From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts Positively to US-China Trade Deal Amidst Vietnamese Tariff Shifts

In Asia, recent steel plant activity shows a generally positive trend, potentially influenced by evolving trade dynamics. The observed changes can be related to news such as “Handelskonflikt: Neue Einigung zwischen Trump und China” and “USA und China unterschreiben Handelsvereinbarung“, but the direct impact on specific plants needs to be assessed at the plant level. The article “Trump’s tariff pause is set to expire, threatening a trade war flare-up” adds a note of caution given existing market uncertainties.

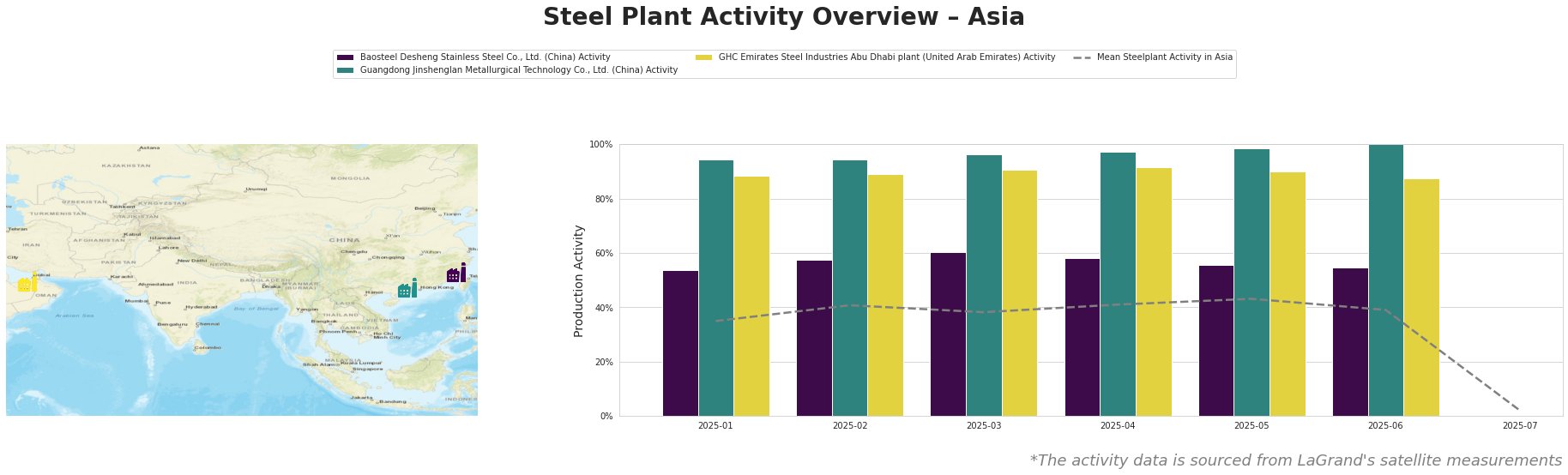

The mean steel plant activity in Asia shows fluctuating trends, increasing from 35% in January to a peak of 43% in May, before declining to 39% in June and a significant drop to 2% in July. The drastic reduction in overall activity in July is notable.

Baosteel Desheng Stainless Steel Co., Ltd., an integrated BF/BOF steel plant in Fujian, China, producing stainless steel, experienced fluctuations in activity, peaking at 60% in March before declining to 55% in both May and June. The impact of trade deal news such as “Handelskonflikt: Neue Einigung zwischen Trump und China” on Baosteel’s stainless steel production levels cannot be directly established from the available data.

Guangdong Jinshenglan Metallurgical Technology Co., Ltd., an EAF-based special steel producer, showed continuously high activity, reaching 100% in June. This steady performance, significantly above the Asian average, could indicate strong regional demand for its products. No direct connection to the provided news articles can be explicitly confirmed.

GHC Emirates Steel Industries Abu Dhabi plant, an integrated DRI/EAF plant producing a range of long products, maintained a relatively stable high level of activity, hovering around 90%, though it dipped to 88% in June. No direct link to the news articles provided can be established.

The recent US-China trade developments, as reported in “USA und China unterschreiben Handelsvereinbarung,” present potential opportunities for steel buyers. However, the “Trump’s tariff pause is set to expire, threatening a trade war flare-up” article highlights the risk of renewed trade tensions, emphasizing the need for cautious procurement strategies. The article “Trump’s Vietnam trade deal to keep US tariffs” suggests a shift in trade dynamics and increased tariffs on Vietnamese goods.

Evaluated Market Implications:

Given the overall positive market sentiment driven by the US-China trade agreement, buyers can consider exploring opportunities for securing advantageous contracts. The July drop in overall activity should be investigated before making long-term commitments.

Procurement Action:

- Short-Term:Closely monitor policy changes. The article “Trump’s Vietnam trade deal to keep US tariffs” indicates potential cost increases from Vietnamese imports. Steel buyers should evaluate alternative sources if their supply chain relies heavily on Vietnamese steel.

- Mid-Term: Monitor the Baosteel Desheng Stainless Steel Co., Ltd. plant activity, as fluctuations could impact stainless steel supply.