From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Output Mixed Signals Amidst Price Declines

Asia’s steel market faces headwinds due to declining prices, even as some production indicators show upward movement. Specifically, “CISA mills’ daily crude steel output up 7.5% in early October 2025, stocks also up” reveals a recent production increase among CISA members, contradicting the overall negative trend. However, this increase contrasts with the “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025”, implying a volatile market environment. Whether the rise in CISA member output is causally related to the September production dip cannot be established with the provided data.

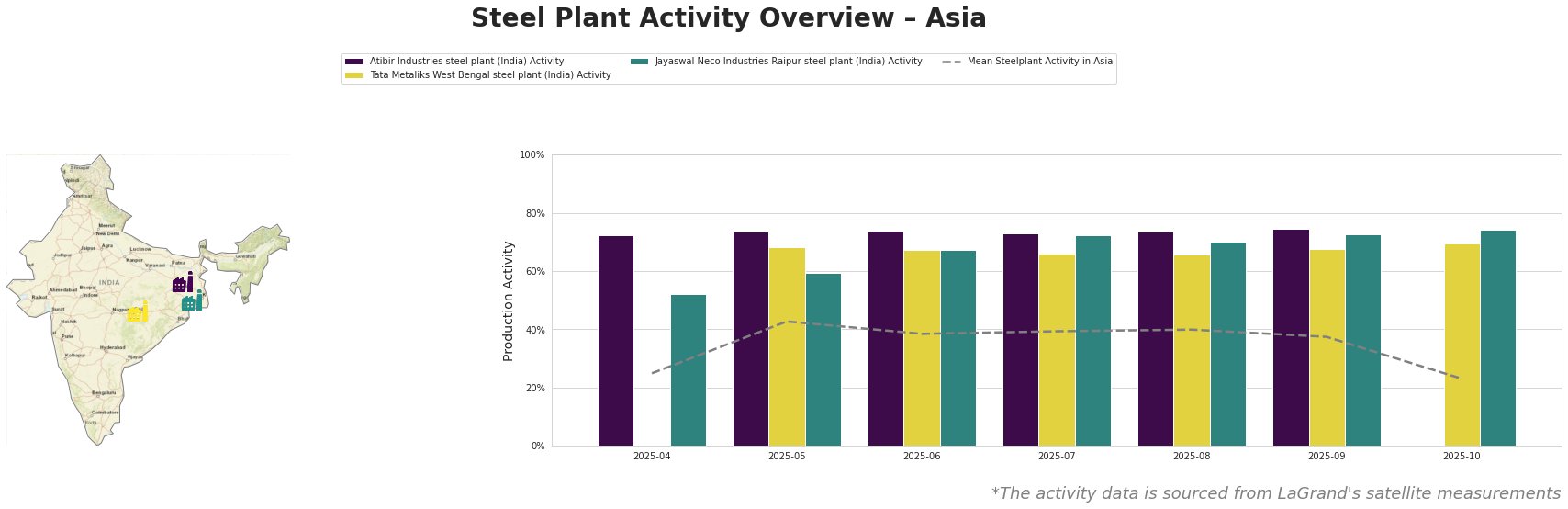

The mean steel plant activity in Asia has seen a significant drop to 23% in October, a substantial decrease from the 40% observed in August. Atibir Industries steel plant showed relatively stable activity between April and September, consistently exceeding the Asian mean, but with no data for October. Tata Metaliks West Bengal steel plant exhibited stable activity between May and September, before an increase in observed activity in October to 70%. Jayaswal Neco Industries Raipur steel plant showed steady activity between May and October, and was at its peak in October at 74%. It is worth mentioning that the crude steel output decrease mentioned in the article “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025” cannot be directly linked to observed plant activity levels, because only Indian steel plant activity levels are available in the provided dataset.

Atibir Industries steel plant, located in Jharkhand, India, is an integrated steel plant with a crude steel capacity of 600 ttpa utilizing BOF technology and blast furnaces. Satellite data shows stable activity throughout the observed months (April to September), consistently higher than the Asian average, but with no data for October. The news articles do not provide information that explicitly explains Atibir Industries’ activity levels.

Tata Metaliks West Bengal steel plant, based in West Bengal, India, operates as an integrated BF-BOF plant with a 255 ttpa crude steel capacity. Its activity remained stable between May and September, with activity levels above the Asian average, before exhibiting an increase in October to 70%. As with Atibir Industries, the provided news articles lack information allowing for explicit connections to observed activity levels.

Jayaswal Neco Industries Raipur steel plant, located in Chhattisgarh, India, is an integrated steel plant utilizing both BF and DRI processes, with a crude steel capacity of 1200 ttpa. The plant’s activity showed steady increases from April to October, peaking at 74%. Similar to the other two plants, no explicit connection between news articles and plant activity could be established.

The significant decrease in the Asian average steel plant activity level alongside the decline in the producer price index (“China’s steel industry PPI down 8.6 percent in January-September 2025“) suggests weakened demand and oversupply concerns, especially given the increase in CISA mills’ output.

Given the mixed signals of increased output from some producers (“CISA mills’ daily crude steel output up 7.5% in early October 2025, stocks also up”) against an overall backdrop of declining prices (“China’s steel industry PPI down 8.6 percent in January-September 2025”) and reduced Chinese production (“China cuts steel production to 73 million tons in September“), procurement professionals should exercise caution. Buyers should carefully negotiate contracts, factoring in the potential for further price declines and increased volatility. Given the reported increases in steel inventories held by CISA members, short-term spot purchases may offer more favorable pricing compared to long-term contracts. Buyers should closely monitor inventory levels and production data from key producers to anticipate potential supply disruptions.