From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Output Fluctuations Amid Rising Exports, Atibir Industries Faces Activity Drop

In Asia, the steel market exhibits fluctuating output levels alongside increasing export volumes, particularly in China. The observed trend of Chinese steel exports exceeding 10 million metric tons in September, as highlighted in “China’s steel exports again above 10 million mt in Sept, up 9.2 percent in Jan-Sept,” contrasts with domestic production adjustments, though a direct link to specific plant activity levels cannot be established from the provided data. Furthermore, the article “CISA mills’ daily crude steel output down 8.9% in late September 2025, stocks also down” shows decreases in production, while the subsequent article “CISA mills’ daily crude steel output up 7.5% in early October 2025, stocks also up” indicates a rebound, reflecting possible market volatility and shifts in demand which also does not seem to directly impact the plant activities observed.

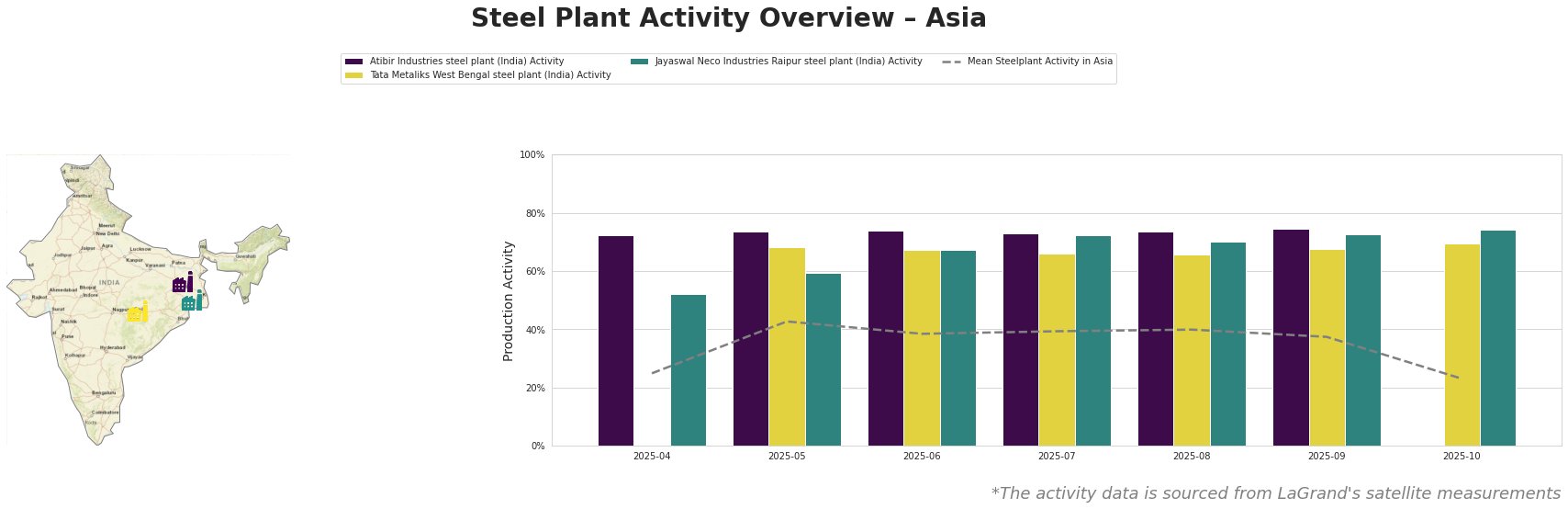

The mean steel plant activity in Asia shows considerable fluctuation, peaking in May at 43% and dropping significantly to 23% in October. Atibir Industries consistently operated well above the mean until October, when activity data is unavailable, but its activity dropped from 75% in September. Tata Metaliks in West Bengal shows a relatively stable activity level, with a small increase to 70% in October. Jayaswal Neco Industries in Raipur similarly demonstrates consistent activity, reaching 74% in October, the highest recorded among the observed plants.

Atibir Industries steel plant

Atibir Industries, located in Jharkhand, India, is an integrated steel plant with a crude steel production capacity of 600 ttpa, utilizing BF and BOF technologies. The plant is ResponsibleSteel certified. Satellite data reveals a consistent activity level between 72% and 75% from April to September 2025, significantly above the Asian average. However, activity data is unavailable for October, and it is unclear if the recent drop in the Asian average steel plant activity to 23% had an effect on Atibir Industries. No direct connection can be established between the observed activity levels at Atibir Industries and the provided news articles.

Tata Metaliks West Bengal steel plant

Tata Metaliks, situated in West Bengal, India, operates as an integrated BF-BOF steel plant with a crude steel capacity of 255 ttpa and iron production of 600 ttpa. The plant is ISO14001 and ResponsibleSteel certified. Its activity remained relatively stable between 66% and 70% from May to October. This stability does not directly correlate with fluctuations highlighted in the articles “CISA mills’ daily crude steel output down 8.9% in late September 2025, stocks also down” and “CISA mills’ daily crude steel output up 7.5% in early October 2025, stocks also up“, indicating a potential decoupling from Chinese market dynamics.

Jayaswal Neco Industries Raipur steel plant

Jayaswal Neco Industries, based in Chhattisgarh, India, is an integrated steel plant using both BF and DRI processes, with a crude steel capacity of 1200 ttpa and iron production of 1020 ttpa. The plant holds ISO14001 and ResponsibleSteel certifications. The activity level has been consistently high, ranging from 52% in April to 74% in October. This consistent performance occurs as “Industrial output of China’s steel sector up 5.7 percent in Jan-Sept 2025“. No direct link between the plant’s activity and the provided news articles can be established.

Evaluated Market Implications:

The Chinese steel market shows signs of volatility, with output fluctuations as highlighted in the articles regarding CISA mills’ production. Simultaneously, China’s steel exports remain high (“China’s steel exports again above 10 million mt in Sept, up 9.2 percent in Jan-Sept“). The high activity at Jayaswal Neco Industries in India suggests stable production capabilities in that region.

Recommended Procurement Actions:

- Steel Buyers: Given the volatility in Chinese steel output and rising export volumes, steel buyers should diversify their sourcing to include Indian suppliers like Jayaswal Neco Industries, which demonstrates consistently high activity. Consider securing contracts to mitigate potential supply disruptions from China.

- Market Analysts: Closely monitor the price impact of China’s export strategy on regional markets, particularly as it relates to domestic production adjustments. Analyze the Indian market’s capacity to absorb potential shifts in global demand. Watch Atibir industries and if the October drop continues in the months ahead.