From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimistic Despite Output Dip: China’s Export Surge and Plant Activity Analysis

Asia’s steel market presents a mixed picture, with declining production offset by rising exports. The recent news articles “China reduces steel output for the third month in a row” and “China’s Rebar Exports Rise 52.4% in January–July 2025” highlight these contrasting trends. While output is decreasing, export volumes, especially of rebar, are surging, potentially reshaping regional supply dynamics. Observed activity data from selected steel plants shows varying responses to these market forces.

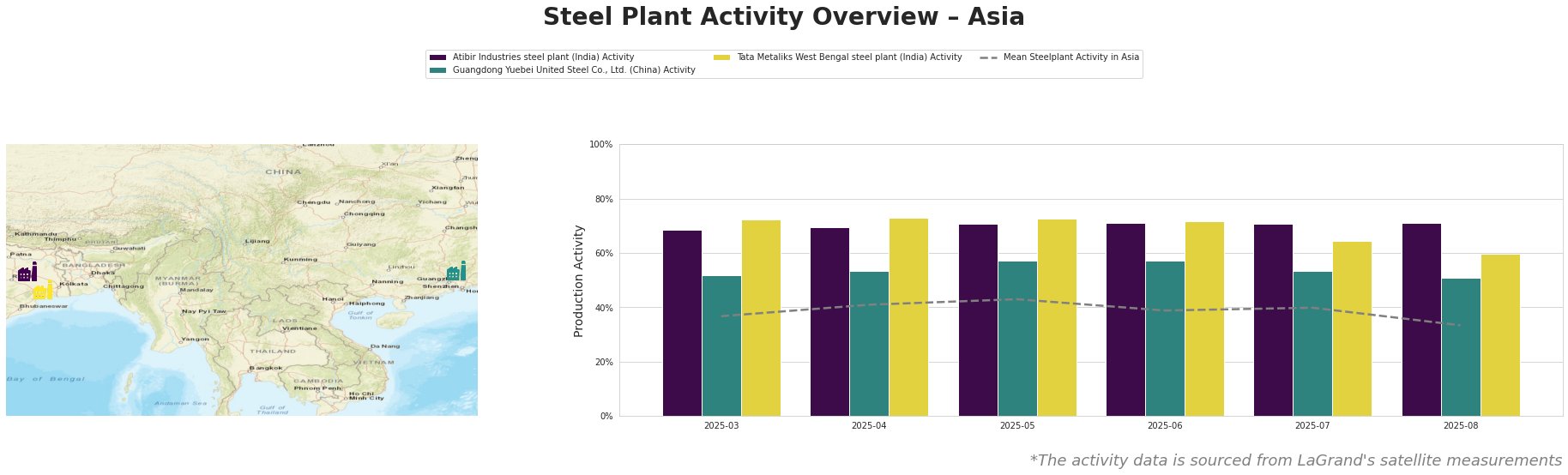

Across Asia, mean steel plant activity has decreased significantly in August to 33% after staying relatively stable between March and July.

Atibir Industries, a 600 ttpa integrated steel plant in Jharkhand, India, utilizing BF/BOF technology for crude, semi-finished, and finished rolled products, has maintained a consistently high activity level of 71% from May through August. No direct correlation to the provided news articles could be established.

Guangdong Yuebei United Steel Co., Ltd., a 2000 ttpa integrated steel plant in Guangdong, China, focusing on rebar production using BF/BOF/EAF processes, saw a decrease in activity from 57% in June to 51% in August. This decline could be partially attributed to the “China reduces steel output for the third month in a row,” although the plant’s rebar focus aligns with the increasing exports reported in “China’s Rebar Exports Rise 52.4% in January–July 2025.”

Tata Metaliks West Bengal steel plant, a 255 ttpa integrated plant in West Bengal, India, producing pig iron and ductile pipes via BF/BOF, experienced a significant drop in activity from 73% in May to 60% in August. No direct correlation to the provided news articles could be established.

The surge in Chinese steel sheet/plate exports by 2.3% (as mentioned in “China’s steel sheet/plate exports up 2.3 percent in January-July“) coupled with production cuts in China may lead to a tightening of supply within China itself, despite the rising export figures. Chinese iron ore output also saw a decrease of 5.4% from January to July, as reported by “China’s iron ore output down 5.4 percent in January-July 2025“. While July saw a YOY production increase, it was down from June levels. This impacts prices in the short term.

Procurement Action: Steel buyers focusing on rebar in regions importing from China should closely monitor Chinese export policies and domestic demand. Consider diversifying supply sources to mitigate potential price volatility arising from the production cuts and the export dynamics described in “China reduces steel output for the third month in a row” and “China’s Rebar Exports Rise 52.4% in January–July 2025.” Buyers should also be aware of the current fluctuations in iron ore prices, as detailed in “China’s iron ore output down 5.4 percent in January-July 2025,” as they impact steel production costs.