From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Q4 Downturn Anticipated Amid China Production Shifts, Baosteel Profit Surge

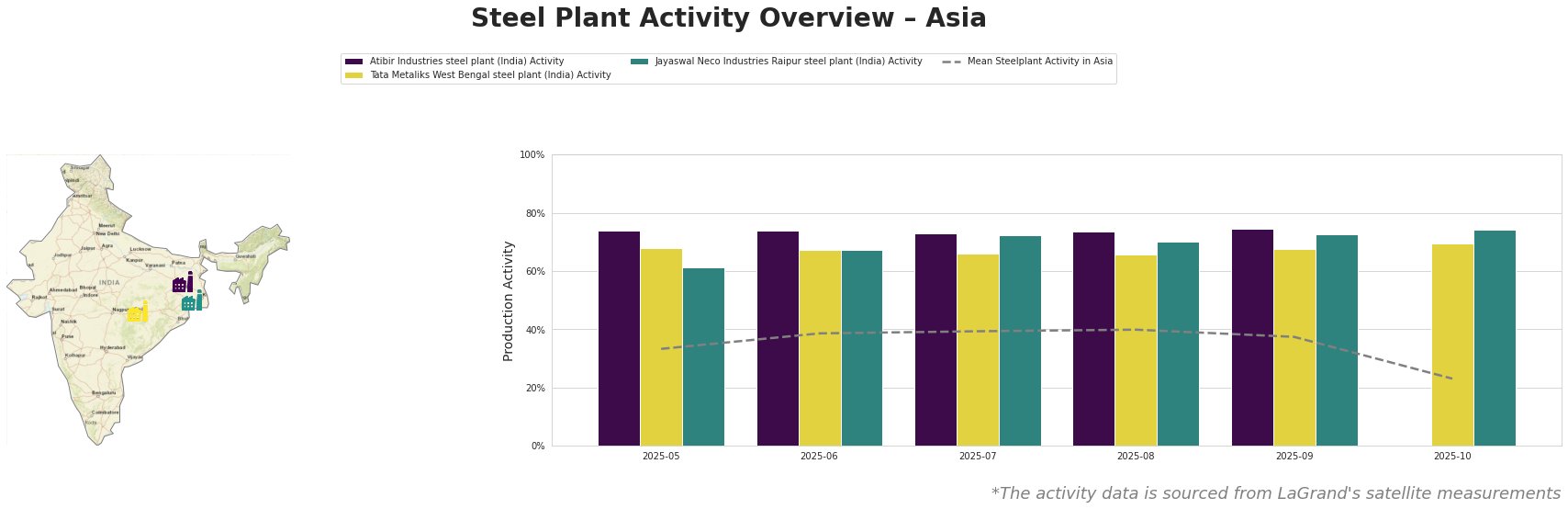

The Asian steel market is bracing for a downturn in Q4, influenced by developments in China and regional trade dynamics. According to “Asian Steel Market Faces Q4 Downturn as Regional Demand and Trade Barriers Intensify,” weakening regional demand, particularly in China’s construction sector, coupled with increasing trade barriers are key factors. Satellite data reveals a significant decrease in the mean steel plant activity in Asia in October 2025, dropping to 23% from 37% in September, potentially linked to the demand slump detailed in the aforementioned article.

The mean steel plant activity in Asia showed relative stability between May and September 2025, fluctuating between 33% and 40%. A significant drop to 23% occurred in October. Atibir Industries’ activity was not measurable in October. Activity at Tata Metaliks West Bengal and Jayaswal Neco Industries Raipur remained relatively stable throughout the observed period, standing at 70% and 74% respectively in October, against the trend of decreased mean steelplant activity in Asia. It must be noted, however, that the plant level observation sample size is low relative to total Asian steel production, suggesting that plant level observations here are more indicative than definitive.

Atibir Industries, located in Jharkhand, India, operates with an integrated BF-BOF process and a crude steel capacity of 600 ttpa. Although the plant activity could not be measured in October, satellite data indicated relative stability in plant activity from May to September (73-75%). No direct connection to any of the provided news articles can be established based on the available data.

Tata Metaliks West Bengal steel plant, located in West Bengal, India, also uses an integrated BF-BOF process. With a crude steel capacity of 255 ttpa and Pig Iron capacity of 600 ttpa, its production focuses on pig iron and ductile pipes. The plant’s activity remained relatively stable at around 66-70% from May to October. No direct link between the observed activity and any of the provided news articles can be established.

Jayaswal Neco Industries Raipur steel plant in Chhattisgarh, India, has a crude steel capacity of 1200 ttpa and utilizes both BF and DRI processes. Satellite data shows a consistently high activity level of around 61-74% from May to October. The “Iron Ore Declines as China’s Steel Production Drops and Inventories Rise, Impacting Asian Steel Value Chain” article notes declining iron ore imports due to reduced Chinese steel output. Jayaswal Neco’s DRI capacity might allow it to navigate iron ore price fluctuations with greater flexibility, but no explicit connection to the plant’s stable activity can be established.

Given the anticipated Q4 downturn outlined in “Asian Steel Market Faces Q4 Downturn as Regional Demand and Trade Barriers Intensify,” and the general production cuts mentioned in “Iron Ore Declines as China’s Steel Production Drops and Inventories Rise, Impacting Asian Steel Value Chain,” steel buyers should focus on short-term contracts to capitalize on potential price decreases and closely monitor inventory levels to avoid overstocking amid uncertain demand. Due to “Baosteel more than doubled its net profit in the third quarter“, one should explore Baosteel’s export offers, with the target to export 15 million tons of steel by 2026.