From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts to US-Japan Trade Deal: Activity Mixed Amid Tariff Adjustments

The Asian steel market is showing a mixed response to recent global trade developments, specifically the US-Japan trade agreement. While the “Zollsatz abgesenkt: USA und Japan schließen Handelsabkommen” articles (Published: 2025-07-23T03:55:57Z and 2025-07-23T05:27:31Z) report a resolution to a tariff dispute and increased Japanese investment in the US, potentially impacting steel demand, satellite data reveals divergent activity trends across key Asian steel plants. However, no direct relationship between the news and the satellite-observed changes in activity can be established.

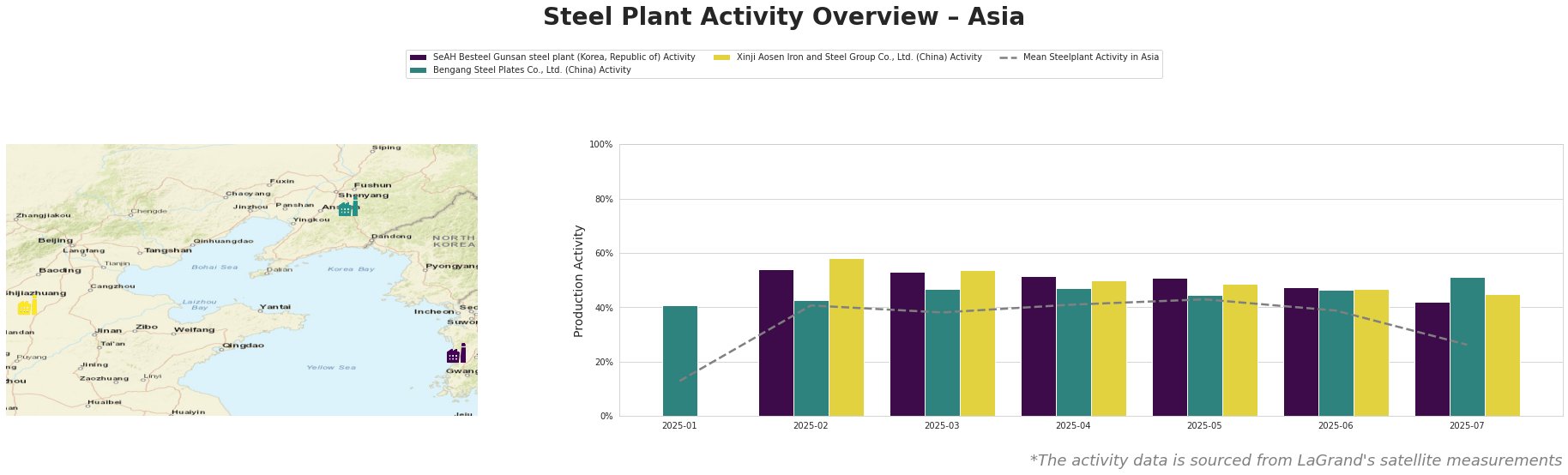

The mean steel plant activity in Asia shows a significant drop in July to 26.0, after consistent levels around 40% in the previous months.

SeAH Besteel Gunsan steel plant (Korea, Republic of), an EAF-based special steel producer focused on the automotive sector with a crude steel capacity of 2100 ttpa, exhibited relatively stable activity from February to June, ranging between 54% and 47%. However, a notable decrease to 42% was observed in July. No explicit link can be established between this decrease and the “Zollsatz abgesenkt: USA und Japan schließen Handelsabkommen” news articles, although the agreement may impact automotive steel demand.

Bengang Steel Plates Co., Ltd. (China), an integrated BF-BOF steel plant with a crude steel capacity of 12800 ttpa producing automotive and home appliance plates, showed relatively stable activity between February and June (43% to 46%). There was a slight increase to 51% in July, moving against the mean, although no direct connection to the provided news articles can be established.

Xinji Aosen Iron and Steel Group Co., Ltd. (China), an integrated BF-BOF steel plant producing billets, slabs, and wire rods with a crude steel capacity of 3600 ttpa, experienced a gradual decline in activity from a high of 58% in February to 45% in July. No direct relationship between this decline and the provided news articles can be established.

Evaluated Market Implications:

The overall decrease in mean steel plant activity in Asia in July, coupled with the US-Japan trade agreement (“Zollsatz abgesenkt: USA und Japan schließen Handelsabkommen” articles), could signal potential shifts in regional steel demand and supply dynamics. While the EU is preparing countermeasures (“EU treibt Verabschiedung von Gegenzöllen voran“), this does not directly affect the Asian market.

Recommended Procurement Actions:

- Steel Buyers: Closely monitor the SeAH Besteel Gunsan plant’s output given the July decrease and the potential downstream impacts of the US-Japan agreement on the automotive sector. Consider diversifying special steel suppliers if possible to mitigate risks associated with potential supply constraints.

- Market Analysts: Prioritize monitoring capacity utilization at Bengang Steel Plates, and analyzing potential impact on specific grade steel prices, given its increased production in July, moving against the mean activity.