From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Production Mixed Amidst Fed Rate Uncertainty and Trade Policy Concerns

In Asia, steel production shows a mixed picture amidst global economic uncertainty. Recent satellite-observed activity levels at key steel plants do not show a direct correlation to developments described in the news article “The US Federal Reserve left its key policy rate unchanged for the fourth time in a row“. Although the uncertainty about US monetary policy has a global impact, its direct effect on production has yet to surface. Additionally, activity levels also appear uncorrelated to the topics described in “Mild US Inflation Is Backdrop for Fed’s Powell on the Hill“. The news article “Morning Bid: Oil, rates and the dollar tumble” describes macroeconomic impacts due to tentative de-escalation in the Middle East, but cannot directly be linked to our production data.

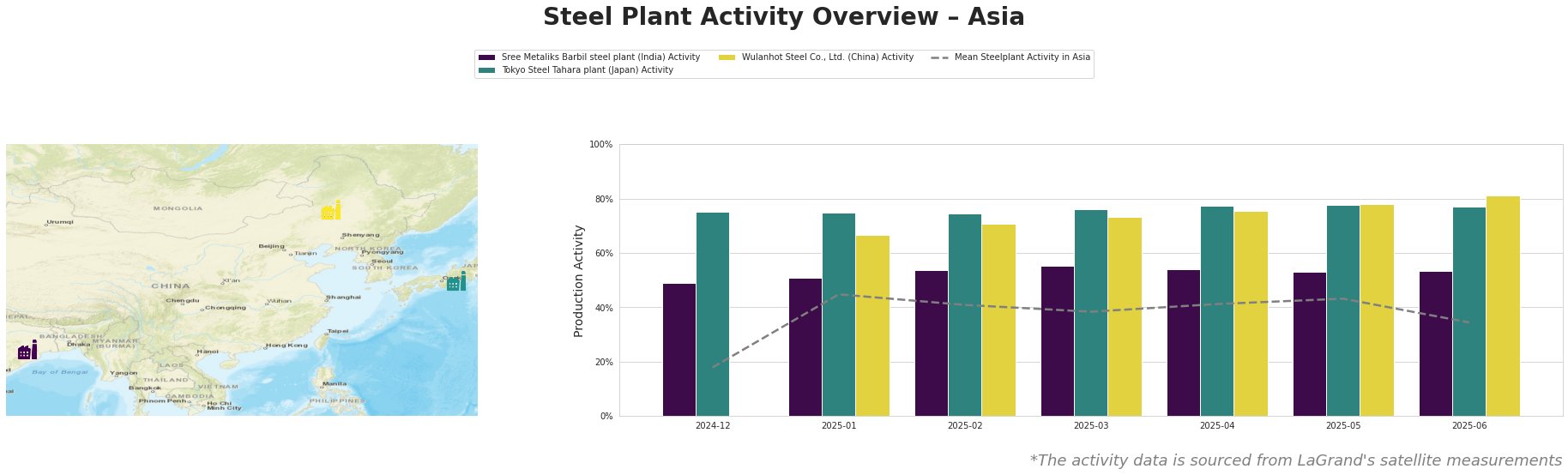

The mean steel plant activity in Asia experienced a drop to 34% in June 2025 after peaking at 45% in January 2025. This indicates a general slowdown in steel production across the region.

Sree Metaliks Barbil steel plant (India), an integrated steel plant with both BF and DRI processes and a crude steel capacity of 700 ttpa, maintained a relatively stable activity level, fluctuating between 49% and 55% from December 2024 to May 2025. The activity dropped slightly to 53% in June 2025. There is no clear connection between this activity and the provided news articles.

Tokyo Steel Tahara plant (Japan), an EAF-based plant with a crude steel capacity of 2500 ttpa, showed consistently high activity, ranging from 75% to 78% throughout the observed period. The plant maintained a relatively stable activity level, and its operations do not appear to be directly impacted by the economic factors discussed in “The US Federal Reserve left its key policy rate unchanged for the fourth time in a row” or “Morning Bid: Oil, rates and the dollar tumble“.

Wulanhot Steel Co., Ltd. (China), an integrated BF/BOF plant with a crude steel capacity of 1050 ttpa, exhibited a steady increase in activity from 67% in January 2025 to 81% in June 2025. This upward trend contrasts with the overall decline in mean activity across Asia. There is no direct connection established between the news articles and this increased activity.

Evaluated Market Implications:

Given the decline in the mean steel plant activity in Asia to 34% in June 2025, steel buyers should expect increased price volatility, especially as specific plant activity data does not correlate with recent news articles about the US Federal Reserve or oil prices. With Wulanhot increasing production and Sree Metaliks showing signs of slightly decreasing production, procurement professionals should watch these plants closely and consider diversifying their supply base to mitigate potential disruptions and secure competitive pricing. The steadiness of the Tokyo Steel Tahara plant may indicate a reliable source that should be accounted for.