From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Poised for Growth Amid US Trade Developments and Stable Plant Activity

In Asia, steel markets are showing positive momentum, potentially influenced by developments in US trade policy, though a direct connection is not always immediately apparent. The “AISI welcomes US-China tariff agreement” could indirectly impact Asian steel producers, as the agreement aims to reduce trade tensions and could potentially shift export dynamics. No direct relationship to plant activity levels in Asia could be established from the provided news articles, however.

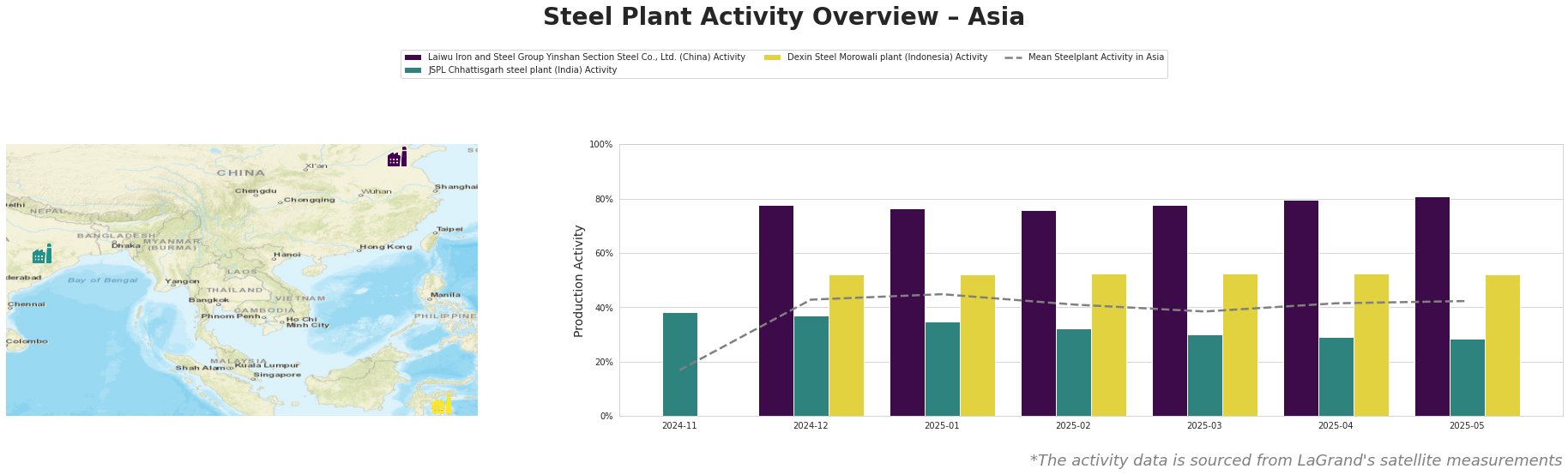

Overall, the average steel plant activity in Asia has fluctuated. From December 2024 onwards the mean activity stabilized between 41% and 45%. Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd. in China showed consistently high activity, ranging from 76% to 81% between December 2024 and May 2025, significantly above the Asian average. In contrast, JSPL Chhattisgarh steel plant in India has seen a gradual activity decline from 38% in November 2024 to 28% in May 2025, falling below the mean activity in Asia. Dexin Steel Morowali plant in Indonesia maintained a stable activity level of 52% from December 2024 to May 2025, above the mean activity. No direct relationship between these plant activities and the provided news articles could be established.

Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd., a major integrated steel producer in Shandong, China, operates primarily with BF and BOF technologies, boasting a crude steel capacity of 5.4 million tonnes. The observed activity at Laiwu has been consistently high in recent months, peaking at 81% in May 2025, though no direct impact from the provided news articles can be established.

JSPL Chhattisgarh steel plant in India, relying on both BF and DRI processes with EAF steelmaking, has a crude steel capacity of 3.6 million tonnes. The plant’s activity has steadily decreased, reaching 28% in May 2025, the lowest observed in the provided timeframe. JSPL’s reliance on imported met coal from Australia could make it sensitive to international price fluctuations, though a direct link to the observed activity decline and the provided news could not be established.

Dexin Steel Morowali plant in Central Sulawesi, Indonesia, utilizes integrated BF and BOF technologies, with a crude steel capacity of 3.5 million tonnes. The plant’s activity has remained stable at 52% from December 2024 to May 2025. The stability could be attributed to strong domestic demand or long-term supply contracts. As with the other plants, no direct link to the provided news articles is evident.

Given the consistently high activity at Laiwu Iron and Steel in China and the potential for shifting trade dynamics due to the “AISI welcomes US-China tariff agreement”, steel buyers should closely monitor Chinese export prices. While JSPL Chhattisgarh’s declining activity might suggest a potential localized supply constraint in India, the stable production at Dexin Steel Morowali in Indonesia offers a stable alternative source, albeit with different product specifications (wire rod, slab, bar, billet). Steel buyers should consider diversifying their procurement sources and negotiating long-term contracts to mitigate potential risks associated with fluctuating plant activity. Consider also the potential impact of the Nippon Steel ready to invest $14 billion in US Steel if deal approved – Reuters on US Steel’s steel supply, however, this will not directly affect supply in Asia.