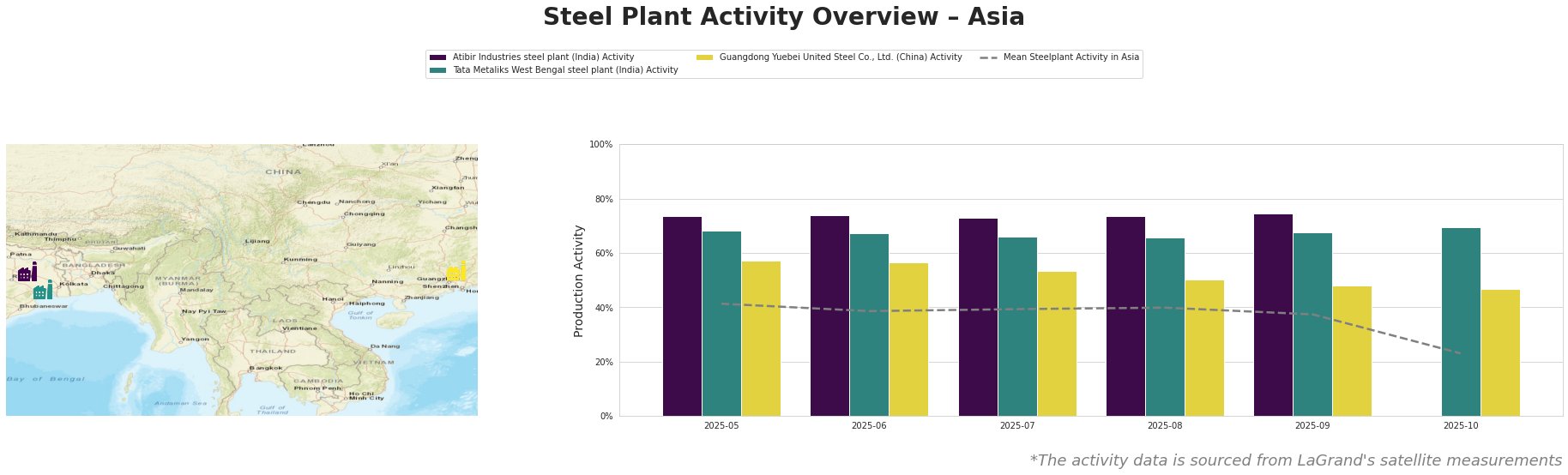

Recent developments in Asia’s steel market have presented a neutral sentiment, primarily influenced by China’s fluctuating production levels. According to “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025”, production declines have been observed, with September output down 4.6% year-on-year. This aligns with satellite data indicating a drop in activity levels at significant steel plants, particularly in China, where Guangdong Yuebei United Steel Co., Ltd. reported a notable decrease.

Measured Activity Overview

Overall activity exhibited a downward trend, reaching a mean activity of 23.0% in October 2025, dropping significantly from a high of 41.0% in May. Atibir Industries’ activity rose to 75.0% in September, yet fell off, suggesting a temporary peak without sustained momentum. Conversely, Guangdong Yuebei’s activity dropped to 47.0%, linked to the declining steel production as noted in the news.

Plant Information

Atibir Industries, located in Jharkhand, is engaged in integrated steel production with a capacity of 600,000 tons of crude steel using the Basic Oxygen Furnace (BOF) method. In September, its activity surged to 75.0%, but the following month showed no observed output. This rise may relate to overall production fluctuations noted in “China cuts steel production to 73 million tons in September”, though no direct correlation with specific operational metrics was established.

In West Bengal, Tata Metaliks reported a drop in activity to 70.0% in October, following a weak performance in September. This reflects broader market instability, particularly in light of China’s production, as highlighted in “China’s crude steel output falls by 2.9% in January-September 2025”.

Guangdong Yuebei faced a decline in activity to 47.0%, indicating alignment with reported reduced production levels—an essential consideration following the weakening demand triggered by market dynamics and holiday influences as stated in “China cuts steel production to 73 million tons in September”.

Evaluated Market Implications

The observed production decreases and mixed activity trends imply potential supply disruptions in regions heavily dependent on Chinese steel, especially Guangdong. Steel buyers should consider prioritizing procurement from steady producers like Atibir Industries until clarity on China’s supply stabilizes.

- Action 1: Secure contracts with Atibir Industries to mitigate disruption risks.

- Action 2: Monitor developments in China closely; consider diversifying steel procurement sources, particularly from independent plants like Tata Metaliks, which has shown slight stability compared to volatile markets.

The current landscape necessitates vigilant strategies toward procurement planning, adapting quickly to shifts in China’s output and emerging local production trends.