From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Rebar Prices Rise Amid Stable Plant Activity, Positive Outlook

Asia’s steel market shows positive momentum with rising rebar prices, as evidenced by “MOC: Average rebar price in China up 0.4 percent in November 24-30” and “NBS: Local Chinese rebar prices up 0.9 percent in late November 2025“. These price increases occur against a backdrop of largely stable steel plant activity, suggesting robust demand. While “Iron ore prices hit four-month lows in November” details fluctuating raw material costs potentially influencing profitability, no direct correlation to immediate steel plant activity shifts can be definitively established from the provided satellite data.

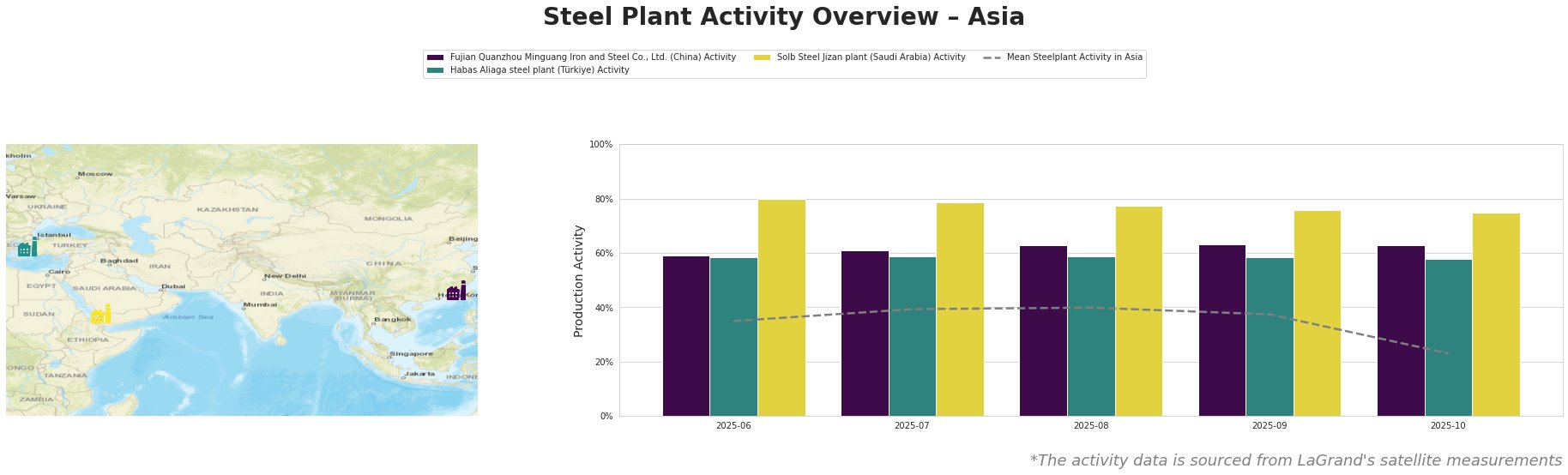

The mean steel plant activity in Asia experienced a notable drop in October 2025 to 23.0%, contrasting with the stable activity levels observed at individual plants like Fujian Quanzhou Minguang.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., a China-based integrated BF steel plant with a crude steel capacity of 2550 ttpa, primarily produces finished rolled products like rebar and wire rod. Observed satellite data indicates a consistent activity level of 63% from August to October 2025, significantly exceeding the Asian mean, despite regional price volatility highlighted in “Iron ore prices hit four-month lows in November”. This stable activity, coupled with ResponsibleSteel Certification, suggests robust operational performance and commitment to sustainability amidst market fluctuations. The rise in finished steel prices, detailed in “MOC: Average rebar price in China up 0.4 percent in November 24-30” and “NBS: Local Chinese rebar prices up 0.9 percent in late November 2025”, suggest that the plant benefited from the overall market improvement, although no direct connection between the price increases and increased production activity can be established from the provided data.

Habas Aliaga steel plant, located in Türkiye, is an electric arc furnace (EAF) based steel producer with a 4500 ttpa crude steel capacity, specializing in semi-finished and finished rolled products. Its satellite-observed activity has remained stable at 58-59% throughout the monitored period, consistently above the average activity for Asian steel plants. This stability occurs despite regional raw material price fluctuations as described in “Iron ore prices hit four-month lows in November”, but no direct connection can be made based on the provided data. The Habas Aliaga steel plant benefits from ResponsibleSteel Certification.

Solb Steel Jizan plant, based in Saudi Arabia, operates an EAF with a 1200 ttpa crude steel capacity, producing semi-finished and finished rolled products. Activity levels have shown a gradual decline from 80% in June to 75% in October 2025, but still remain significantly above the average for Asian steel plants. This slight decrease does not seem to be directly related to the Chinese rebar price increases reported in “MOC: Average rebar price in China up 0.4 percent in November 24-30” and “NBS: Local Chinese rebar prices up 0.9 percent in late November 2025”, nor is it directly linked to the iron ore price fluctuations described in “Iron ore prices hit four-month lows in November”. It also maintains ResponsibleSteel Certification.

Given the rising rebar prices and the stable, above-average activity levels at Fujian Quanzhou Minguang, Habas Aliaga, and Solb Steel Jizan steel plants, steel buyers should consider securing contracts with these producers to mitigate potential supply shortages stemming from increased demand. Procurement teams focused on rebar should closely monitor the price trends in China, as indicated by “MOC: Average rebar price in China up 0.4 percent in November 24-30” and “NBS: Local Chinese rebar prices up 0.9 percent in late November 2025”, and proactively adjust their purchasing strategies to capitalize on the current market conditions. Additionally, steel buyers should monitor the cost of Iron ore as that can have a substantial impact on prices.