From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Production Cuts Impacted by Emissions Concerns, Semis Export Decline

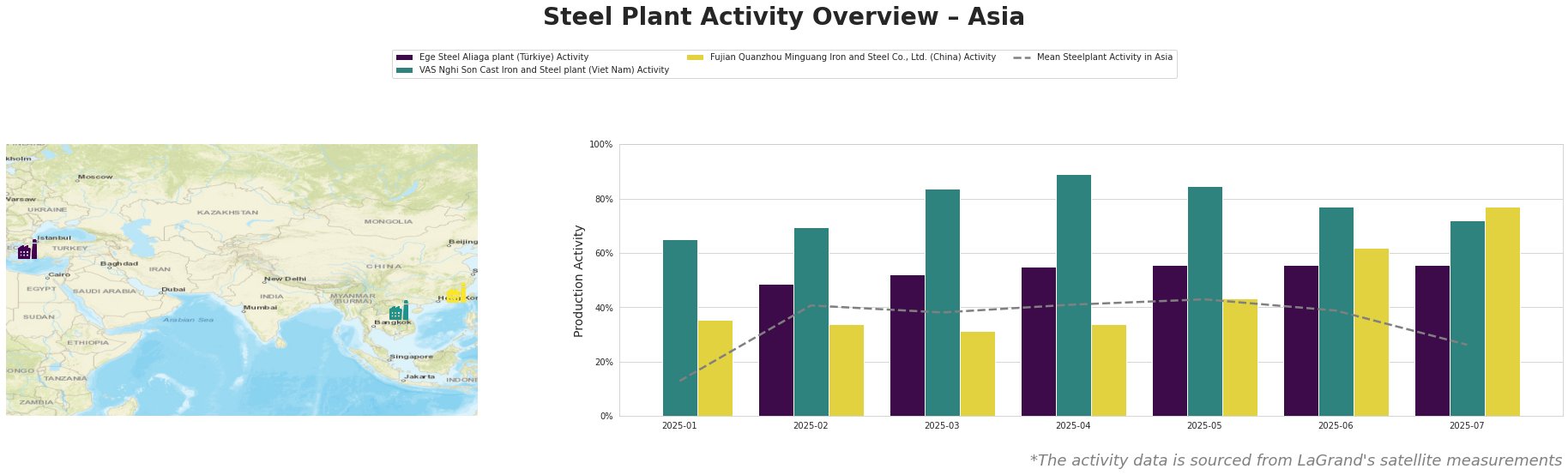

Asia’s steel market faces a complex situation as Chinese production adjustments interplay with environmental factors and shifting trade dynamics. Observed plant activity levels in China, Vietnam, and Türkiye show divergent trends which are affected by developments highlighted in news articles such as “China’s crude steel output in June lowest so far this year“, “Emissions in China’s steel sector rose by 17.3% y/y in June“, and “China’s semis exports down 14% in June from May, H1 volume hits record 5.9 million mt“. The relationship between satellite observed activity and these articles is explictly examined below.

Overall, the mean steel plant activity in Asia peaked in May at 43% and then declined to 26% in July.

The Ege Steel Aliaga plant in Türkiye, with an EAF-based crude steel capacity of 2 million tonnes per annum, maintained a stable activity level around 56% from May through July, consistently exceeding the Asian average. This stability occurs despite the broader trends discussed in the provided news articles; no direct connection to the Turkish plant’s performance can be established. Ege Steel Aliaga Plant produces semi-finished and finished rolled products, rebar, and wire rod.

The VAS Nghi Son Cast Iron and Steel plant in Vietnam, an EAF-based facility with a crude steel capacity of 3.15 million tonnes per annum, saw its activity decline from a high of 89% in April to 72% in July. The plant produces semi-finished products such as billet and finished rolled products such as rebar and wire rod. This decrease does not have a direct linkage to any of the provided news articles as it is neither explicitly connected nor located in China.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd. in China, an integrated BF/BOF steel plant with a crude steel capacity of 2.55 million tonnes per annum, showed a significant increase in activity, rising from 43% in May to 77% in July. This integrated plant produces finished rolled products such as round bar, high-speed bar, coiled rebar and wire rod. Considering the news from “China’s crude steel output in June lowest so far this year” it is interesting to note an activity increase in a Chinese plant in the timeframe leading up to July 31, 2025. Given the simultaneous report of “Emissions in China’s steel sector rose by 17.3% y/y in June,” it’s possible this increase could be related to a shift in production focus towards specific plants that may have faced fewer curtailments or different environmental regulations.

Given the overall decline in Chinese steel output as highlighted in “China’s crude steel output in June lowest so far this year” and the simultaneous increase in emissions (as reported in “Emissions in China’s steel sector rose by 17.3% y/y in June“), steel buyers should:

- Prioritize securing rebar and wire rod supply from sources outside of Fujian province: Due to the increased activity at Fujian Quanzhou Minguang Iron and Steel Co., Ltd., consider potential supply chain bottlenecks or price fluctuations specifically related to these products from this region, especially since this steel plant predominantly produces rebar and wire rod.

- Monitor price volatility of semi-finished steel: The article “China’s semis exports down 14% in June from May, H1 volume hits record 5.9 million mt” indicates that while exports decreased in June, overall H1 volumes were high. Buyers should closely monitor price movements and availability of semi-finished products as China adjusts its export strategy in the second half of the year.