From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Rate Cut Anticipation & Stable Production Despite US Inflation

Asia’s steel market remains relatively stable, with production levels holding steady despite global economic uncertainties. Recent satellite data indicates consistent activity at major steel plants, but the US inflation and potential Fed rate cuts are creating market undercurrents. Observed stability does not correlate to any specific news articles provided.

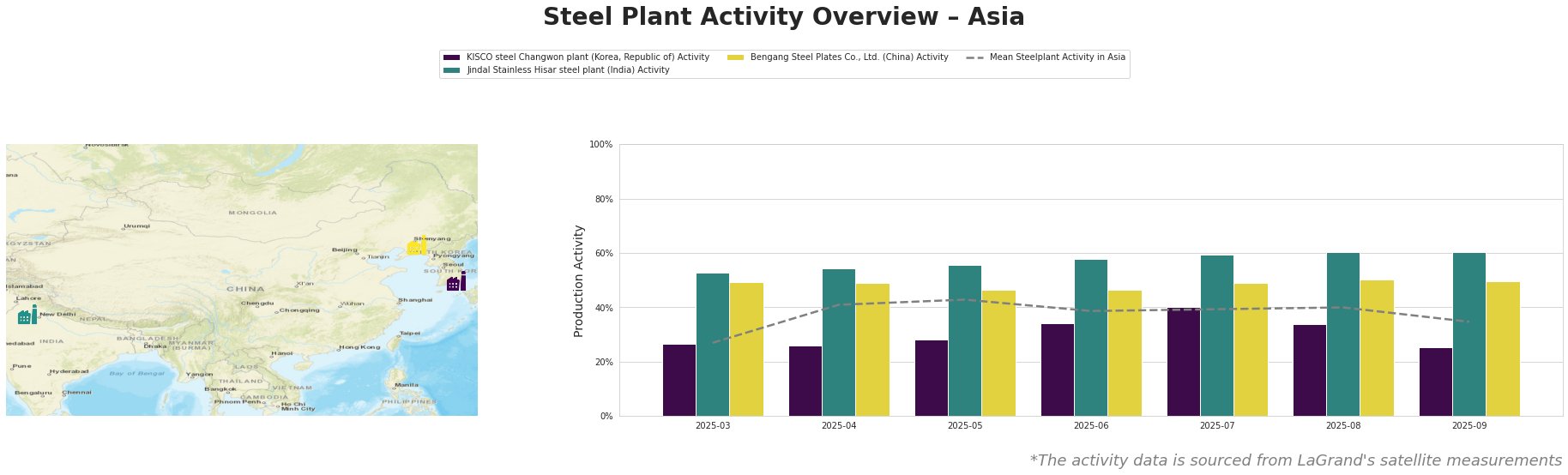

The average steel plant activity in Asia has fluctuated, peaking at 43% in May and dropping to 35% in September. KISCO steel Changwon plant, a South Korean EAF-based producer focusing on rebar and billets, saw its activity decline to 25% in September, down from a peak of 40% in July. Jindal Stainless Hisar steel plant in India, specializing in stainless steel products, has shown a steady increase in activity, reaching 60% in August and holding steady through September, significantly above the Asian mean. Bengang Steel Plates Co., Ltd. in China, an integrated BF-BOF producer of automotive and appliance plates, showed stable activity around 50%. Activity shifts do not correlate to any specific news articles provided.

KISCO steel Changwon plant’s activity decreased significantly from 40% in July to 25% in September. Given its reliance on EAF technology and rebar production, this drop could be related to shifts in regional construction demand or electricity costs, but this cannot be confirmed by provided evidence. Jindal Stainless Hisar steel plant has shown continuous growth. Bengang Steel Plates Co., Ltd. shows a stable production at around 50%.

The broader economic context is shaped by news such as “US inflation quickens to 2.9pc in August, core up,” indicating inflationary pressures in the US economy. The articles, “Stock market today: S&P 500, Nasdaq trade near records as retail sales show US consumer resilience” and “Stock market today: S&P 500, Nasdaq pull back from records as Fed rate decision looms,” highlight market anticipation of a Federal Reserve rate cut despite persistent inflation. No direct link can be established between the rate cut anticipation and the observed Asian steel plant activity.

Given the potential for a US rate cut and the risk of continued inflation as highlighted in “US inflation quickens to 2.9pc in August, core up”, steel buyers should closely monitor currency fluctuations and potential shifts in export demand. Specifically, if the dollar weakens following a rate cut, steel exports from Asia may become more competitive. Given the activity drop at the KISCO steel Changwon plant, procurement professionals seeking rebar or billets should diversify their supply sources to mitigate potential disruptions. The stable activity at Bengang Steel Plates Co., Ltd. suggests a reliable supply of plates for automotive and appliance sectors. Buyers should negotiate contracts that allow for flexibility in pricing due to currency fluctuations.