From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimistic Amid Nvidia’s China Return and Stable Plant Activity

Asia’s steel market shows a generally positive outlook, although activity levels vary across key plants. Recent regulatory changes, as highlighted in “Nvidia darf wieder KI-Chips nach China liefern” and “Wall Street Cheers Nvidia’s Return To China AI Market,” may impact demand, while plant activity data offers insights into current supply dynamics. Although “Analysis-High-priced stocks and bonds raise tariff threat for markets“ could impact market dynamic long-term, no direct relationship could be established to influence activity levels yet.

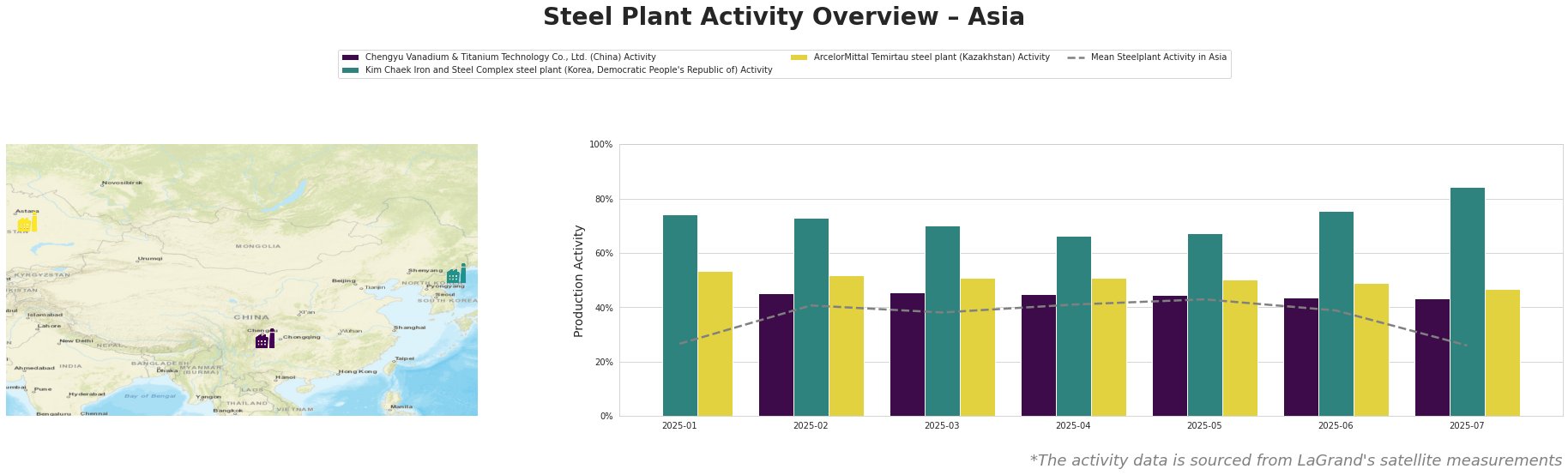

The mean steel plant activity in Asia experienced fluctuations, peaking at 43% in May and dropping significantly to 26% in July. Kim Chaek Iron and Steel Complex consistently operated above the Asian average, reaching a high of 84% activity in July. Chengyu Vanadium & Titanium Technology Co., Ltd. showed relative stability around the 45% mark. ArcelorMittal Temirtau showed a gradual decrease, reaching 47% in July.

Chengyu Vanadium & Titanium Technology Co., Ltd., a Sichuan-based integrated steel plant with a 6000ktpa BOF crude steel capacity, primarily produces vanadium-containing hot-rolled ribbed steel bars and steel wire rods. The plant’s activity remained relatively stable, hovering around 45% throughout the observed period, with a slight decline to 43% in July. No direct connection can be established between this stable trend and the news articles.

Kim Chaek Iron and Steel Complex, located in North Hamgyeong, DPRK, is an integrated steel plant with an outdated 6000ktpa crude steel capacity with several BOF, EAF and OHF lines on site. Its activity levels were consistently high, peaking at 84% in July, significantly above the Asian average. This high activity, although not directly linked to any news, could indicate sustained domestic demand or export commitments, especially with the products of the plant being tools, machinery, and products for infrastructure.

ArcelorMittal Temirtau, situated in Karaganda, Kazakhstan, is an integrated plant with a 6000ktpa BOF crude steel capacity. It produces a diverse range of products, including coils, sheets, and rebars. The plant’s activity showed a gradual decline from 53% in January to 47% in July. This downward trend may indicate adjustments in production strategy or be linked to regional market conditions. Although “Analysis-High-priced stocks and bonds raise tariff threat for markets” could influence strategy, no direct relationship could be established.

Evaluated Market Implications:

The approval for Nvidia to resume AI chip sales to China, as mentioned in “Nvidia darf wieder KI-Chips nach China liefern” and “Wall Street Cheers Nvidia’s Return To China AI Market,” could stimulate demand in sectors relying on AI technologies, potentially driving up demand for specialized steel grades.

- Procurement Action: Steel buyers should closely monitor demand fluctuations in sectors tied to AI and high-tech manufacturing. Early engagement with suppliers capable of producing specialized steel grades is recommended to secure supply amidst potential demand surges.

- Procurement Action: Given the consistent high activity at Kim Chaek Iron and Steel Complex, buyers should monitor geopolitical news and trade policies related to North Korea to anticipate any potential disruptions in regional steel supply chains. Consider diversifying suppliers if feasible.

- Procurement Action: The gradual decline in activity at ArcelorMittal Temirtau suggests potential for negotiation on spot market purchases. However, buyers should also investigate the underlying reasons for the production adjustments to assess the reliability of supply in the long term.