From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Renewables Boom Drives Demand, Japanese Mills Surge, Indian Production Falters

Asia’s steel market is showing very positive signs, influenced by the accelerating energy transition and shifting production dynamics across the region. Renewed demand is linked to the construction of renewable energy facilities, evidenced by the news articles titled “Renewables overtook coal for powergen in 1H: Ember“, “Global renewable power capacity to double by 2030: IEA“, “IEA-Bericht: Energiewende macht weltweit Fortschritte – reicht das für die Klimaziele?“, “Energy transition ‘rolling on’ despite headwinds: DNV“, and “Imports of green energy products to the EU exceed €14 billion per year“. However, no direct link could be established between plant activity and these articles.

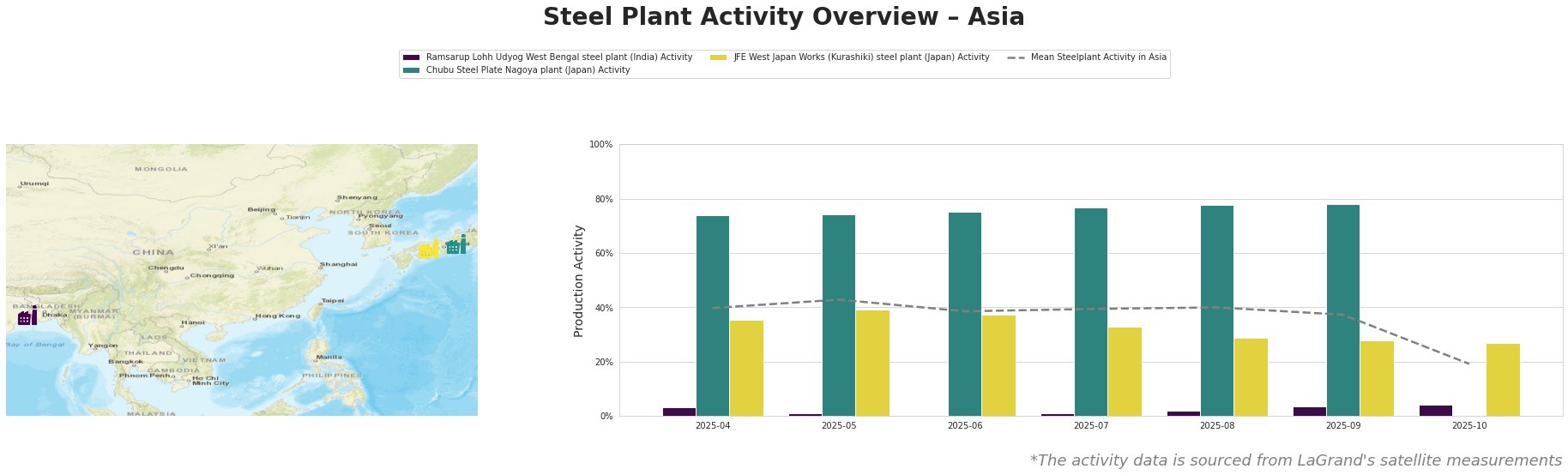

The mean steel plant activity in Asia began at 40% in April, peaked at 43% in May, decreased to 37% in September, and dramatically dropped to 19% in October. Ramsarup Lohh Udyog in West Bengal, India, remained consistently below the Asian average, with activity fluctuating between 0% and 4%. The Chubu Steel Plate Nagoya plant in Japan showed consistently high activity, ranging from 74% to 78% until October, where the activity wasn’t measured. JFE West Japan Works (Kurashiki) in Japan demonstrated more variable activity, starting at 35% in April, peaking at 39% in May, and declining to 27% in October.

Ramsarup Lohh Udyog West Bengal steel plant, an integrated BF and DRI facility with a 182 TPTA DRI capacity and producing billets, transmission lines, and wires for the energy sector, has consistently operated at very low activity levels. The activity levels have remained below 5% between April and October. The low activity suggests possible operational or financial difficulties, though no confirming news is available.

Chubu Steel Plate Nagoya plant, a 700 TPTA EAF steel plant producing plates for automotive, building & infrastructure, tools & machinery, and transport, has consistently operated at high activity levels between April and September, between 74% and 78%. The high activity aligns with the increased demand for steel in infrastructure and automotive sectors, but there is no direct supporting news available in the provided corpus. No data is available for October.

JFE West Japan Works (Kurashiki) steel plant, a large integrated BF-BOF facility with a 10,000 TPTA crude steel capacity, produces a wide range of flat and long products, including hot/cold rolled sheets, plates, and H-profiles, serving diverse sectors like automotive, construction, and energy. The satellite-observed activity shows a decline from 35% in April to 27% in October, suggesting a possible production slowdown. This activity slowdown could be attributed to changing market conditions or planned maintenance, but no confirming news could be identified.

Evaluated Market Implications:

The consistent low activity at Ramsarup Lohh Udyog raises concerns about its reliability as a supplier of billets, transmission lines, and wires, particularly for energy-related projects. Steel buyers should seek alternative sources for these products, especially if timelines are critical. The Chubu Steel Plate Nagoya plant’s consistently high activity makes it a reliable source for steel plates, supporting the automotive, construction, and transportation sectors. Procurement managers seeking a secure supply of plates should prioritize this plant. The observed activity decrease at JFE West Japan Works (Kurashiki), coupled with its diverse product portfolio, suggests a potential tightening of supply across various steel products. Buyers should proactively engage with JFE or diversify their supply base to mitigate risks. Given the overall positive sentiment, as mentioned in the IEA report, there could be an increase in prices in the near term.