From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Poised for Growth Despite Coal Supply Concerns

Asia’s steel market sentiment remains positive amidst fluctuating plant activity, with potential implications from Australian coal mine disputes. This report analyzes recent activity changes and links them to news events where possible. The observed changes at Ramsarup Lohh Udyog, GHC Emirates Steel Industries and Xinyu Iron and Steel Group Co., Ltd. do not have any direct relationship to the news items “US’ Peabody extends Australian coal mine lock-out again“, “US’ Peabody extends coal mine lock-out: Correction“, and “US BLM seeks to reopen PRB coal leasing“.

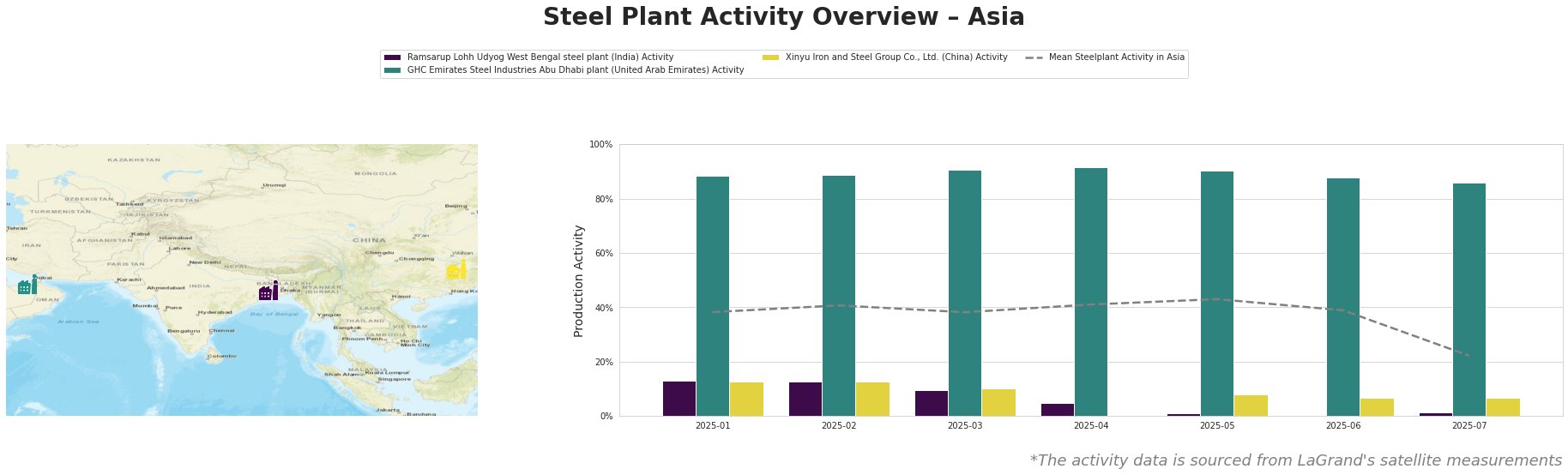

Here’s an overview of recent monthly activity trends:

The mean steel plant activity in Asia fluctuated between 38% and 43% from January to May, before declining to 39% in June and a significant drop to 22% in July.

Ramsarup Lohh Udyog West Bengal steel plant, an integrated plant with BF and DRI processes and an EAF producing billets, transmission lines, and wires for the energy sector, experienced a continuous activity decline from 13% in January-February to 0% in June, slightly recovering to 1% in July. This is significantly below the Asia mean activity, but no direct connection to the news articles “US’ Peabody extends Australian coal mine lock-out again”, “US’ Peabody extends coal mine lock-out: Correction”, and “US BLM seeks to reopen PRB coal leasing” could be established.

GHC Emirates Steel Industries Abu Dhabi plant, an integrated DRI-based steel plant producing rebar, wire rod, and heavy sections for various sectors, showed consistently high activity levels, fluctuating between 86% and 92%. This is well above the average. No direct connection to the news articles “US’ Peabody extends Australian coal mine lock-out again”, “US’ Peabody extends coal mine lock-out: Correction”, and “US BLM seeks to reopen PRB coal leasing” could be established.

Xinyu Iron and Steel Group Co., Ltd., an integrated BF-based steel plant producing medium, cold/hot rolled thin, thick, and extra thick plates, experienced a consistent activity level between 13% and 7%. This is below the average. No direct connection to the news articles “US’ Peabody extends Australian coal mine lock-out again”, “US’ Peabody extends coal mine lock-out: Correction”, and “US BLM seeks to reopen PRB coal leasing” could be established.

Evaluated Market Implications:

The “US’ Peabody extends Australian coal mine lock-out again” and “US’ Peabody extends coal mine lock-out: Correction” articles highlight potential disruptions to coking coal supply if the labor dispute escalates and spreads to other mines. While the direct impact on Asian steel plants is not immediately evident from the activity data, a prolonged lockout could indirectly affect met coal prices and availability, potentially impacting plants reliant on imported coal, particularly those using BF technology.

Recommended Procurement Action:

- Steel buyers should monitor the Peabody mine lockout situation in Australia closely. While no immediate correlation to Asian steel plant activity is observed, a prolonged dispute could impact met coal prices, increasing input costs for steel plants relying on BF technology. Consider diversifying met coal sources and securing supply contracts to mitigate potential price volatility. Given the Ramsarup Lohh Udyog West Bengal steel plant shows a significant decline, buyers should check their dependencies and potentially mitigate risk.