From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Positive Outlook Supported by Rising Plant Activity Despite Fluctuations in US Trade

Asia’s steel market maintains a positive sentiment, bolstered by generally increasing plant activity across key producers. This trend occurs against a backdrop of fluctuating US steel trade, as highlighted by news articles such as “US steel imports rise 19.6% in May 2025“, “US slab imports up 70.3 percent in May 2025“, “US HDG imports down 13.8 percent in May 2025” and “US steel exports up 9.8 percent in May 2025“. However, a direct relationship between US trade data and Asian steel plant activity levels cannot be definitively established based on the provided information.

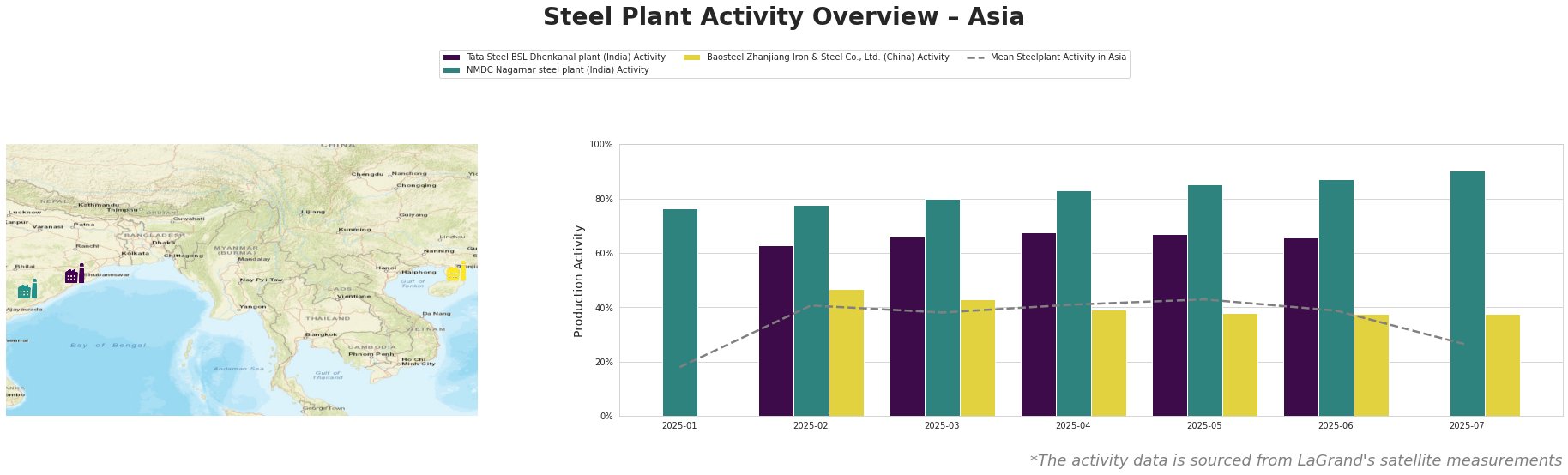

The mean steel plant activity in Asia shows a fluctuating trend, peaking in May 2025 at 43% and then dropping to 26% in July. Tata Steel BSL Dhenkanal plant in India exhibited stable activity around 66-67% from March to June. NMDC Nagarnar steel plant in India shows consistently high activity levels, reaching 90% in July 2025, significantly above the Asian mean. Baosteel Zhanjiang Iron & Steel Co., Ltd. in China showed a slight decrease in activity from February (47%) to June/July (38%).

Tata Steel BSL Dhenkanal, an integrated steel plant in Odisha, India, utilizes both BF and DRI technologies with a crude steel capacity of 5.6 million tonnes. Activity levels at the Dhenkanal plant remained relatively stable between March and June 2025 (66-67%). However, no data is available for January and July. Based on the provided news articles, there is no immediate connection between Tata Steel BSL Dhenkanal plant’s activity and recent US steel trade developments.

NMDC Nagarnar steel plant, located in Chhattisgarh, India, operates with BF and BOF technologies, possessing a 3 million tonne crude steel capacity and focusing on finished rolled products like hot rolled coils, sheets, and plates. This plant showcased a consistent increase in activity, culminating in a high of 90% in July 2025, significantly exceeding the Asian average. Although “US steel imports rise 19.6% in May 2025” and other news articles indicate changes in US trade flows, their direct impact on the NMDC Nagarnar plant cannot be established.

Baosteel Zhanjiang Iron & Steel Co., Ltd., situated in Guangdong, China, is an integrated BF-BOF steel plant with a substantial crude steel capacity of 12.5 million tonnes, producing hot rolled plates, cold rolled sheets, and hot-dip galvanized products. The plant’s activity level exhibited a slight decline from 47% in February to a stable 38% from April to July. Given that the “US HDG imports down 13.8 percent in May 2025” while “US HDG exports up 6.5 percent in May 2025“, it might impact Baosteel’s HDG product exports, but a direct causation can not be verified.

The high activity at NMDC Nagarnar suggests potential increases in the availability of hot rolled coils, sheets, and plates. Simultaneously, stable activity at Baosteel Zhanjiang alongside fluctuating US HDG trade suggest no immediate risk of supply disruption, but buyers should continuously monitor the US HDG export market as outlined in “US HDG exports up 6.5 percent in May 2025” .

Recommended Procurement Action: Steel buyers should explore procurement opportunities with NMDC Nagarnar, given its increased production of hot-rolled products. Additionally, buyers should monitor the impact of “US HDG imports down 13.8 percent in May 2025” and “US HDG exports up 6.5 percent in May 2025” on Baosteel’s HDG product availability and pricing, and diversify their HDG sources if necessary.