From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts to EU-US Trade Developments: Plant Activity Mixed

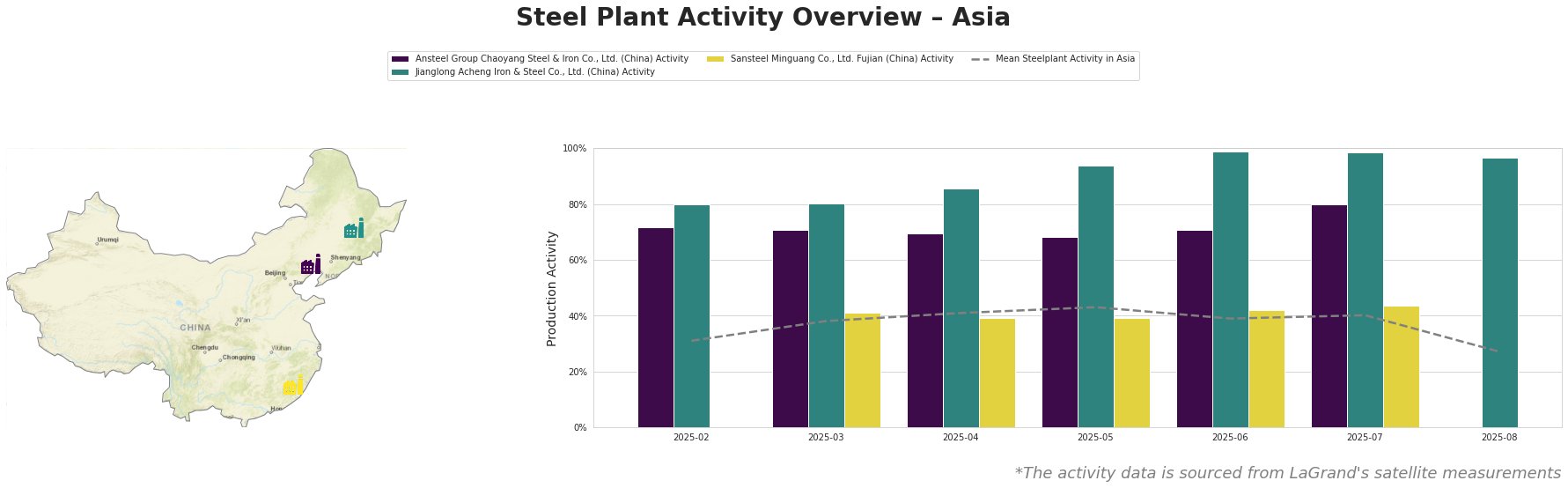

The Asian steel market shows signs of fluctuating production amidst global trade realignments. While several steel plants demonstrated relatively stable activity throughout the observed period, a notable slowdown was observed in August, potentially driven by anticipation of or reaction to the EU’s decision to delay countermeasures on US goods, as reported in “EU delays countermeasures on US goods for six months” and “EU delays countermeasures on US goods for six months”. No direct connection between these news items and plant activity can be explicitly established from the current data.

The average steel plant activity in Asia peaked in May 2025 at 43%, before experiencing a drop to 27% in August.

Ansteel Group Chaoyang Steel & Iron Co., Ltd.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., located in Liaoning, China, is an integrated steel plant with a crude steel capacity of 2.1 million tonnes per annum (mtpa), relying on basic oxygen furnace (BOF) technology. Throughout the observed period, the plant’s activity remained consistently high, peaking at 80% in July 2025. A reading for August is missing from the data. The trends in activity do not show an obvious relationship with the news events, and no direct relationship can be established from the current data.

Jianglong Acheng Iron & Steel Co., Ltd.

Jianglong Acheng Iron & Steel Co., Ltd., situated in Heilongjiang, China, is another integrated steel plant with a crude steel capacity of 1.1 mtpa, also employing BOF technology. Activity at this plant demonstrated consistently high levels, reaching 99% in June and July 2025, significantly exceeding the Asian average. A reading for August is missing from the data. The trends in activity do not show an obvious relationship with the news events, and no direct relationship can be established from the current data.

Sansteel Minguang Co., Ltd. Fujian

Sansteel Minguang Co., Ltd. Fujian, a major integrated steel producer based in Fujian, China, boasts a substantial crude steel capacity of 6.8 mtpa. Its activity levels remained relatively stable, with a moderate increase from 41% in March to 44% in July, before a reading is unavailable for August. The trends in activity do not show an obvious relationship with the news events, and no direct relationship can be established from the current data.

Evaluated Market Implications

The significant drop in average Asian steel plant activity in August warrants careful monitoring. The simultaneous delay of EU countermeasures against the US, as detailed in “EU delays countermeasures on US goods for six months,” might have influenced production strategies in anticipation of altered global trade flows, particularly in China.

Procurement Actions:

- Monitor Chinese coastal steel prices: Given the uncertainty indicated by activity data and the potential impact of trade realignments, steel buyers should monitor price developments of finished rolled steel products and coated steel products out of China closely to secure favorable prices.

- Diversify Supply Sources: For buyers reliant on Chinese steel, particularly from plants like Jianglong Acheng, consider diversifying supply sources to mitigate potential disruptions.

- Review Contractual Agreements: Steel buyers and analysts should review existing contractual agreements with steel suppliers, and consider the implications of the EU-US trade agreement and the potential impact of tariffs on steel imports and exports.