From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts Positively to US Trade Deals; Chinese Output Remains High Amid Tariff Concerns

In Asia, the steel market shows overall positive sentiment driven by the US trade deals, while Chinese steel production remains robust. This report analyzes observed steel plant activity in relation to recent news. The “Stocks Supported as US Announces a Trade Deal with Japan” article indicates positive market movement, although no direct link can be established to changes in steel plant activity. However, the article “Businesses deliver gloomy results even as markets celebrate Japan trade deal” mentions that SSAB has experienced tariff headwinds and currency issues as contributors to their troubles, with the latter seeing cheap steel redirected to Europe due to tariffs, although SSAB does not produce steel in Asia.

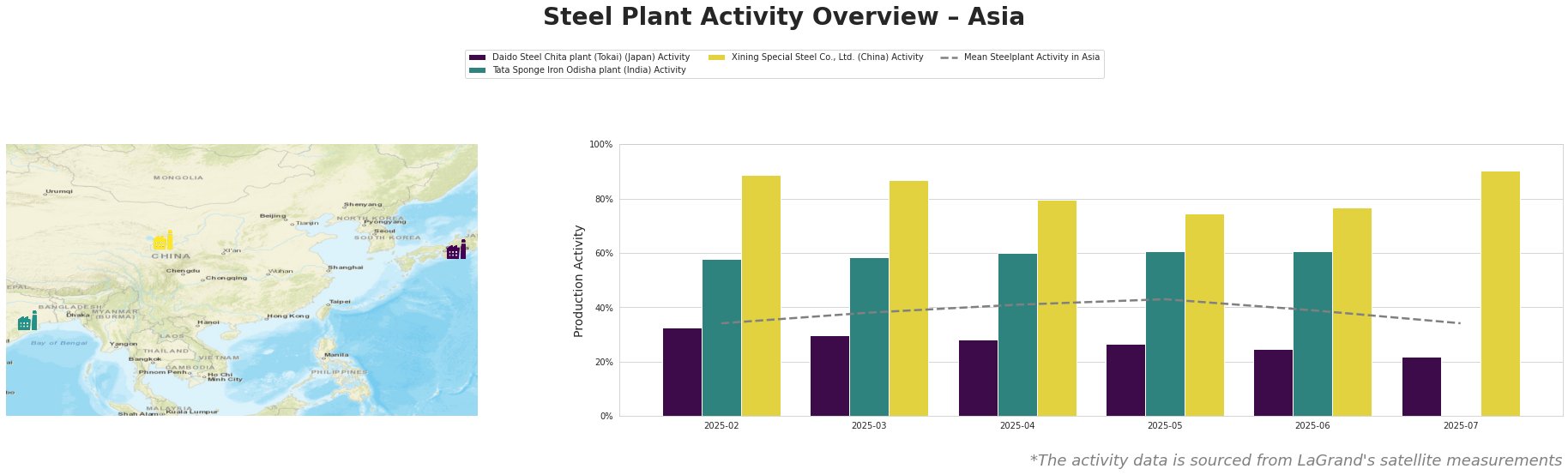

Across all plants the mean steel plant activity in Asia showed an increase from February to May (34% to 43%) and subsequently decreased to 34% in July.

Daido Steel Chita plant (Tokai), a Japanese plant with a 1.5 million tonne EAF-based capacity focused on specialty steels, has shown a consistent decline in activity from 33% in February to 22% in July. This decline does not seem to correlate with any news, as, despite the positive market response to the US-Japan trade deal (“Stocks Supported as US Announces a Trade Deal with Japan”), “Businesses deliver gloomy results even as markets celebrate Japan trade deal” highlights challenges faced by businesses due to broader trade war impacts. This decline could be related to company-specific factors or domestic demand.

Tata Sponge Iron Odisha plant, an Indian DRI plant with a 400,000 tonne capacity, showed relatively stable activity between 58% and 61% from February through June. The satellite observations ended in June, therefore no conclusion for July can be drawn. No clear connection can be established between this plant’s activity and the news articles, including the one describing uncertainty regarding a potential trade deal with India (“US stock futures dip with earnings, tariff talks in focus“).

Xining Special Steel Co., Ltd., a Chinese integrated steel plant with a 2 million tonne crude steel capacity, showed high and volatile activity, starting at 89% in February, dropping to 74% in May, and then rising sharply to 90% in July. This high activity level, consistently above the Asian mean, may be linked to the ongoing trade tensions, potentially driven by domestic demand substituting for exports affected by tariffs (“Stock market today: Nasdaq, S&P 500 slide amid wave of earnings as tariffs bite GM profit“).

Evaluated Market Implications:

-

Potential Supply Disruptions: The declining activity at Daido Steel Chita plant may lead to potential supply disruptions for specialty steels, particularly in the automotive and tooling sectors.

-

Recommended Procurement Actions:

- Steel Buyers in Automotive/Tooling: Closely monitor Daido Steel’s output and explore alternative specialty steel suppliers, especially given the lack of a direct positive impact from the US-Japan trade deal observed at this plant.

- Market Analysts focusing on China: Closely monitor China steel plants to determine whether the increased domestic production is a permanent phenomenon or whether it is a short-term effect due to tariffs on global trade.

- All Steel Buyers: Given high activity at Xining Special Steel Co., Ltd., carefully consider this plant’s future activity, given the news item: “Businesses deliver gloomy results even as markets celebrate Japan trade deal”.