From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Plummets: China’s Production Cuts Fuel Export Surge Amidst Regional Uncertainty

In Asia, the steel market faces growing headwinds due to production cuts in China. The slump is explicitly driven by factors highlighted in the news articles: “China reduced steel production by 9.2% y/y in June” and “China’s crude steel output in June lowest so far this year, down 3% in H1”. These reductions have not translated to reduced export pressure. As highlighted by “China increased steel exports by 9.2% y/y in 1H2025“, there is a continued increase in exports, indicating an imbalance stemming from declining domestic demand. The satellite data do not directly correlate with the Chinese national production statistics.

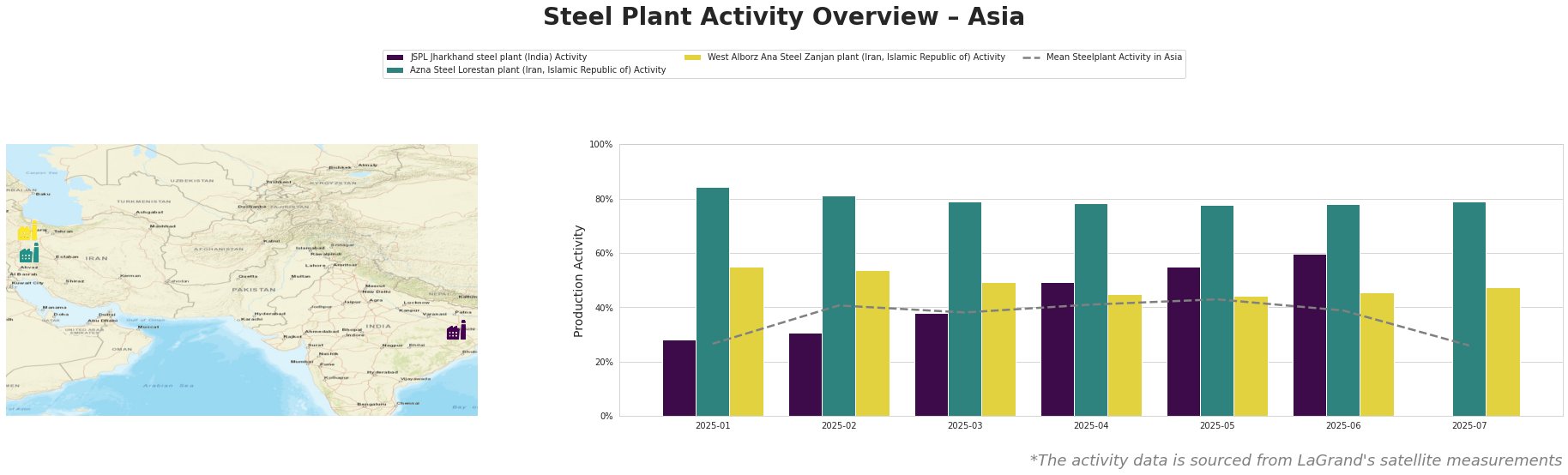

The mean steel plant activity across Asia shows a marked decrease in July, dropping to 26% from a high of 43% in May, indicating a broad regional slowdown. JSPL Jharkhand in India shows a consistent increase from January to June, peaking at 60%, significantly outperforming the Asian mean activity level. The Azna Steel Lorestan plant in Iran consistently operates at high activity levels, between 78% and 84%, and shows relative stability over the observation period. West Alborz Ana Steel Zanjan in Iran shows moderate activity, fluctuating between 44% and 55%, but also shows the largest reduction in activity compared to the others. There is no obvious explicit link between the observed activity levels of these three plants and the news articles related to Chinese production and exports.

JSPL Jharkhand steel plant, an EAF-based plant in Jharkhand, India, with a crude steel capacity of 1.6 million tonnes per annum (ttpa), demonstrates consistently increasing activity throughout the observed period, reaching 60% in June. This upward trend is contrary to the overall Asian market sentiment and the news of production cuts in China. No direct connection between JSPL Jharkhand’s activity and the named news events could be established.

The Azna Steel Lorestan plant in Lorestan, Iran, is an EAF-based plant with a crude steel capacity of 1.2 million ttpa, producing semi-finished products like sheets and slabs. Activity at this plant remains high and stable, around 78-84% throughout the observed period. This stability does not appear to be directly affected by the Chinese production cuts or export increases reported in the news. No direct connection between Azna Steel Lorestan’s activity and the named news events could be established.

West Alborz Ana Steel Zanjan plant, located in Zanjan, Iran, is an integrated DRI-EAF plant with a crude steel capacity of 1.5 million ttpa, focusing on semi-finished products like billets. Its activity fluctuates between 44% and 55%, with a slight decrease in April and May. Like the other plants, no direct impact on this plant’s activity can be explicitly linked to the Chinese steel production cuts or export surges reported in the provided news articles.

Evaluated Market Implications:

The Chinese domestic production cuts, highlighted in “China reduced steel production by 9.2% y/y in June” and “China’s crude steel output in June lowest so far this year, down 3% in H1”, coupled with the export increase reported in “China increased steel exports by 9.2% y/y in 1H2025”, indicate a potential oversupply situation in the export market, driving down prices.

Recommended Procurement Actions:

- Steel Buyers: Given the increasing Chinese exports and declining domestic demand (“China increased steel exports by 9.2% y/y in 1H2025”), buyers should explore opportunities to negotiate more favorable terms with Chinese suppliers. This is explicitly justified by the potential oversupply situation created by the production cuts (“China reduced steel production by 9.2% y/y in June”) and increased exports. Carefully monitor Chinese export prices, as reported in the news, and compare them against regional market prices to identify potential cost savings.

- Market Analysts: Closely monitor the sustainability of high activity levels at plants like Azna Steel Lorestan and the growth at JSPL Jharkhand in the face of overall market headwinds. Further investigation is warranted to understand their resilience and potential market share implications. Analyze trade data to identify specific product categories and regions most affected by increased Chinese exports. Track any policy changes in China that may further influence production and export volumes.