From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Report: CBAM Uncertainty Disrupts Exports as Activity Levels Remain Mixed

Asian steel markets, particularly in India, are facing significant disruptions amid uncertainties regarding the EU’s Carbon Border Adjustment Mechanism (CBAM), as highlighted in the articles “CBAM uncertainty suppresses Asian steel flows to Europe; long-term prospects remain positive“ and “Uncertainty over CBAM constrains steel shipments from Asia to Europe; long-term outlook remains positive.” Despite increased exports from China and Indonesia, the cloud of regulatory ambiguity is impacting Asian steel plant operations, evidenced by notable reductions in activity levels.

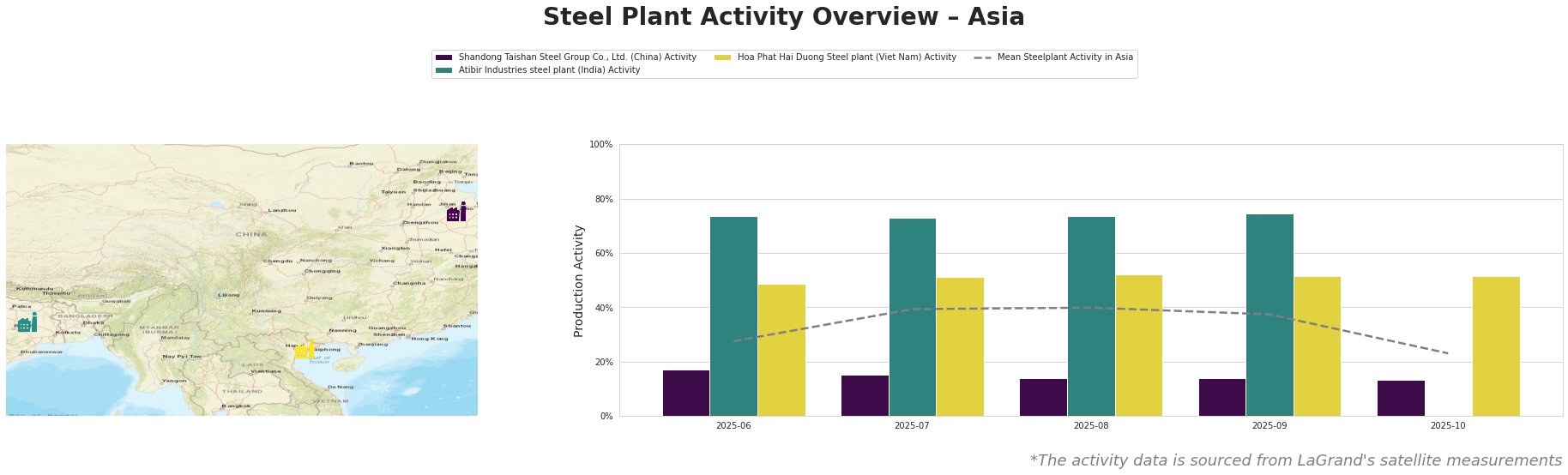

In the last few months, the Shandong Taishan Steel Group exhibited a significant decline in activity, dropping from 17.0% to 13.0%, which reflects the dampening sentiment in the market due to upcoming regulations. This decline aligns with the discussions in “The European steel market is weighing a new trading regime amid volatile demand and CBAM uncertainty,” indicating the operational struggles posed by new customs controls expected to tighten imports.

Atibir Industries Steel Plant maintained higher activity levels, around 74.0% in recent months, but distributed uncertainty may lead to potential adjustments in strategy. Conversely, Hoa Phat Hai Duong Steel Plant’s activity varied slightly around 51.0% but shows resilience despite the backdrop of CBAM-related challenges.

Potential supply disruptions could arise predominantly from Shandong Taishan Steel Group, as its reduced operational activity signals constraints in production capacity potentially leading to limited availability in the market. Steel buyers should prepare for possible delays in sourcing from this region.

For procurement actions, it is recommended that steel buyers:

1. Diversify sourcing to include the more stable Atibir Industries and Hoa Phat Hai Duong, given their relatively consistent activity levels.

2. Monitor the Shandong Taishan Steel Group closely for any indications of further activity declines, which might necessitate increased inventory levels from alternative suppliers.

3. Keep abreast of evolving CBAM regulations, particularly as they will likely reshape pricing and availability in the coming months, thus affecting procurement strategies across the region.

By staying informed on regulatory changes and plant performance, buyers can potentially capitalize on changes in the Asian steel landscape.