From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts to Trade Measures; Vietnam Tariffs Impact Expected, China’s Activity Dips

Asia’s steel market faces a mixed outlook amid evolving trade dynamics. Recent anti-dumping measures, exemplified by “Vietnam has imposed definitive anti-dumping duties on hot-rolled steel products from China” and “China extends AD duties on stainless steel for another five years“, are reshaping regional trade flows. While these news articles highlight shifts in trade policy, their direct impact on observed steel plant activity levels in July cannot be definitively established due to the short time frame between the news release date and the latest satellite-observed data available.

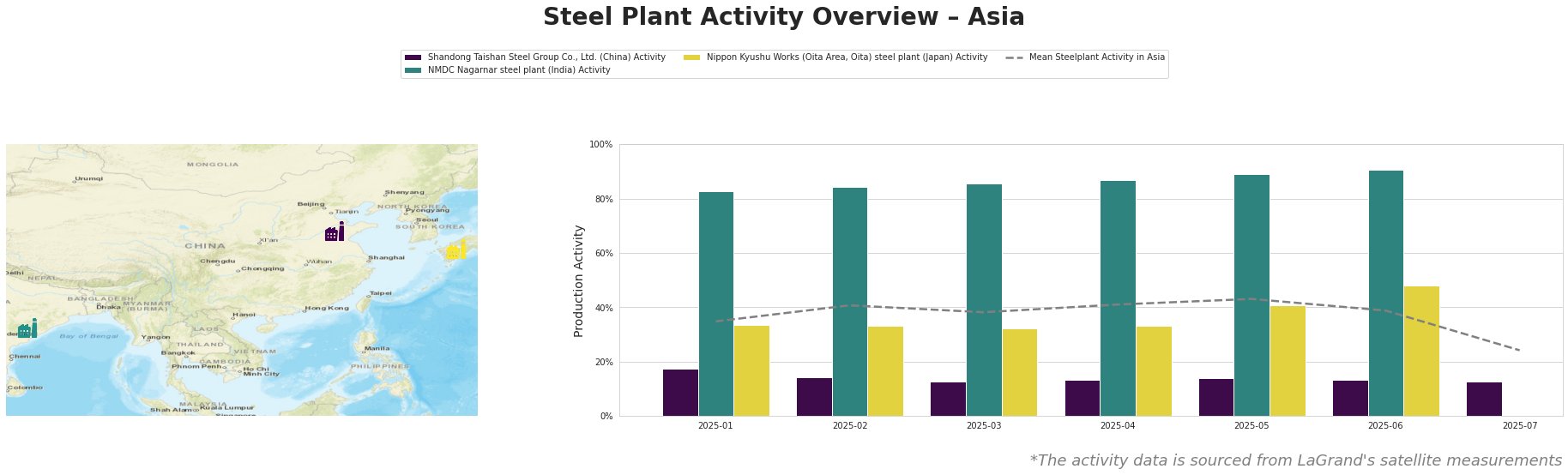

The mean steel plant activity across Asia showed relative stability from January to June, fluctuating between 35% and 43%, before a sharp drop to 24% in July. Shandong Taishan Steel Group’s activity remained consistently low around 13-18% throughout the observed period. In contrast, NMDC Nagarnar steel plant maintained high activity levels between 83% and 91%. Nippon Kyushu Works (Oita Area, Oita) experienced a gradual increase, peaking at 48% in June. The recent sharp drop in the Asian mean steelplant activity in July may be the result of missing data, and does not reflect changes at the individual plants listed in the report.

Shandong Taishan Steel Group Co., Ltd., a Chinese integrated steel producer with a 5 million tonne crude steel capacity, primarily uses BF-BOF technology to produce hot-rolled coil, cold-rolled coil, and stainless steel. Activity at this plant has been consistently low, hovering around 13-18% throughout the monitored period. The anti-dumping duties imposed by Vietnam, as highlighted in “Vietnam has imposed definitive anti-dumping duties on hot-rolled steel products from China,” could potentially impact Shandong Taishan Steel’s export strategy, given their focus on hot-rolled coil production, although a direct impact is not yet observable in the activity data.

NMDC Nagarnar steel plant, an Indian integrated steel plant with a 3 million tonne crude steel capacity using BF-BOF technology, focuses on producing hot-rolled coils, sheets, and plates for various sectors like automotive and infrastructure. The plant’s activity remained consistently high, ranging from 83% to 91%. This suggests robust domestic demand and operational efficiency. The US decision to assign a zero dumping margin for heavy-walled rectangular pipes from South Korea’s HiSteel in “US assigns zero dumping margin for heavy-walled rectangular pipes from S. Korea’s HiSteel” is unlikely to directly influence the NMDC Nagarnar steel plant’s operations.

Nippon Kyushu Works (Oita Area, Oita), a Japanese integrated steel plant with a 10 million tonne crude steel capacity using BF-BOF technology, produces hot-rolled steel sheets and steel plates. The plant’s activity showed a gradual increase from 34% in January to 48% in June. However, activity data for July is missing, which obscures possible impacts of trade decisions or local economic factors. The duties imposed by the EU in “EU extends Korea, Malaysia, Russia fittings AD duties” are not expected to directly influence the Nippon Kyushu Works’ operations, since Japan is not among the countries mentioned in the news article.

Given the imposition of anti-dumping duties by Vietnam on Chinese hot-rolled steel, as reported in “Vietnam has imposed definitive anti-dumping duties on hot-rolled steel products from China” and “Vietnam Imposes Hefty Anti-Dumping Tariffs on Chinese Steel Imports,” steel buyers who previously relied on Chinese imports should explore alternative supply sources, including domestic Vietnamese producers or suppliers from countries not subject to these tariffs. They should also closely monitor price fluctuations in the Vietnamese market due to these trade restrictions. Furthermore, buyers should seek clarity on the specific Harmonized System (HS) codes affected by South Korea’s extended provisional AD duties as described in “S. Korea extends provisional AD duties on stainless steel plate from China“, to avoid unintended disruptions to their supply chain.