From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts Positively to US-China Trade Developments: Plant Activity Rises

The Asian steel market shows positive sentiment amid US-China trade talks, as evidenced by fluctuations in steel plant activity. The news article “Stock market today: Dow, S&P 500, Nasdaq tread water in wait for clues on US-China trade talks” highlights the market’s sensitivity to trade negotiations, and “US stock futures lower after US, China reach trade deal that awaits presidential sign offs” indicates potential resolution, influencing activity. Observed changes in plant activity could reflect these developments, although a direct connection cannot always be explicitly established.

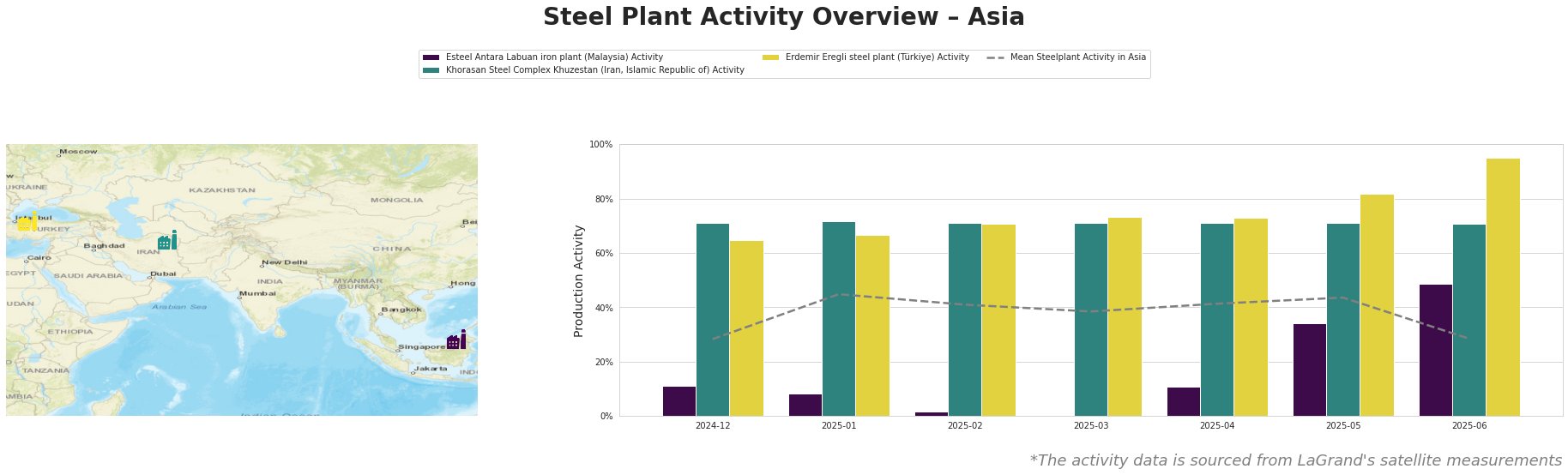

The mean steel plant activity in Asia fluctuated, peaking at 45% in January 2025 and then generally trending downwards to 28% in June 2025. The Khorasan Steel Complex Khuzestan maintained a consistently high activity level around 71% throughout the observed period. Erdemir Eregli steel plant saw a notable increase, reaching 95% activity in June 2025, significantly above the Asian mean. Esteel Antara Labuan iron plant exhibited the largest volatility, dropping to 0% in March 2025 before sharply rising to 49% in June 2025, still remaining below the Asian mean.

Esteel Antara Labuan, a DRI-based iron plant on Labuan Island, Malaysia, produces HBI (DRI) with a capacity of 900 ttpa. Activity plummeted to 0% in March 2025 before surging to 49% by June 2025. Given the news articles’ focus on US-China trade dynamics and their influence on broader market sentiment, it is difficult to directly correlate this plant’s activity shifts with specific news events, as no specific news about the plant itself are present.

Khorasan Steel Complex Khuzestan, an integrated DRI-based steel plant in Razavi Khorasan, Iran, has a crude steel capacity of 1500 ttpa and DRI capacity of 1800 ttpa, primarily producing rebar, billets, and DRI/HBI. Its activity remained remarkably stable at approximately 71% throughout the period. This stability could reflect consistent domestic demand or pre-existing supply agreements unaffected by the specific trade discussions mentioned in the news. No direct correlation can be established between the plant’s activity and the provided news articles.

Erdemir Eregli, an integrated BF-BOF steel plant in Zonguldak, Türkiye, boasts a crude steel capacity of 4000 ttpa. The plant’s activity surged to 95% in June 2025, a significant increase compared to earlier months and the mean Asian activity. The rise may be attributable to anticipation of increased demand related to positive news around US-China trade relations, and the news article “US stock futures lower after US, China reach trade deal that awaits presidential sign offs” hints at a possible trade agreement.

Evaluated Market Implications

The activity increase at Erdemir Eregli steel plant (Türkiye) coupled with the news about US-China trade talks suggests a potential increase in demand, and signals tighter supply of flat steel products in particular.

Recommended Procurement Action:

- For steel buyers: Given the potentially tighter supply indicated by Erdemir Eregli’s increased activity, steel buyers who require flat steel products are advised to secure contracts promptly to mitigate risks of increased prices and lead times. Monitor the official ratification of the US-China trade deal to fully assess its impact on steel supply and demand.