From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Production Declines Offset by Indian Demand, Offering Tactical Procurement Opportunities

Steel production trends in Asia present a mixed outlook. According to the news article “Global steel production fell by 5.9% y/y in October,” China experienced a significant decline of 12.1% year-over-year in October, contributing to an overall global decrease. This aligns with the news article “China reduced iron ore production by 3.2% y/y in January-October,” highlighting a strategic shift away from heavy industry. While these production cuts suggest potential price pressure, the news article “India remains net steel importer despite shipments dropping 15% y-o-y in January-October 2025” indicates sustained Indian demand, potentially moderating the impact. Satellite observations reveal divergent activity levels across key regional steel plants, adding further nuance to the supply picture.

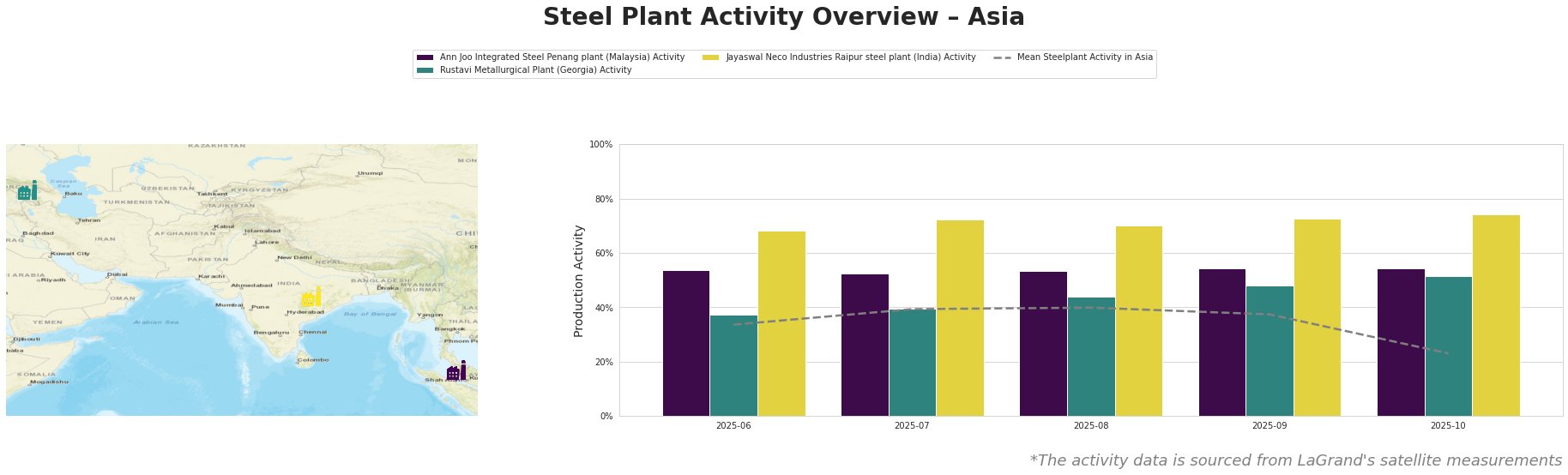

Measured Activity Overview:

Overall, the mean steel plant activity in Asia experienced a decline in October, dropping to 23% from 37% in September. This represents a substantial decrease in activity compared to earlier months. The Ann Joo Integrated Steel Penang plant maintained a consistent activity level of approximately 54% throughout the observed period, consistently exceeding the regional mean. Rustavi Metallurgical Plant demonstrated a steady increase in activity, rising from 37% in June to 51% in October, also surpassing the regional mean in October. The Jayaswal Neco Industries Raipur steel plant exhibited the highest activity levels among the observed plants, reaching 74% in October. However, the data table shows that Jayaswal Neco Industries Raipur also follows the downward moving trend observed in other steelplants, even if at a higher level compared to others.

Ann Joo Integrated Steel Penang plant

The Ann Joo Integrated Steel Penang plant in Malaysia, with a crude steel capacity of 500 thousand tonnes per annum (ttpa) produced via electric arc furnaces (EAF) utilizing an integrated blast furnace (BF) process, has maintained stable activity levels around 54% between June and October 2025. This sustained activity, consistently above the Asian average, suggests resilience despite the broader regional downturn and reduced imports in India. The stable output could provide a reliable source of semi-finished products like pig iron and billets for building and infrastructure projects. No direct connection can be established between the news articles and satellite-observed activity, as the plant maintains high levels compared to the average across the observed time period.

Rustavi Metallurgical Plant

Rustavi Metallurgical Plant in Georgia, possessing a crude steel capacity of 120 ttpa via EAF and an integrated BF process, exhibited a steady increase in activity from 37% in June to 51% in October. This rise, occurring amidst global production declines, indicates a potential expansion or increased operational efficiency. While the plant produces a range of products, including rebar and seamless pipes, its relatively small size and location outside major Asian markets limit its immediate impact on regional steel supply. No direct connection can be established between the news articles and satellite-observed activity.

Jayaswal Neco Industries Raipur steel plant

The Jayaswal Neco Industries Raipur steel plant in India, with a crude steel capacity of 1200 ttpa utilizing both BF and DRI processes, consistently operated at high activity levels, reaching 74% in October. This high level of activity, despite the mean activity level across the observed steelplants trending downwards between June and October, correlates with India’s continued status as a net steel importer, as reported in “India remains net steel importer despite shipments dropping 15% y-o-y in January-October 2025“. However, the observed activity decline over the course of the observed months may reflect the reduced imports mentioned in the news article, even if it maintains a high-activity level compared to the other observed steel plants.

Evaluated Market Implications

The combined effect of reduced Chinese steel production “China reduced iron ore production by 3.2% y/y in January-October” and sustained Indian demand, as indicated by “India remains net steel importer despite shipments dropping 15% y-o-y in January-October 2025“, is creating a complex market dynamic. While global production is down (according to the news article “Global steel production fell by 5.9% y/y in October“), specific plants like Jayaswal Neco Industries Raipur are maintaining high activity levels to serve the Indian market.

Procurement Action: Steel buyers should monitor price fluctuations closely, particularly for flat steel products, given India’s reduced import volumes. Given the sustained activity at Jayaswal Neco Industries Raipur, explore opportunities to secure contracts with this plant, focusing on blooms and billets to mitigate potential supply chain disruptions from decreased Chinese output. Diversification of supplier base and market vigilance are important given a global trend downwards in global steel production in combination with shifting import/export activities across the region.