From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Outlook: Production Cuts Loom Despite Export Surge – Procurement Alert

Asia’s steel market faces potential volatility driven by production cuts and fluctuating prices. Recent news, including “China to cut steel production by at least 25 million tons in 2025,” signals a future tightening of supply. This contrasts with the expectation stated in “China’s steel exports will exceed 100 million tons in 2025 – Baosteel,” suggesting continued export pressure, at least in the short term. No immediate, direct impact of these announcements on steel plant activity levels could be established based on satellite-observed data.

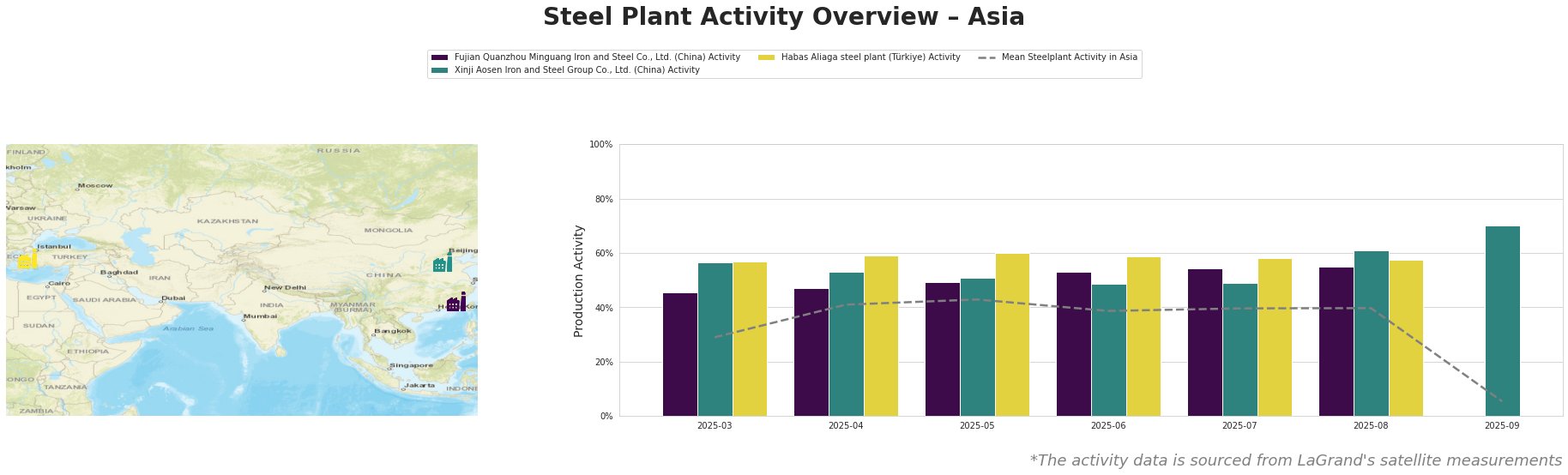

Average steel plant activity in Asia showed a slight upward trend from March to May 2025, peaking at 43%, before decreasing to 40% and then dropping dramatically in September to 5%. Xinji Aosen Iron and Steel Group Co., Ltd. exhibited the highest activity at 70% in September. The low mean value in September is a result of missing data for 2 of 4 steel plants.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF/BOF steel plant in Fujian, China, produces approximately 2.55 million tons of crude steel annually, focusing on finished rolled products like rebar and wire rod. Its observed activity gradually increased from 46% in March to 55% in August. No direct connection between this increase and the news articles could be established.

Xinji Aosen Iron and Steel Group Co., Ltd., also an integrated BF/BOF steel plant located in Hebei, China, has a crude steel capacity of 3.6 million tons and produces semi-finished and finished rolled products like billets and hot-rolled strips. The plant’s activity increased significantly to 70% in September, exceeding the mean Asian activity. The increase may be related to the anticipation of production cuts announced in “China to cut steel production by at least 25 million tons in 2025”, however no direct connection could be established.

Habas Aliaga steel plant, an EAF-based steel plant in İzmir, Türkiye, produces 4.5 million tons of crude steel annually, focusing on semi-finished and finished rolled products like billet, rebar, and hot-rolled coil. The plant’s activity remained relatively stable between March and August at around 57-60%. No direct connection between this stable activity and the news articles could be established.

Considering the information from “China to cut steel production by at least 25 million tons in 2025” and the observed activity data, steel buyers should:

- Monitor Xinji Aosen Iron and Steel Group Co., Ltd. Activity: Given the observed surge in activity at Xinji Aosen Iron and Steel Group Co., Ltd., consider securing supply contracts from this plant while production remains high, anticipating potential future decreases.

- Factor in Export Dynamics: While Chinese production may decrease, “China’s steel exports will exceed 100 million tons in 2025 – Baosteel” suggests export pressure remains. Factor this into procurement strategies, potentially exploring opportunities for imported steel from China, but be aware of potential trade policy shifts.

- Monitor Price Fluctuations: The “China’s steel sector PMI declines to 49.8 percent in August 2025” and “MOC: Average rebar prices in China down 1.1 percent in August 18-24 2025” articles signal potential price fluctuations and declining domestic demand. Buyers should closely monitor price indices and consider hedging strategies to mitigate price risk.