From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Outlook: Strong Activity Boost Following Increased Plant Performance

Recent satellite observations reveal notable increases in operational activity across key steel plants in Asia, suggesting robust market sentiment. According to the news article Corpus Christi LNG starts train 5 commissioning, the commencement of expansion at Cheniere’s facility indicates heightened pipeline activities and potentially vibrant demand that may influence regional steel production and utilization. Although no direct correlation can be established between the US LNG sector and Asian steel activity, the overall positive energy market landscape can impact regional steel consumption trends.

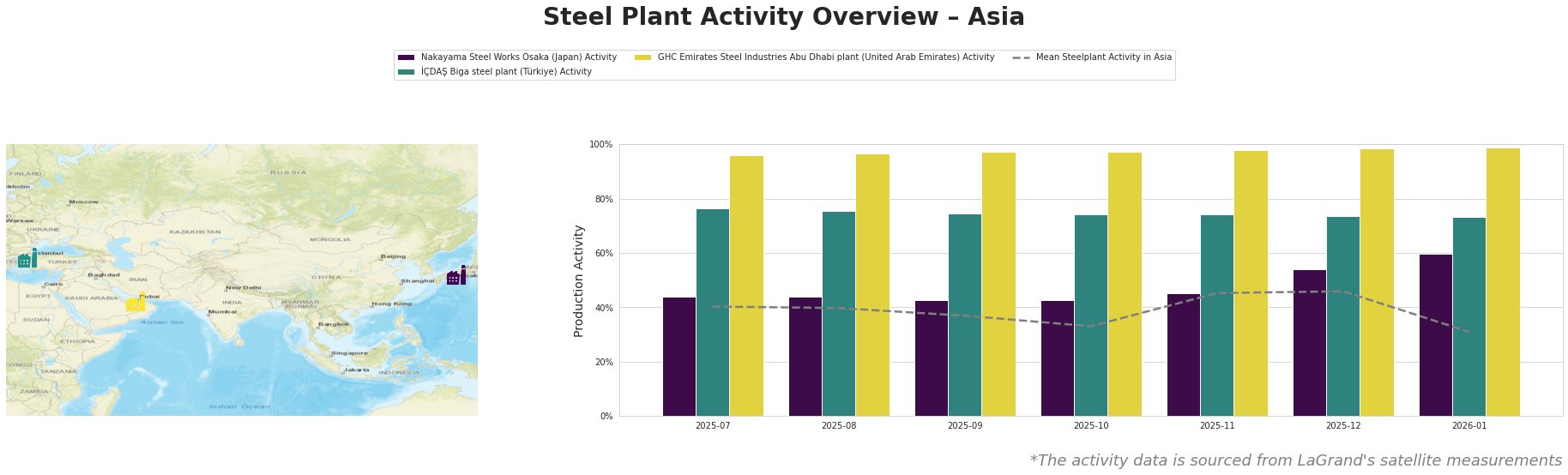

Nakayama Steel Works Osaka: This plant has shown a significant increase in activity, with a jump from 54% in December to 60% in January. The rise may be linked to increased regional demand influenced by activities in adjacent sectors, although no direct news connections were found.

İÇDAŞ Biga Steel Plant: Activity slightly decreased to 73% in January from 74% in December, marking a stable performance overall. The plant remains a crucial player in meeting domestic demands, especially for construction and infrastructure, although its declines do not correlate directly with the recent news articles.

GHC Emirates Steel Industries: This plant continues to peak in activity, reaching 99% in January, up from 98% in December. The steady production levels underline strong demand within the UAE and regional markets, which could relate to increased energy sector activities as noted in the US’ Delfin LNG plans FID ‘in the next month’ article, indicating a supporting infrastructure investment climate.

The overall market sentiment remains dynamic, driven by increased activity levels in key plants. Emphasizing procurement strategy, steel buyers should focus on creating relationships with high-performing suppliers like GHC Emirates Steel, which is poised to meet increasing demand. With the potential for supply disruptions in lower-performing plants such as Nakayama and İÇDAŞ, reinforcing supplier networks and diversifying procurement sources will be essential for mitigating risks and capturing market opportunities.