From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts Positively Amidst EU Tariff Threats: Ansteel Boosts Output

In Asia, the steel market displays resilience amidst potential EU tariffs on Chinese steel. The news articles “The EU may impose tariffs of 25-50% on Chinese steel – Handelsblatt,” “EU plans tariffs of 25%-50% on Chinese steel and related products, Handelsblatt reports,” and “The EU plans to impose duties of 25-50% on Chinese steel and related products, according to Handelsblatt.” signal potential shifts in global trade flows. While these articles don’t directly explain changes in Asian plant activity levels, they highlight the pressure on Chinese steel exports, potentially redirecting supply and influencing regional dynamics. The news article “The EU plans to reduce steel import quotas and increase tariffs” further underscores this trend.

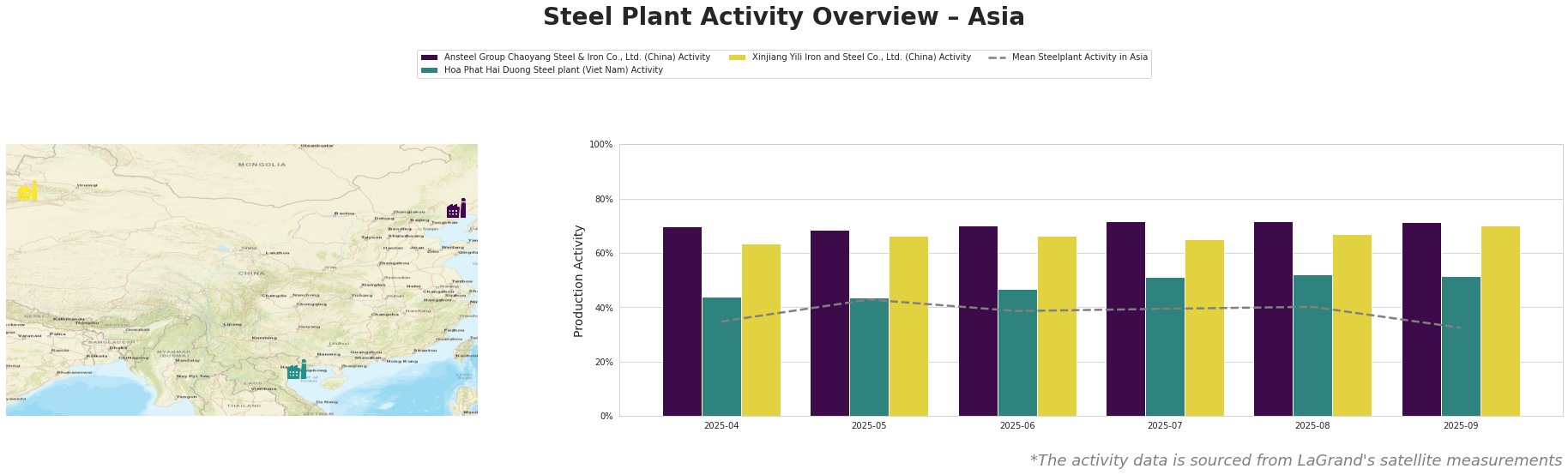

The mean steel plant activity in Asia fluctuated, peaking at 43% in May and dropping to 32% in September. Ansteel Group Chaoyang Steel & Iron Co., Ltd. maintained consistently high activity, around 70-72%, significantly above the Asian average. Hoa Phat Hai Duong Steel plant saw a gradual increase, peaking at 52% in August before decreasing slightly to 51% in September. Xinjiang Yili Iron and Steel Co., Ltd. showed relatively stable activity, increasing to 70% in September.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., located in Liaoning, China, operates as an integrated BF-BOF steel plant with a crude steel capacity of 2.1 million tonnes per annum (mtpa). The plant primarily produces finished rolled products, including steel plates and pipes. Its activity remained consistently high, at approximately 70% or above, over the observed period, peaking at 72% from July-September. This sustained high activity, despite the overall regional fluctuation, may reflect a strategic focus on domestic Chinese demand or alternative export markets outside the EU in anticipation of the tariffs mentioned in “The EU may impose tariffs of 25-50% on Chinese steel – Handelsblatt”.

Hoa Phat Hai Duong Steel plant, situated in Hai Duong, Vietnam, is also an integrated BF-BOF steel plant, boasting a crude steel capacity of 2.5 mtpa. Its product range includes construction steel, hot rolled coil, and pipes. The plant’s activity experienced a gradual increase from 44% in April-May to 52% in August, then decreasing slightly to 51% in September. This upward trend could reflect growing regional demand within Southeast Asia. No direct correlation between the observed activity and the cited news articles can be established.

Xinjiang Yili Iron and Steel Co., Ltd., located in Xinjiang, China, has a smaller crude steel capacity of 1 mtpa, relying on BF-BOF technology. It specializes in hot-rolled round bars and wire rods. The plant’s activity levels remained relatively stable, increasing steadily from 63% in April to 70% in September. While the EU tariff news (“The EU may impose tariffs of 25-50% on Chinese steel – Handelsblatt”) could indirectly influence this plant, given its location and product focus, no direct connection can be confirmed.

Evaluated Market Implications:

The consistently high activity at Ansteel Group Chaoyang, alongside potential EU tariffs, may indicate a shift in export strategies, potentially diverting more Chinese steel to other markets and tightening supply for EU-dependent nations.

Recommended Procurement Actions:

- Steel Buyers: Given the potential for redirected Chinese exports and increased regional demand, prioritize securing contracts with non-Chinese Asian steel suppliers to mitigate risks associated with the EU tariff situation.

- Market Analysts: Closely monitor the export data from Ansteel Group Chaoyang and other major Chinese steel producers to identify shifts in destination markets. Track pricing trends in Southeast Asia to assess the impact of potentially diverted Chinese supply on regional prices.