From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Oversupply Risk Amid Rising Stainless Exports & Stable Plant Activity

Asia’s steel market faces potential oversupply challenges despite relatively stable plant activity. The OECD forecasts significant volatility and overcapacity in the steel market, largely driven by Asia, as stated in “Steel under pressure: OECD forecast shows future volatility“. This article is related to observed stable steel plant activities, as a global risk of oversupply may not immediately translate into rapid production increases. Simultaneously, China’s rising stainless steel exports, as noted in “China’s stainless steel exports up 15.09 percent in Jan-Apr“, contribute to the uncertainty.

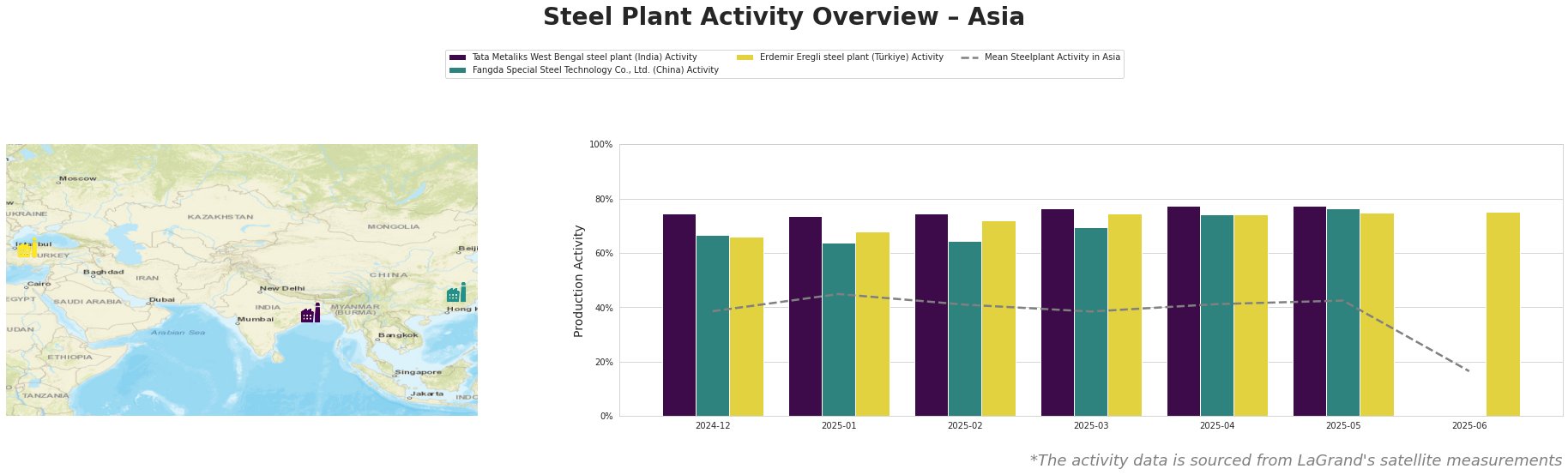

The mean steel plant activity in Asia fluctuated between 38% and 45% from December 2024 to May 2025, with a significant drop to 16% in June 2025.

Tata Metaliks West Bengal steel plant, an integrated BF producer focused on pig iron and ductile pipes, maintained a consistently high activity level, ranging from 73% to 77% between December 2024 and May 2025. This stable high level does not show any clear connection to the named news articles.

Fangda Special Steel Technology Co., Ltd., a Chinese integrated BF producer of finished rolled products, showed activity increasing from 67% in December 2024 to 77% in May 2025. This activity increase does not show a clear connection to the news article “China’s stainless steel exports up 15.09 percent in Jan-Apr“, which focuses on Stainless Steel, as Fangda mainly produces carbon steel products.

Erdemir Eregli steel plant in Türkiye, another integrated BF producer specializing in flat steel products, exhibited a similarly stable high activity level, ranging from 66% to 75% between December 2024 and June 2025. There is no immediately obvious link between Erdemir Eregli steel plant’s activity and the provided news articles.

The significant drop in the mean activity level in Asia to 16% in June 2025 is caused by missing values for both, Tata Metaliks West Bengal steel plant and Fangda Special Steel Technology Co., Ltd..

Given the OECD’s forecast of oversupply and the stable activity at major plants like Erdemir Eregli and Tata Metaliks, steel buyers should closely monitor price trends and consider negotiating longer-term contracts to secure favorable rates in anticipation of potential price drops. Given the steady production at Fangda Special Steel and rising Chinese stainless exports, buyers should investigate alternative suppliers to diversify their procurement options.