From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts Positively to US-China Trade Deal: Plant Activity Mixed

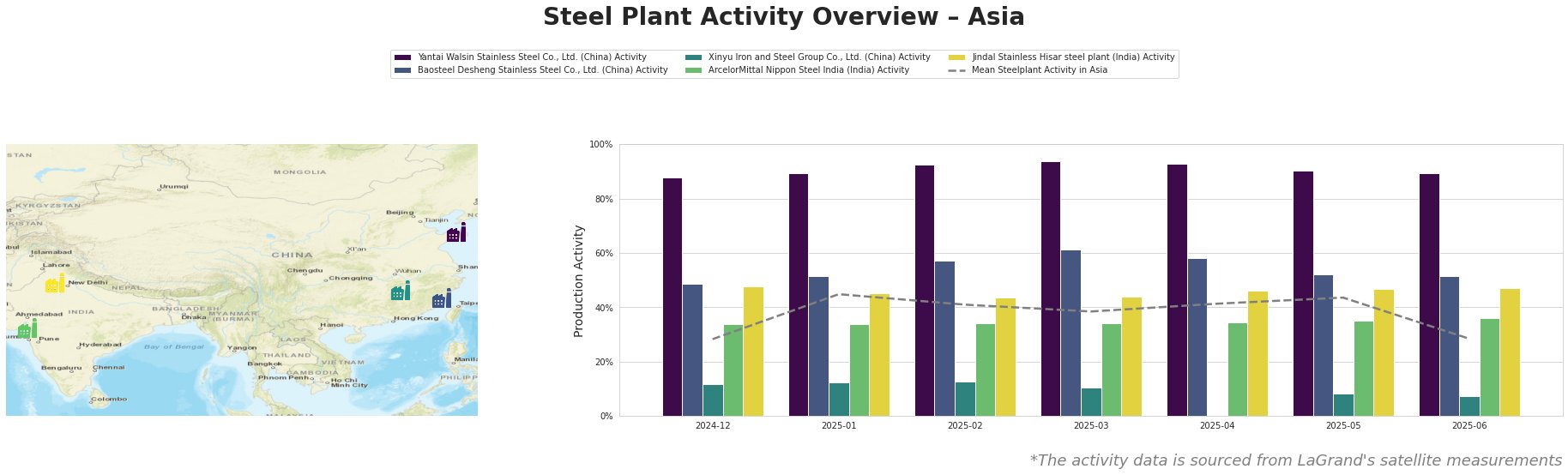

In Asia, steel market sentiment is positive following news of a preliminary trade agreement between the US and China. The agreement, reported in “USA und China erzielen Rahmenabkommen für den Handel,” “Aussenhandel: China und USA erzielen vorläufiges Ergebnis,” “Handelsstreit: China und USA mit Zwischenergebnis,” and “Deal zwischen USA und China – Trump: USA und China haben sich auf einen Handelsdeal geeinigt,” aims to de-escalate trade tensions. Satellite data shows varied activity levels across steel plants in the region, however, a direct and explicit relationship between those reports and observed activity can be hardly established.

Yantai Walsin Stainless Steel Co., Ltd., a Shandong-based electric arc furnace (EAF) steel plant with a crude steel capacity of 1.4 million tonnes per annum (ttpa), consistently operated at high activity levels, near 90% or above from December 2024 through June 2025. There is no clear, explicit, and directional link between the US-China trade news and observed plant activity levels.

Baosteel Desheng Stainless Steel Co., Ltd., located in Fujian and operating an integrated (BF-BOF) steel plant with a 3.41 million ttpa crude steel capacity, showed fluctuating activity. Starting at 49% in December 2024, activity peaked at 61% in March 2025 before declining to 52% in May and June 2025. The overall production decline has no explicit link to the US-China trade news.

Xinyu Iron and Steel Group Co., Ltd. in Jiangxi, an integrated steel plant (BF-BOF) with a substantial 10 million ttpa crude steel capacity, experienced a significant drop in activity, declining from 12% in December 2024 to 7% in June 2025. No clear or obvious connection to the US-China news could be detected.

ArcelorMittal Nippon Steel India, a Gujarat-based steel plant utilizing both blast furnace (BF) and direct reduced iron (DRI) processes with a 9.6 million ttpa crude steel capacity, maintained stable activity levels around 34-36% between December 2024 and June 2025. Its activity does not show a direct link to the news.

Jindal Stainless Hisar steel plant, located in Haryana and operating EAF steelmaking with a capacity of 800,000 tppa, also showed relatively stable activity, fluctuating between 44% and 48% during the observed period. Its activity does not show a direct link to the news.

Evaluated Market Implications:

While the news of a potential US-China trade deal (“Deal zwischen USA und China – Trump: USA und China haben sich auf einen Handelsdeal geeinigt“) has created positive market sentiment, satellite data reveals mixed activity levels across Asian steel plants. Specifically, the observed decrease in activity at Xinyu Iron and Steel Group Co., Ltd. could potentially indicate localized supply constraints, though a direct link to the US-China trade developments could not be explicitly confirmed by the available information.

- Recommended Procurement Action: Steel buyers should closely monitor Xinyu Iron and Steel Group Co., Ltd.’s output and consider diversifying their supplier base for medium, cold, and hot rolled thin plates, thick, and extra thick plates to mitigate potential supply disruptions. Consider reaching out to the plant directly to confirm production forecasts.