From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Positive Outlook Despite Fluctuations – Activity Tied to Emissions Targets

Asia’s steel market demonstrates overall positive sentiment, influenced by new emissions reduction targets and climate finance initiatives. Steel plant activity levels show some fluctuations, but no direct links could be established between these observations and the news articles titled “EU missed chance to show climate leadership: Green MEP” and “Climate finance in EMDEs over $1 trillion in 2023: CPI“. Satellite data suggests activity is likely influenced by domestic Asian policy. The article “Indonesia, Malaysia set new emissions reduction targets” is likely to affect long-term steel production strategies within these regions as capacity and production methods are adapted.

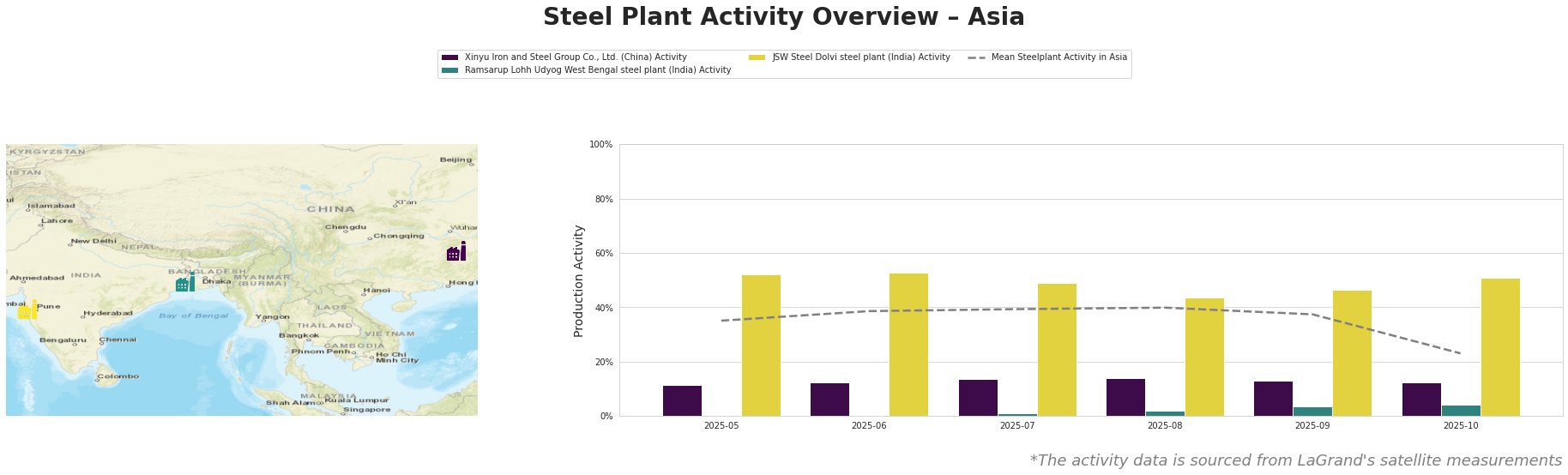

The mean steel plant activity in Asia fluctuated between 35% and 40% from May to August, before dropping significantly to 23% in October. Xinyu Iron and Steel Group Co., Ltd. in China, an integrated BF steel plant with a 10,000 ttpa crude steel capacity, showed relatively stable activity around 11-14% throughout the period. Ramsarup Lohh Udyog West Bengal steel plant in India, producing semi-finished and finished rolled products using integrated BF and DRI processes, demonstrated very low activity, increasing slightly from 0% in May-June to 4% in October. JSW Steel Dolvi steel plant in India, with a 5,000 ttpa crude steel capacity utilizing integrated BF and DRI processes alongside EAF technology, exhibited the highest activity levels among the observed plants, ranging from 44% to 53%. Its activity decreased from June to August before increasing again in September and October. The October drop in mean activity is significantly influenced by Xinyu Iron and Steel Group Co., Ltd. and Ramsarup Lohh Udyog West Bengal steel plant. No explicit connection can be made between the observed activity patterns and the news articles provided, though the article “Indonesia, Malaysia set new emissions reduction targets” may lead to longer-term shifts in plant activity as emissions targets are pursued.

Indonesia and Malaysia’s commitment, highlighted in “Indonesia, Malaysia set new emissions reduction targets“, to reduce emissions, suggests potential long-term investment in EAF technology and DRI processes.

-

Xinyu Iron and Steel Group Co., Ltd.: Given the stable, low activity level, and the plant’s reliance on BOF technology, buyers should anticipate potential supply constraints for medium, cold, hot, and thick plates if domestic Chinese environmental regulations tighten in line with national emissions targets. Procurement teams should explore diversifying suppliers outside of the Jiangxi region.

-

Ramsarup Lohh Udyog West Bengal steel plant: The consistently low activity at this plant, particularly given its DRI capacity, suggests potential operational or financial challenges. Buyers should avoid relying on this plant for critical supply, focusing on more stable suppliers for billets, transmission lines and wires.

-

JSW Steel Dolvi steel plant: With strong activity and a mix of BF, DRI and EAF production, this plant appears well-positioned. The relatively higher level of EAF capacity might signal its resilience towards climate related constraints.