From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Production Cuts Loom as China Drives Export Surge, Prices Volatile

Asia’s steel market faces potential shifts as China implements production cuts while simultaneously increasing exports. The “China issues work plan for steel industry, over 25 million mt output cut expected in 2025” and “China to cut steel production by at least 25 million tons in 2025” articles detail plans for significant output reductions. However, “China’s steel exports will exceed 100 million tons in 2025 – Baosteel” suggests exports will remain high, potentially offsetting domestic supply constraints. These policy changes, coupled with PMI data showing contraction (“China’s steel sector PMI declines to 49.8 percent in August 2025“) and falling rebar prices (“MOC: Average rebar prices in China down 1.1 percent in August 18-24 2025“), point to a complex market landscape. No direct relationship between these articles and the observed plant activity could be established.

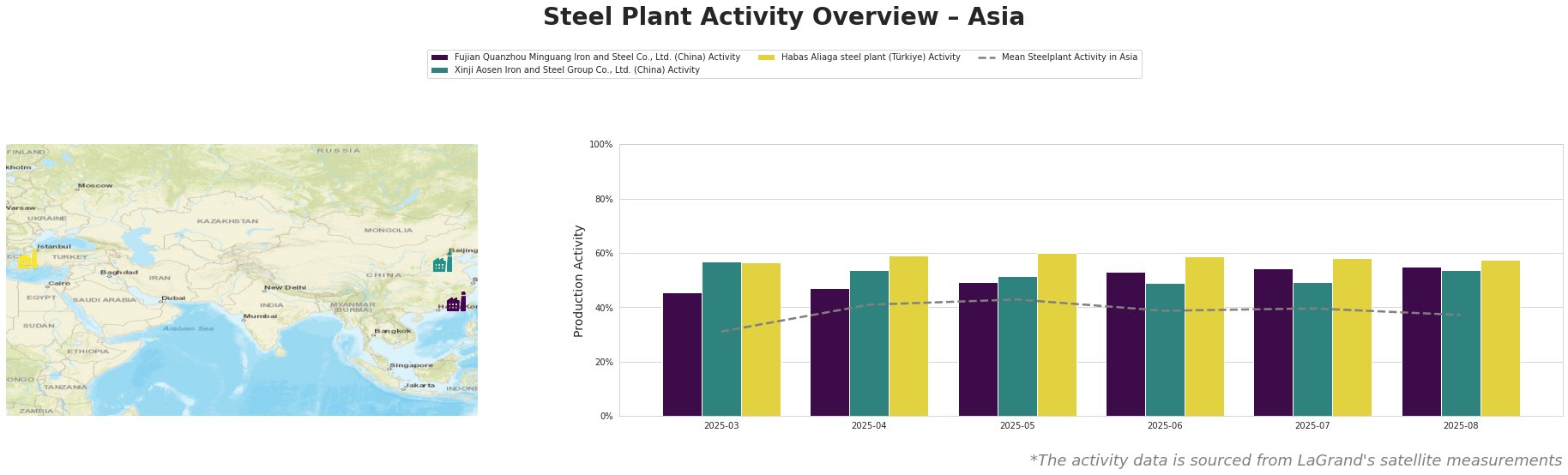

The mean steel plant activity in Asia shows fluctuations, peaking at 43% in May and subsequently declining to 37% in August. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. shows a generally increasing trend, rising from 46% in March to 55% in August. Xinji Aosen Iron and Steel Group Co., Ltd. experienced a peak in activity in March at 57%, subsequently dropping to 49% in June and July before recovering to 54% in August. Habas Aliaga steel plant in Turkey shows a stable activity level, fluctuating narrowly between 56% and 60%. Fujian Quanzhou Minguang consistently operates above the Asian average, while Xinji Aosen fluctuates around it. No direct connection between news articles and the plant activity trends could be established.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., a BOF-based integrated steel plant in Fujian, China, with a crude steel capacity of 2.55 million tons and producing finished rolled products like rebar, has shown a steady increase in activity, reaching 55% in August. As the plant’s activity has trended against the mean activity in Asia, it is possible that this plant is operating independently of the reported nationwide production cuts outlined in “China issues work plan for steel industry, over 25 million mt output cut expected in 2025”, or is yet to be impacted.

Xinji Aosen Iron and Steel Group Co., Ltd., located in Hebei, China, is another integrated BF/BOF steel plant with a crude steel capacity of 3.6 million tons, producing semi-finished and finished rolled products. The plant experienced a dip in activity in June/July to 49% and recovered to 54% in August. As Xinji Aosen produces semi-finished products like billets and slabs, any potential supply disruptions may cascade down the supply chain.

The Habas Aliaga steel plant, located in İzmir, Turkey, is an EAF-based plant with a crude steel capacity of 4.5 million tons, producing both semi-finished and finished rolled products. The plant’s activity levels remained relatively stable throughout the observed period, with levels consistently higher than the mean across Asian plants. No direct connection between news articles and the plant activity trends could be established.

Given China’s stated intent to reduce steel production while maintaining export volumes, buyers should anticipate potential supply constraints within China and increased competition from Chinese exports in other Asian markets.

- Recommended Action for Steel Buyers: Closely monitor Chinese export prices and availability, as these will likely fluctuate based on domestic production cuts. Given the “China’s steel sector PMI declines to 49.8 percent in August 2025” report indicating rising raw material purchase prices, buyers should expect potential upward pressure on steel prices in the near term. Procurement professionals focusing on products from BF/BOF integrated steel plants like Fujian Quanzhou Minguang and Xinji Aosen should closely monitor the potential impacts of production cuts in China and the subsequent impacts on both domestic and export availability.