From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimism: Turkish Billet Imports Surge Amidst Fluctuating Plant Activity

Asia’s steel market shows signs of optimism, particularly in Turkey, despite fluctuating steel plant activity. “Turkey’s billet imports up 58.1 percent in Jan-Aug 2025” directly supports the observed high activity levels at İÇDAŞ Biga steel plant, a key billet producer. No direct links could be found between this news and the plants in China and North Korea.

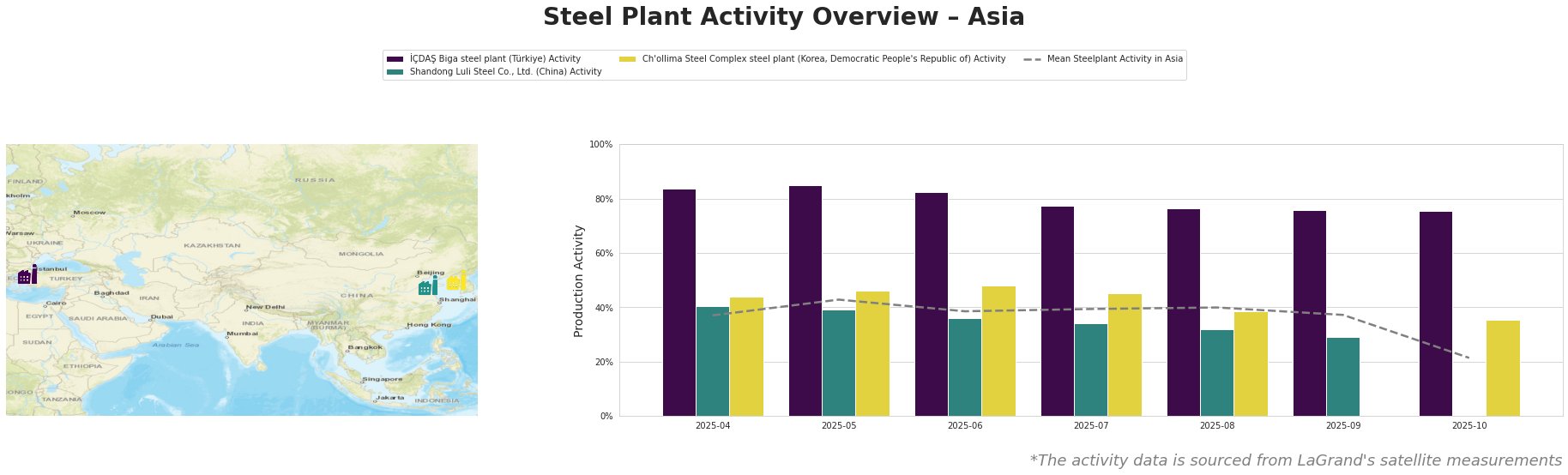

The mean steel plant activity in Asia saw a significant drop to 21.0% in October 2025. İÇDAŞ Biga’s activity remained stable at 76% from August through October, consistently exceeding the Asian average. Shandong Luli Steel experienced a steady decline from 40% in April to 29% in September. Ch’ollima Steel Complex’s activity peaked in June at 48% and fell to 35% in October.

İÇDAŞ Biga steel plant, located in Çanakkale, Turkey, is a major EAF-based steel producer with a 2.5 million tonne crude steel capacity, focusing on semi-finished and finished rolled products like billets and wire rod. Its consistently high activity, peaking at 85% in May 2025 and stabilizing at 76% between August and October, correlates with “Turkey’s billet imports up 58.1 percent in Jan-Aug 2025”, potentially indicating strong domestic production to meet billet demand and export requirements, as well as the availability of raw material due to increased imports. The news article “Turkey’s wire rod exports up 1.2 percent in Jan-Aug 2025” could not be directly linked to the plant’s activity.

Shandong Luli Steel Co., Ltd., a Chinese integrated steel plant with a 1.4 million tonne crude steel capacity, utilizes BF and BOF processes to produce semi-finished and finished rolled products like hot rolled ribbed steel bars and billets. The plant’s activity has steadily decreased from 40% in April to 29% in September 2025. There’s no clear connection between this decline and the provided Turkish news articles. The decline in activity does coincide with a period in which Turkish imports of HRC increased, but no specific connection can be established.

Ch’ollima Steel Complex steel plant in North Korea has a 760,000 tonne crude steel capacity and produces plates and wire rod. Its activity peaked at 48% in June 2025 and decreased to 35% in October. No direct connections could be established between this activity trend and any of the provided news articles focused on the Turkish market.

Evaluated Market Implications:

The substantial increase in Turkish billet imports, coupled with the stable, high activity at İÇDAŞ Biga steel plant, indicates a strong demand for billets in Turkey, potentially driven by increased construction activity or export opportunities. The news article “Turkey’s billet imports up 58.1 percent in Jan-Aug 2025″ in combination with the plants high activity levels seems to indicate there is a shortage of local production capacity, or that the company has other reasons to rely on import, such as price benefits.

Recommended Procurement Actions:

- Steel Buyers: Given Turkey’s increased billet imports and the high activity at İÇDAŞ Biga, steel buyers should secure billet supply contracts well in advance to mitigate potential price increases or supply disruptions.

- Market Analysts: Closely monitor Turkish billet import volumes and domestic production rates to assess the sustainability of this demand and identify potential investment opportunities in billet production capacity within Turkey. Review pricing strategies and regional competition for cost-saving opportunities.