From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Rebar Price Uptick Signals Continued Stability Amidst Iron Ore Volatility

Asia’s steel market shows signs of continued stability and a positive outlook, driven by rising rebar prices in China, as reported in “MOC: Average rebar price in China up 0.4 percent in November 24-30” and “NBS: Local Chinese rebar prices up 0.9 percent in late November 2025“. These price increases, however, occurred against a backdrop of iron ore price fluctuations, detailed in “Iron ore prices hit four-month lows in November“. While this article details iron ore price volatility, no direct link to the observed steel plant activity levels can be explicitly established.

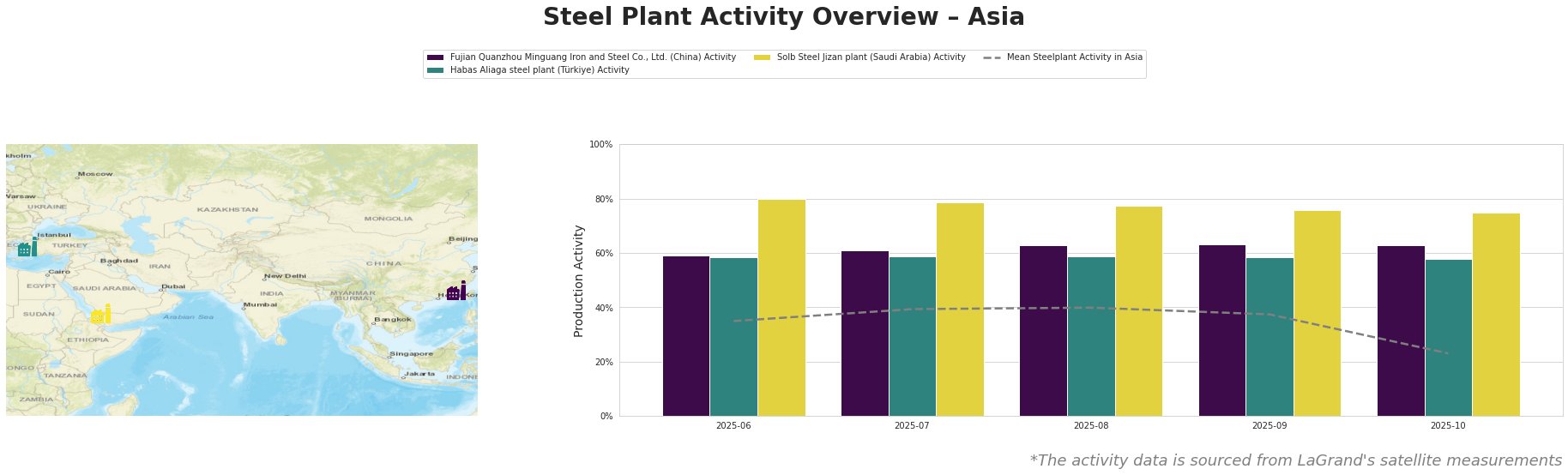

Overall, mean steel plant activity in Asia experienced a significant drop in October to 23%, a substantial decrease from 40% in August.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., a BOF-based integrated steel plant in Fujian, China, maintained a consistently high activity level at 63% between August and October 2025. Despite iron ore price volatility discussed in “Iron ore prices hit four-month lows in November“, this plant’s stable activity suggests a resilient production schedule, potentially due to pre-existing iron ore inventories or strong downstream demand. However, no explicit connection can be established between the plant’s activity and the news articles about rising rebar prices or iron ore price volatility.

The Habas Aliaga steel plant, an EAF-based plant in İzmir, Türkiye, showed relatively stable activity, fluctuating narrowly between 58% and 59% from June to October. As an EAF plant using steel scrap, iron ore price fluctuations may have a smaller impact. No direct impact of the market insights as outlined in “MOC: Average rebar price in China up 0.4 percent in November 24-30” and “NBS: Local Chinese rebar prices up 0.9 percent in late November 2025” could be explicitly established on the steel plant’s activity.

Solb Steel Jizan plant, an EAF-based plant in the Jizan Region, Saudi Arabia, experienced a slight activity decrease from 80% in June to 75% in October. This may reflect regional market adjustments. As an EAF-based plant, fluctuations in Chinese rebar prices and iron ore prices may have a limited impact. No direct impact of the market insights as outlined in “MOC: Average rebar price in China up 0.4 percent in November 24-30” and “NBS: Local Chinese rebar prices up 0.9 percent in late November 2025” or “Iron ore prices hit four-month lows in November” on the steel plant’s activity could be explicitly established.

Given the rising rebar prices reported in China, steel buyers should consider securing supply contracts with producers like Fujian Quanzhou Minguang Iron and Steel Co., Ltd. to mitigate potential price increases, provided logistical considerations are favorable. The overall drop in mean Asian steel plant activity in October, combined with the relative stability of the rebar market, could signal a potential supply tightening in the near term. Steel analysts should closely monitor inventory levels and production rates at key plants. Procurement professionals should accelerate orders to capitalize on current price levels and build inventory buffers against possible supply disruptions.